-

-

The total out-of-pocket health care expenses of a 65-year-old couple in retirement could exceed $320,000, plus 5% annual increases.

August 8 -

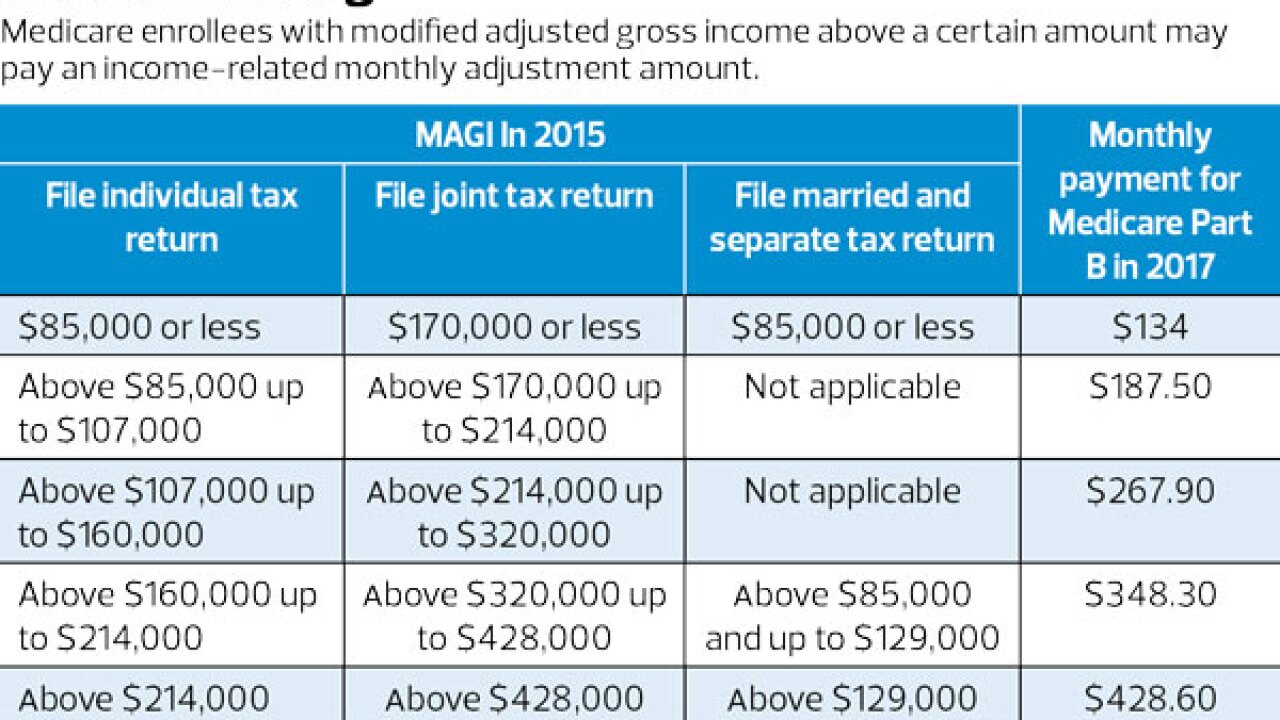

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

Retirement investors may opt for whole life insurance, which offers tax-deferred growth on premiums, or a home, which they can sell with up to $250,000 (or $500,000 for couples) in capital gains tax exclusion.

August 4 -

Recent actions by the federal government are not helping Americans to improve their retirement prospects, says analyst.

August 3 -

Naming a young grandchild as beneficiary of a traditional IRA could be a wrong move, as the distributions will be subject to the "kiddie tax."

August 2 -

More than 80% of the richest clients want big asset growth later in life, according to a new UBS survey.

August 2 -

If clients are unhappy with any aspect of their life that financial planning will solve, make that the primary focus.

August 2 Life Planning Partners

Life Planning Partners -

Investors are about to enter the worst two-month period of the year for stocks, according to an expert with Bespoke Investment Group.

August 1 -

Unlike when they were still working and their employer withheld an amount for their taxes, retirees need to make estimated tax payments to the IRS.

July 31