-

Cutting IRS staffing in half over the next 10 months would mean less help and longer waits for taxpayers and let wealthy tax cheats escape paying what they owe.

March 6 -

The newest edition of the Internal Revenue Service's Dirty Dozen tax scams shows that fraudsters going at it as strong as ever.

March 5 -

A group of former commissioners at the Internal Revenue Service is sounding the alarm about the thousands of layoffs at the agency in the midst of tax season.

February 25 -

The threatened layoffs appeared to be underway Thursday, with estimates of between 6,000 and 7,000 employees being fired in the middle of tax-filing season.

February 20 -

Bessent said the Internal Revenue Service would be largely spared from DOGE's cost-cutting — at least until after the April 15 filing deadline.

February 7 -

At least one rule enshrined by President Biden's administration appears safe under President Trump's team. Here's how a 2019 law changed taxpayer disputes.

February 3 -

The IRS kicked off tax season facing a hiring freeze imposed by President Trump in an executive order and uncertainty over $20 billion in budget cuts.

January 27 -

President Trump signed a series of executive orders after his inauguration, including a hiring freeze for federal government workers, particularly at the IRS.

January 20 -

Lawsuits before the Supreme Court and in lower federal courts across the country could further reduce enforcement powers at the IRS and the SEC this year.

January 13 -

The proposed regulations involve provisions of the SECURE 2.0 Act, including auto enrollment in 401(k) and 403(b) plans, and the Roth IRA catchup rule.

January 10 -

The Treasury Department and the Internal Revenue Service released final rules for the Clean Electricity Investment and Production Tax Credits in Sections 45Y and 48E of the Tax Code.

January 7 -

The tax-efficient, low-cost funds may have an even greater advantage over traditional mutual funds due to the IRS's lack of a definition for "substantially identical" securities.

December 31 -

Here's a roundup of tax-related news and insights on politics, practice management, investment strategies, health savings accounts, estate planning and more.

December 23 -

The optional standard mileage rate for automobiles driven for business will increase 3 cents next year.

December 19 -

The IRS and its partners shared a half-dozen ways to safeguard your firm and your clients during National Tax Security Awareness Week.

December 19 -

A group of Republican lawmakers sent a letter to the incoming Trump administration asking it to end the IRS Direct File service via a day one executive order.

December 12 -

As the IRS scrutinizes large partnerships, they have new ways to report and correct errors in their returns.

December 5 -

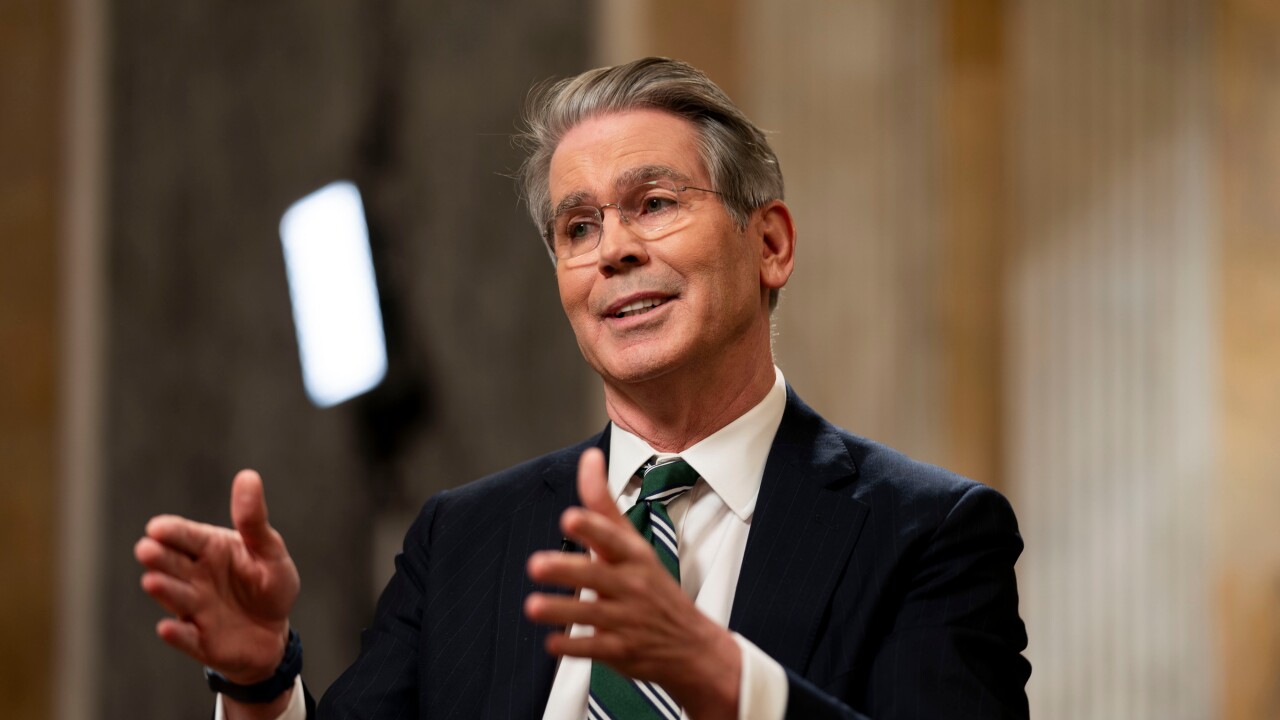

Billy Long served as a representative from Missouri from 2011 to 2023.

December 4 -

The essential IRS rules regarding the downsides — and potential benefits — of earning extra cash on the side.

December 4 American College of Financial Services

American College of Financial Services -

The long efforts to put in place the enforcement mechanisms to attack syndicated conservation easements appear to at last be finalized.

December 3 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting