-

Federal investigators are uncovering billions of dollars in fraud tied to pandemic relief programs.

September 21 -

Commissioner Rettig is promising not to use the nearly $80 billion his agency will be receiving to increase audits of small businesses or taxpayers who earn less than $400,000.

August 17 -

The service is gearing up for a potentially massive tax-enforcement push if Congress passes a plan including $40 billion to expand audits on the wealthy.

June 28 -

The disclosure of the personal income and tax data of some of the wealthiest Americans has been referred to additional federal investigators.

June 10 -

Prosecutors say Carlos Kepke conspired with Smith from 1999 to 2014, and aided and assisted in the preparation of materially false tax returns.

April 19 -

Commissioner Charles Rettig left open the possibility that there may be delays.

April 14 -

The service offered information on how to elect to apply an overpayment on 2020 taxes against Q1 2021 estimated taxes, which are still due on April 15.

April 14 -

The agency’s commissioner is upbeat, but tax preparers and financial planners worry that this year could be especially chaotic due to the COVID pandemic.

February 18 -

This may be the final chance for eligible clients to submit for the additional economic impact payments under the CARES Act this year.

August 17 -

The IRS is giving taxpayers who want to receive their payments by direct deposit a tight deadline.

May 12 -

The agency recently estimated a gap of $381 billion in unpaid tax from 2011-‘13, which equates to roughly 14.2% never being submitted.

January 9 -

Clients are advised to consider delaying their Social Security benefits, as up to 85% will be subject to income taxes, an expert says.

August 20 -

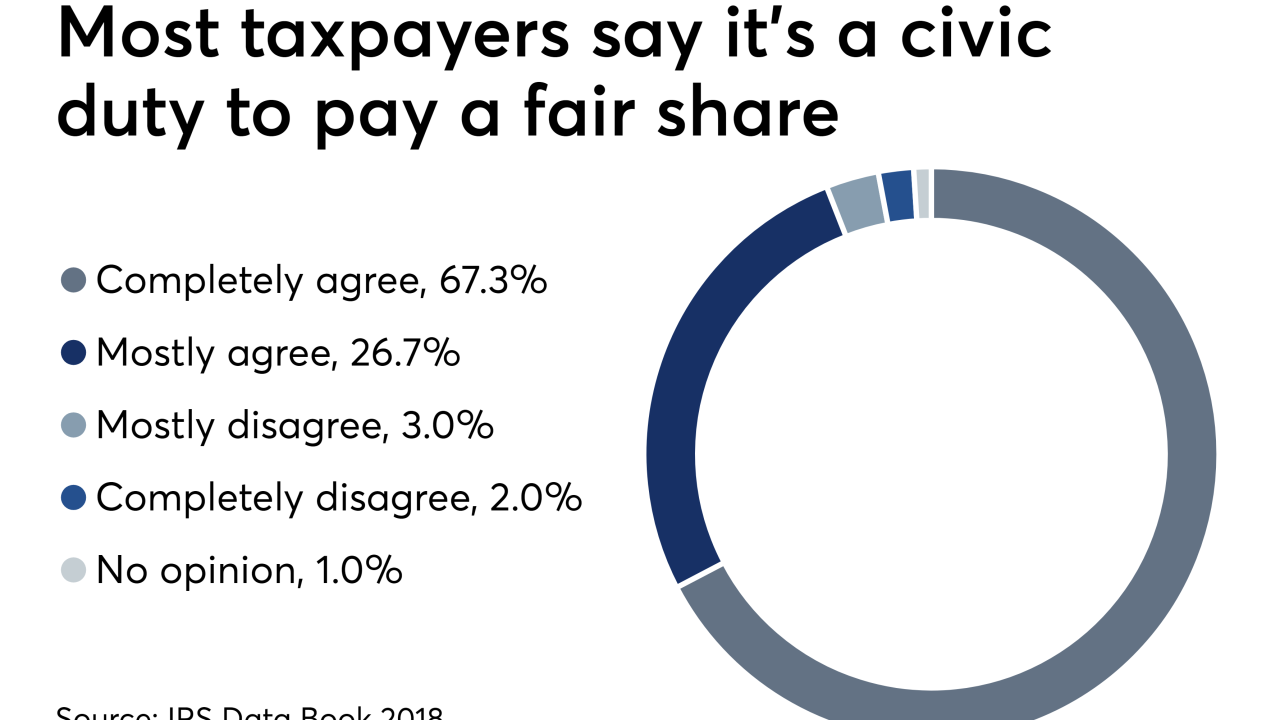

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

May 22