Bank Investment Consultant has spilled much (digital) ink covering the talent crunch in the bank advisory world. The advisor force is getting older and there simply aren’t enough younger advisors to fill the void created when the veterans retire.

The irony is that the advisor force reflects its baby boomer clientele in this demographic respect. And just when those aging clients (and prospects) are going to need help the most, banks will be strained to offer it unless they can find ways to develop and hold onto young talent.

●

Some research suggests that banks would need to double the number of their advisors in order to take full advantage of the opportunity in front of them. But banks often judge such decisions on the bottom line, which may lead to the decision that they can better allocate their resources elsewhere. The fact is that profits generated by their advisors just aren’t as high as other lines of business. But advocates counter that advisors can generate much-needed fee income at a time when interest rates remain stubbornly low.

There may not be a good solution to this problem in the short-term for banks, but holding onto their young talent would be a good first step.

To that end, we decided to highlight the up-and-comers in the channel. We asked banks and broker-dealers to submit the bank advisors they considered their "rising stars." We said these advisors should be either under 30, or in the business less than five years (to account for career-changers), and should embody the traits that point to future success.

The editorial staff here at Bank Investment Consultant then sifted through the nominations and with some discussion and debate, picked our final eight. Unlike our signature rankings such as the BIC Top 50 or the Top Program Managers, this list is purely qualitative and subjective, but these advisors have the characteristics that we feel point to ongoing success in the industry.

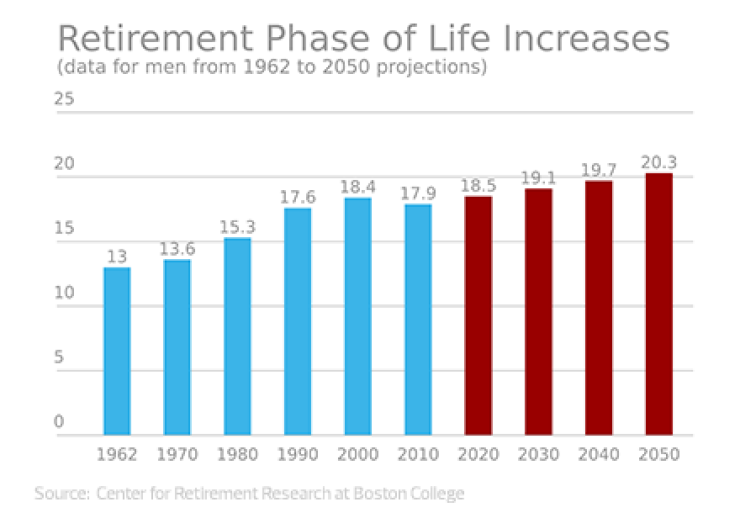

We then asked all eight finalists the same three questions, which you can see below. Some similar themes surfaced in their replies, such as market volatility, or the angst of saving for retirement (see related charts). Other aspects of their answers are unique to them. Some have clients still scarred from the crisis of 2008, some have younger clients who act like they've never met a market that isn't bullish. One uses analogies to convey difficult topics; another admits to clients that her own financial balances are down so they know they’re not alone.

Their responses are below. Or for an abbreviated version of their answers, as well as photos,

Read More:

Succession: Look to the Bank for Potential Trainees Banks Poised to Pay Up For High-Producing Advisors Better Ways to Foster Young Talent

Nathan Bosek

Bremer Bank

St. Cloud, Minn

Raymond James

Current AUM: $18.8 million

2015 production: $174,000

2014 production: $35,000

Age: 27

What are the most important issues your clients are facing and how are you able to help?

My clients are mainly worried about returns in their portfolio and market volatility. We stress that there are things they cannot control no matter how much they try, which include returns and volatility. Instead, we help them re-focus their concerns on things we can control, like the risk in their portfolio and their saving and spending. As part of this effort, we help them develop an investment policy statement, which takes into account their sense of risk tolerance and puts the time frame for their goals in perspective. To help them with the saving and spending needs, we use financial planning software to show them if they are on track to achieve their goals in all phases of their lives. After our first couple of appointments, the conversation shifts from worrying about what the market is doing to focusing on their own plan and making sure they are on track.

