-

The justices are scheduled to resolve disagreement among lower courts over whether market regulators can order fraudsters to repay ill-gotten gains to victims.

January 12 -

A new proposal would allow firms to tack three additional months onto the amount of time they can place holds on the accounts of clients 65 and older in cases of suspected financial exploitation.

January 9 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8 -

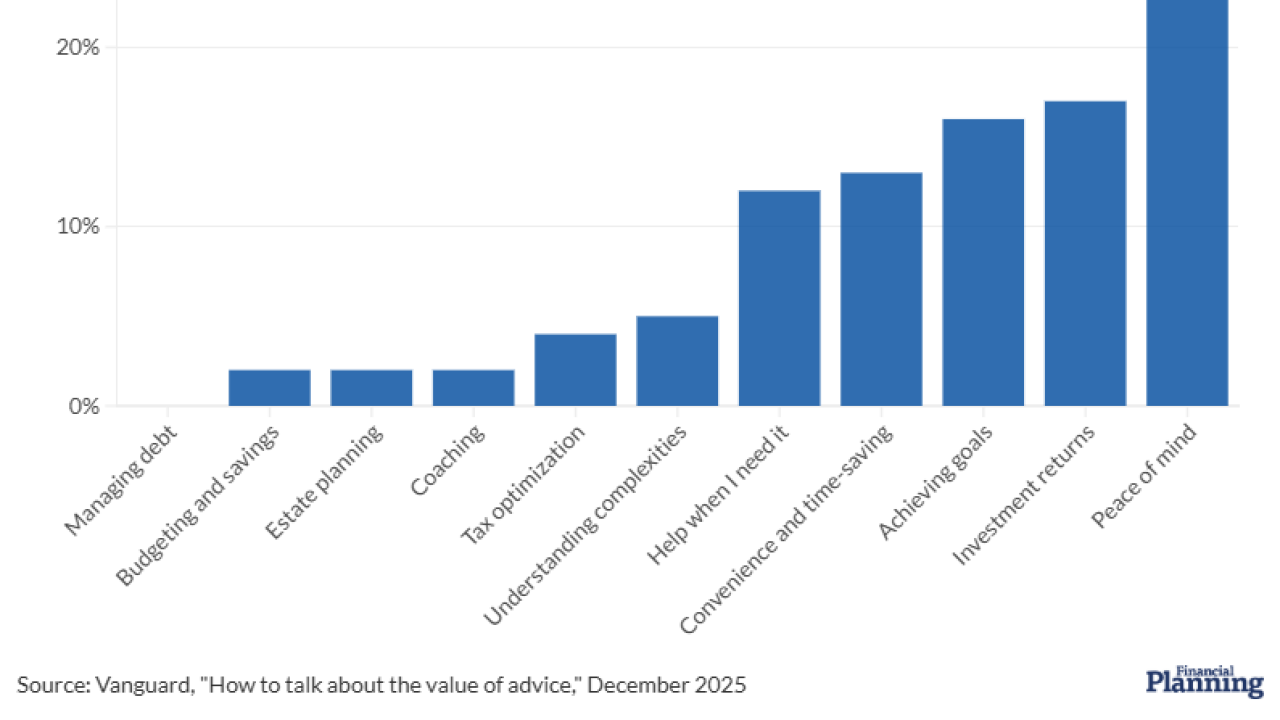

Vanguard's latest poll and analysis offers a multifaceted explanation into how financial advisors should talk about their value to clients and prospective customers.

January 8 -

Fewer U.S. adults have non-retirement investment accounts than three years earlier, and many retail investors struggle with understanding fees and fraud risk.

January 7 -

Under a new proposal, clients would have to opt in to receiving account statements and other documents in paper form.

January 5 -

The U.S. and more than 100 other countries finalized an agreement that would exempt American companies from some foreign taxes.

January 5 -

A FINRA arbitration panel finds a "pattern" in JPMorgan's attempts to blacken the regulatory records of advisors moving to rival firms.

January 2 -

American Portfolios Financial Services, a formerly independent brokerage now under the Osaic umbrella, was accused of not being forthright about its handling of clients' uninvested cash.

December 31 -

A detailed to-do list for SEC-registered firms to build a foundation for compliant and effective anti-money laundering protocols.

December 31 Flagright

Flagright -

Chuck Roberts, who was banned from the industry in July, continues to rack up customer disputes and big settlement amounts for his former firm.

December 30 -

The IRS Criminal Investigation unit cited its top cases that led to multiyear prison sentences and multimillion-dollar financial settlements for tax crimes.

December 26 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

Angel Ayala became the subject of JPMorgan's latest suit against its former private client advisors — "two days before Christmas day when most people are spending time with family," said his lawyer.

December 24 -

While the term "financial supermarket" may have gone out of fashion, firms still see opportunity to boost profits and keep clients loyal by blurring the lines between banking and wealth management.

December 22 -

Following Liu's departure from Citi early this year, allegations arose that she had been mistreated by wealth head Andy Sieg. Citi investigated the accusations and ultimately denied them.

December 22 -

A new risk alert calls out firms for improperly disclosing relationships with outside promoters brought in to provide a testimonial or endorsement.

December 19 -

Amanda Reynolds filed a complaint asking the court to determine whether pets can be recognized as non-humans dependents.

December 19 -

The GENIUS and Clarity Acts and SEC guidance on custody clear a path for advisors recommending digital asset strategies, albeit with expanded diligence protocols.

December 19 Gemini

Gemini -

Two former advisors accuse JPMorgan of assigning them to poorer parts of Brooklyn, New York, and allowing their White male colleagues to poach their clients.

December 18