-

Lawmakers are considering scrapping individual deductions, including tax breaks for certain plan contributions.

June 30 -

The move comes the same week that the SEC said it would try to coordinate with the Labor Department on the regulation.

June 30 -

Jay Clayton acknowledged in testimony on Capitol Hill that it's a “very complicated issue.”

June 27 -

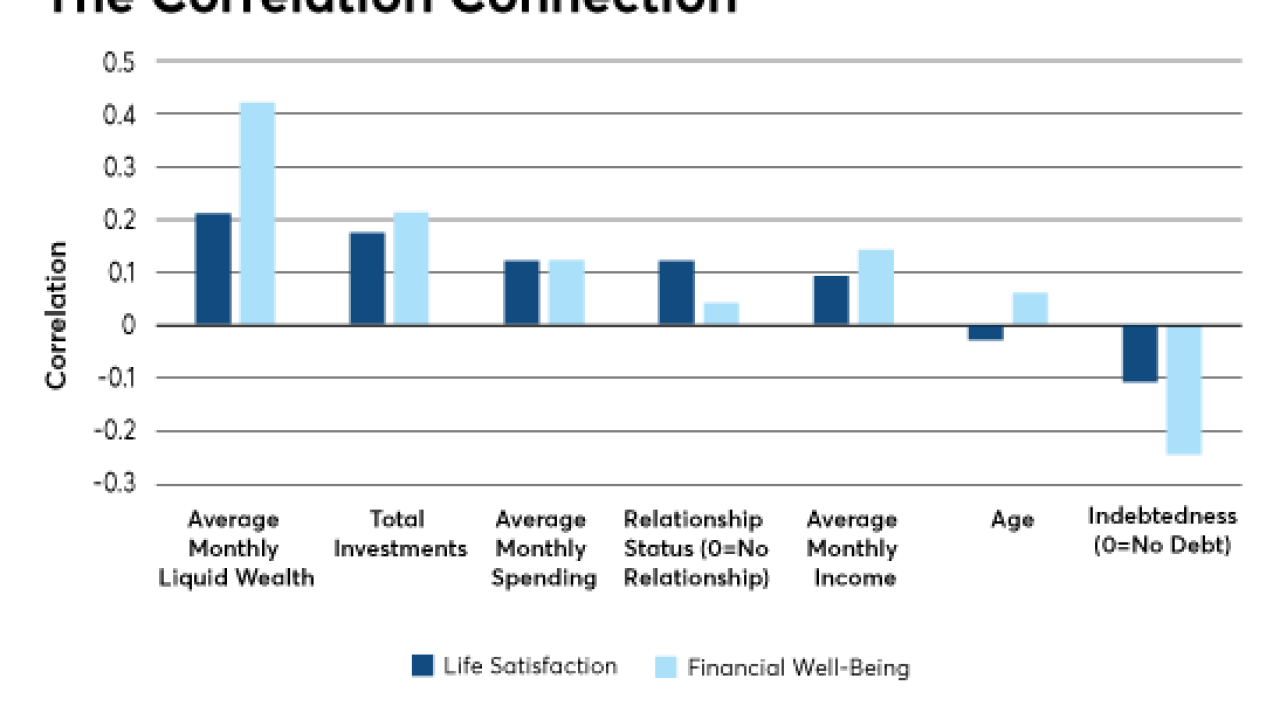

New research suggests we’re hardwired to crave substantial liquid reserves, but advisers can blunt it — if not outright quench it.

June 19 -

Stocking away income in company-sponsored plans can provide corporate executive clients tax-free compounded growth on investments.

June 16 -

The legislation ― called the Financial Choice Act ― has little chance of passing the Senate in its current form.

June 8 -

Central bank rate policies are artificially driving up asset prices while creating little growth in the real economy, the Janus bond fund manager suggests.

June 8 -

Claiming the earned income tax and child tax credit may get tougher under Trump’s 2018 budget plan.

June 2 -

An open question is how the latest effort by the agency would coordinate with the Department of Labor.

June 2 -

Harvesting losses to write off taxable gains is one strategy to address the Trump administration's plan to scrap the 3.8% net investment income surtax.

May 26