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

One of the biggest changes I face compared to my older colleagues is foot traffic in the banks. I work with my bank partners to try and generate ways to increase foot traffic and one way is through a joint planning appointment. Client willing, we include the personal banker in the financial planning meeting so we can discuss loans, deposits or anything else that we can help them with. Sometimes, it’s a matter of noticing they should be refinancing some of their debt to lower rates.

What's the best piece of advice an older advisor has ever given you?

It was when I was just starting out. I was 21 years old at the time and concerned with clients questioning my age/experience level. A colleague told me, “If you look the part and act the part, no one will question your age. They are all just looking for guidance and help with their finances, and if you’re able to provide them with that advice in a professional and effective way, you won’t get asked your age.” I’ve followed that advice, and since I started my career as an advisor, I’ve been asked my age a total of four times, and in none of those instances have I lost a client because of my age.

Andrea Devon

Elmira Savings Bank

Elmira, N.Y.

LPL

Current AUM: $21.6 million

2015 production: $172,000

2014 production: $72,000

Age: 27

What are the most important issues your clients are facing and how are you able to help?

Working inside a financial institution I have many clients currently invested in CDs that are subject to interest rate risks. With interest rates being at an all-time low, I have been able to provide alternative options to CDs that have turned out to be more rewarding with less time commitment. Clients are also faced with longevity and the concerns that they may outlive their money. Few clients understand the true value of a dollar going into retirement and underestimate the amount needed to live comfortably in retirement. With such factors as inflation and market volatility, I am able to give them comfort in providing a portfolio that will help minimize these risks and concerns.

Other than technology, what do you feel are the biggest changes you face compared to your older colleagues?

While working alongside an older colleague I sense some complacency with the investment products recommended. It seemed as though the advisor was not willing to view new products or new offerings from companies or wholesalers. Although challenging, as a prudent Financial Advisor it is our obligation to be open to changes in products and be willing to understand new products so that we may make the best recommendation for each client in every situation. Finding time to learn new products is always crucial. Another change we face today is a new way of networking and marketing. In today’s society, we have companies offering our services and investments at the click of a button for a lower cost. So we must provide value in our services to earn the trust of those investing, especially the younger generations.

What's the best piece of advice an older advisor has ever given you?

The best advice received from an older advisor was to understand that nothing in constant. There will always be change in the financial industry. Rather than fear change we should embrace it and recognize when change must be made. There will always be opportunities in change, whether that's a change in our practice and the way we do business, or changes in our client’s needs.

Katie Fehrenbacher

First National Bank

Olney, Ill.

Investment Centers of America

Current AUM: $18 million

2015 production: $141,000

2014 production: $165,000

Age: 26

What are the most important issues your clients are facing and how are you able to help?

Over the past six months, market volatility seems to be the main concern for several clients. Some clients aren't bothered by it, while others have a difficult time weathering the ups and downs. I remind them that their investments were based on their unique goals and objectives. And as long as those goals and objectives haven't changed, there's no need to make changes to their investments. For instance, I recently had a new client request an appointment. She hadn't kept track of her balance as much as watched the news and started to worry about her account. I think she just wanted to reassurance, and left my office feeling comfortable and confident. I've learned that some clients who think they're okay with market risk, really are not okay with it at all when things get volatile. I let them know that in my experience, clients who move in and out of the market at the wrong time take much longer to recoup losses than clients who keep their investments intact. Unfortunately, volatility is just part of investing at times. Even my balances are down, so I let them know they are not alone!

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

I believe the regulatory changes in today’s world are much more relevant than when my older colleagues were just starting. As a financial advisor, I try to stay on top of the latest news. No matter what changes are happening in the outside world, my clients always appreciate my expertise.

What's the best piece of advice an older advisor has ever given you. "Be the client's friend--who would want to fire their friend?" This saying has always stuck with me. In my four years as an advisor, I've only had a handful of clients transfer their accounts elsewhere. The few that have done so wanted to consolidate their holdings or moved.

