-

The agency aims to hire scores of auditors, but there's a nationwide shortage of accountants.

November 22 -

Tax experts are hypothesizing what will happen in Congress during the lame-duck session and over the next two years.

November 11 -

Thanks to new adjustments from the IRS, Americans can put significantly more savings in their 401(k)s next year. But will they?

October 24 -

"ERC mills" are encouraging applications for the tax credit from businesses that may not qualify for the pandemic relief program.

October 24 -

Inflation adjustments to tax brackets mean many Americans will owe less money to the IRS. But persistent inflation may erode the boost.

October 19 -

A new tax form for 2022 returns that will be filed next year clarifies how investors should report digital assets.

October 19 -

More than 60 tax provisions are going up, according to Rev. Proc. 2022-38.

October 18 -

An IRS proposal has spawned confusion about whether non-spousal heirs to Roth plans need to take RMDs before draining the accounts after 10 years.

October 18 -

Beneficiaries won't get hit with a 50% penalty for not making withdrawals in 2021 and 2022 — an unexpected move by the IRS. But questions still remain.

October 10 -

Some favorite techniques used by the wealthy in recent years aren't looking so good amid higher interest rates.

September 27 -

Federal investigators are uncovering billions of dollars in fraud tied to pandemic relief programs.

September 21 -

Taxpayers are concerned the extra $80 billion will lead to more tax audits.

September 14 -

Commissioner Rettig is promising not to use the nearly $80 billion his agency will be receiving to increase audits of small businesses or taxpayers who earn less than $400,000.

August 17 -

The wording has changed from "virtual currencies" to "digital assets" in general, and there are other changes too.

August 9 -

A look at the biggest regulations, legislation and court cases in the field from the first half of the year.

July 21 -

The service’s recent policies expedited the hiring of new employees, but prolonged delays in eligibility verification could increase the risk of exposure of taxpayer data, according to a new report.

July 11 -

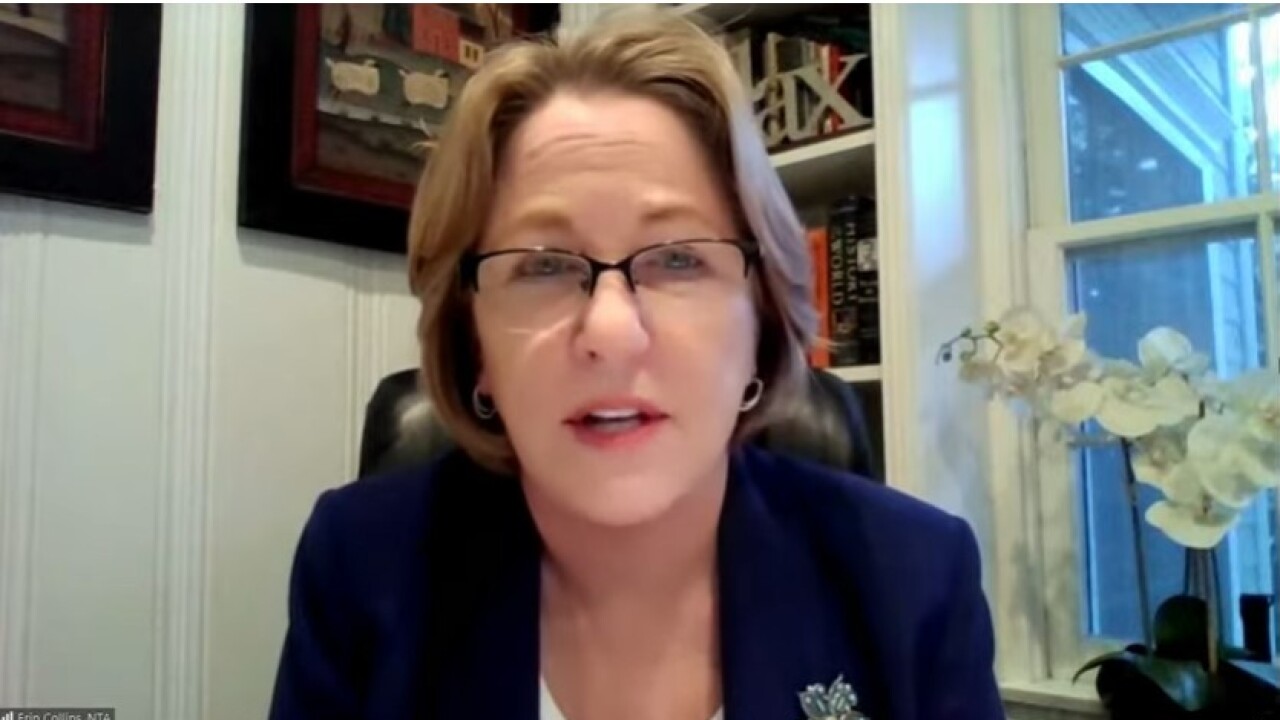

NTA Erin Collins expressed concern Wednesday about continuing delays by the service in processing tax returns filed on paper last year.

June 22 -

A congressional appropriations committee wants to give the Internal Revenue Service $1 billion more in funding to improve taxpayer service and technology and make the overall tax system fairer.

June 16 -

The service is taking steps to increase its audit rates of higher-income taxpayers after coming under sharp criticism in Congress over its lagging audit numbers.

June 1 -

The service decided to destroy the documents in March 2021 because of its inability to process its backlog of paper tax returns, according to a new report.

May 9