-

Contribution limits in a Roth IRA could shrink for couples after marriage.

July 23 -

Overall donations to charity organizations fell by 1.7%, while total individual giving decreased by 1.1%, the first drop since 2013.

July 16 -

Which is better? An SEP plan or solo 401(k)?

July 9 -

Clients won't be taxed as the result of a deal if they hold the shares in ETFs or index mutual funds.

July 9 -

Despite changes in the new law aimed at scrapping a penalty for most new couples, those from high-income households may owe more this year.

July 2 -

The agency is asking taxpayers to account for multiple jobs within a household and to factor in the $2,000 child tax credit for each kid under 17.

June 4 -

The limit on deductible contributions to health savings accounts will jump by $50 for individuals and $100 for families next year.

May 31 -

A lump-sum distribution for net unrealized appreciation on employer stock can slash a tax bill in half, but there’s plenty of fine print.

May 28 -

With income taxes attached to hardship withdrawals, they are often advised to carefully weigh other options.

May 28 -

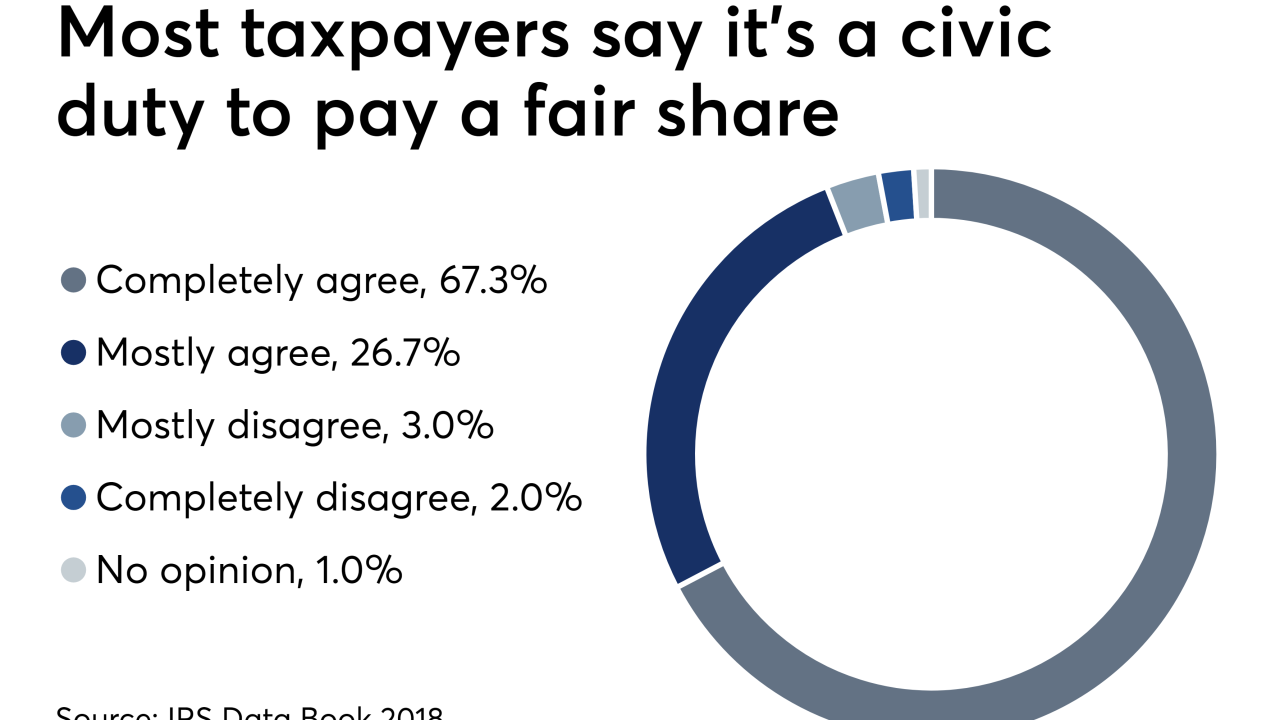

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

May 22