Nancy Hernandez-Guzman

Patelco Credit Union

San Bruno, Calif.

CUSO Financial Services

Current AUM: $66. 2 million

2015 production: $457,000

2014 production: $188,000

Age: 29

What are the most important issues your clients are facing and how are you able to help?

Clients are spending more and saving less. With the increase in the cost of living in the Bay Area, clients are faced with difficulty in saving as much as they should. In order to afford living in this area, they often have to use savings to keep up with expenses. I help them by running a financial analysis on their current situation, which helps them see that if they are not saving, they may have to work longer to attain their dreams . Also, clients have a hard time staying the course and understanding market volatility under turbulent market conditions. With the noise of the media and information overload on the Internet, clients lose track of their long term investment objectives. This makes some clients want to shift to market timing strategies that carry more risk than staying the course. In a diversified portfolio with the appropriate risk tolerance, the time you are invested in the market matters most--not trying to time it. It helps to keep clients updated about what’s happening in the market and what this means to their current plan.

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

Each year, it’s becoming more difficult for financial advisors to have freedom in regards to what investments they can recommend. With the different regulatory agencies restricting the way we do business, it’s becoming more difficult to build a fully-diversified portfolio. Adapting to these changes and making sure we are staying current requires a lot of time and energy. Another change is that younger investors are more savvy and fee conscious. They have endless information at their fingertips. Therefore, the newer generation of advisors has to add much more value and advice rather than just investments.

What's the best piece of advice an older advisor has ever given you?

He told me that all financial advisors have access to similar investment options, and while the products that you choose are important to reach a client’s financial success, what really matters is the trust you earn from your client. The product they are buying is really you. Mastering what it takes to be a trusted advisor will make you successful in this career.

Tariq Johnson

Altura Credit Union

Riverside, Calif.

CUSO Financial Services

Current AUM: $45.9 million

2015 production: $315,000

2014 production: $150,000

Age: 27

What are the most important issues your clients are facing and how are you able to help?

The most prevalent issue my clients are facing is still feeling the aftermath of the 2007/2008 market crash and being nervous to take risk and possibly lose assets that they’ve work so hard for. They tend to mask what their true fear is, so I do my best to listen deeply and understand the root of what they are actually saying.

I always make a point to use analogies and explain things to them in a simple manner that they can relate to as opposed to using industry jargon. (One analogy is for clients who tend to make piecemeal financial decisions. He stresses that it's important to have a cohesive financial plan, noting that if they were putting together a puzzle, they can't do so using pieces from three different boxes. Rather, it's important to find pieces that are meant to fit together.) This helps us build an authentic personal relationship built on trust and understanding one another. Once we take a step back and look at their risk tolerance, objectives, personal values, and behavioral tendencies, we are able to put together a robust plan that allows them be in the best position to meet their objectives, while maintaining the peace of mind they desire.

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

Thebiggest changes I’m noticing are in the regulatory aspect of the business. I’ve been licensed for eight years and so much has changed from a compliance and regulatory standpoint, and I believe it will continue to change. It’s important to tune in to what is happening to stay compliant in a rapidly-changing environment.

What's the best piece of advice an older advisor has ever given you?

When someone calls you, call them back right away.

Mike Monteverde

Citibank

New York

Current AUM: $43 million

2015 production: $371,000

2014 production: $232,000

Age: 26

What are the most important issues your clients are facing and how are you able to help?

The most pervasive issue my clients face, specifically new clients, is the dislocation between their risk tolerance and the risk they are taking in their portfolios and retirement accounts. Many people have been blinded by the bull market over the past six to seven years and have market exposure that is uncomfortable and at times unreasonable. To correct this, we review the risk metrics of their current portfolio, examine their personal risk appetites and desired returns, and do our best to align the two.

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

Among the biggest changes in the industry are the ubiquity of market research and growth of do-it-yourself investing. These changes have drastically morphed the value proposition of a financial advisor, moving away from one-off transactions and basic execution towards much more in-depth and comprehensive planning. The relationship and educational components of the advisory business will continue to grow in importance as information symmetry increases.

What's the best piece of advice an older/more experienced advisor has ever given you?

Develop an emotional relationship with your clients, not the markets. It is imperative for an advisor to maintain a cool head in the face of turmoil and volatility, whether in the markets or the client’s personal life, in order to guide clients through difficult times. Creating a plan and setting expectations allows the advisor to help a client stick to the fundamentals of investing and avoid a short-term emotional reaction that would derail long term objectives.

Andy Rivenbark

TowneBank

Suffolk, Va.

Raymond James

Current AUM: $26.6 million

2015 production: $183,000

2014 production: $105,000

Age: 30 (qualifies for consideration because he has less than 5 years in the industry)

What are the most important issues your clients are facing and how are you able to help?

One issue my clients are facing is in understanding how their investments are allocated in a way to reach their goals. My clients are in all stages of financial goal planning; some are contacting me about retirement, while others are saving for college expenses for their new born child. Whatever the financial needs may be, the same question always comes up in conversation: What next? As an advisor, I am able to guide them through these tough decisions. I have found that by taking the time to really get to know my clients on a personal level and understand each of their financial wants and needs, I am able to make the best, and most individualized, financial planning recommendations for their life stage.

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

Financial media coverage has expanded tremendously in just a few short years. Not only is there television coverage from the moment the market opens until the minute it closes, but online coverage through social media can be accessed at any hour of the day. Now, financial articles, videos, and commentary from professionals are available through Facebook, Twitter, and Linkedin. This readily accessible information will continue to expand and evolve, but it's important for clients to understand that this type of advice is generalized and may not meet the needs of more complex and personal situations.

What's the best piece of advice an older/more experienced advisor has ever given you?

"Do what is best for the client, not what is best for you." We do not have proprietary investment funds or products (at Raymond James) to solicit to my clients. I am able to make recommendations based on the client’s needs, not the firm’s need to generate revenue. Also, If a client owns good investments from a previous advisor relationship, I do not encourage them to make a change just to generate commission.

Gene Songy

South Louisiana Bank

Houma, La.

Investment Centers of America

Current AUM: $65 million

2015 production: $542,000

2014 production: $337,000

Age: 27

What are the most important issues your clients are facing and how are you able to help?

The biggest issue that I see every day with my clients is uncertainty. I live in a community that is driven by the oilfield and there is a lot of uncertainty in that sector right now. They are uncertain about the market volatility and how this will hinder their retirement plans. They are uncertain about having enough money for retirement and concerned about outliving their savings. During times of uncertainty, clients’ needs go far beyond their account performance and the next investment idea. It is about giving them comfort in the decisions that we made for the long term and not irrationally reacting to the short term buzz. They want someone looking out for their best interest and giving them unbiased advice. I focus on the plan and goals that were laid out before I invest the first penny.

What do you feel are the biggest areas for change (aside from technology) that you face compared to your older colleagues?

The regulatory environment is a lot tougher these days than it ever was before. I believe for a younger advisor like me this environment isn't scary or creating additional headaches because it is all I have ever known. My comfort also comes from having flexibility in my book of business to adapt to change as easily, efficiently, and with as little cost to the client as possible. Unfortunately, a lot of older advisors will be affected by future Department of Labor regulations, but knowing you can adapt easily to that change is the most important aspect of our business. I am certain as time goes on other regulatory issues will come and go, but having confidence in your business process and adaptability will be the key to long term success.

What's the best piece of advice an older advisor has ever given you. The most important thing that I have learned is to build your business today the way you want it to be 10, 20, and 30 years from now. If you want to work with a certain type of client, then you should start now. If you want to focus on building an advisory book of business then start it from the beginning. If you are building a business that is focused on financial planning and less about the return of a client’s portfolio, then there is no better time to start than the present. I have done it my way from the beginning, and it may have been tough at first but I sit here only five short years later and can say it was worth it.