Wealthy retirees are confident about their savings plans and are increasing their exposure to equities, according to “

In today’s low interest-rate environment, equities provide the best returns, respondents say.

“People are living longer and know they’re living longer,” says Sameer Aurora, head of client strategy at UBS Wealth Management Americas. “They’re planning for a retirement that could last 30 years.”

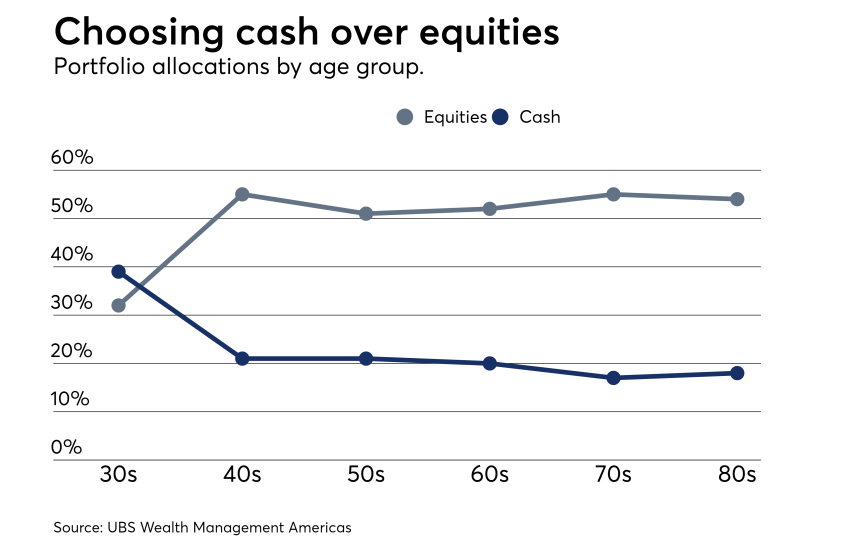

This comfort with stocks runs counter to the longstanding tradition of reducing equities with age, points out UBS.

For its survey, the wirehouse polled more than 2,000 retirees and pre-retirees, each with more than $1 million in investable assets.

Click through the slideshow to see how retirement, and retirement planning, is changing for wealthy individuals.

“On the equity side, wealthy retirees plan to continue to grow their assets regardless of age,” Aurora says. With income from Social Security, pensions and dividends, clients can choose a more aggressive investing strategy, he says.

“It actually enables them to invest relatively aggressively to make sure they’re providing for a retirement that may last a long time,” Aurora says.

Almost three-quarters say they are willing to take on the additional risk to get the best possible returns. With interest rates low, equity investments provide significant upside compared to other options.

In addition, just over half of retirees say they are planning for future generations, and equities are a good way to build wealth for their heirs.

Respondents in their 70s and 80s keep about 50% of their assets in equities and only about 20% in cash. Cash holdings generally decrease after a client reaches 30 years old.

“People in their 80s have as much of their assets in equities as people in their 40s,” says Aurora, calling that finding an “eye-opening revelation.”

“Two-thirds are focused on an asset level and financial security,” Aurora says.”

The most popular retirement target is between $1 million and $3 million in assets. For 45% of pre-retirees, that level of savings will make them feel comfortable leaving the workplace.

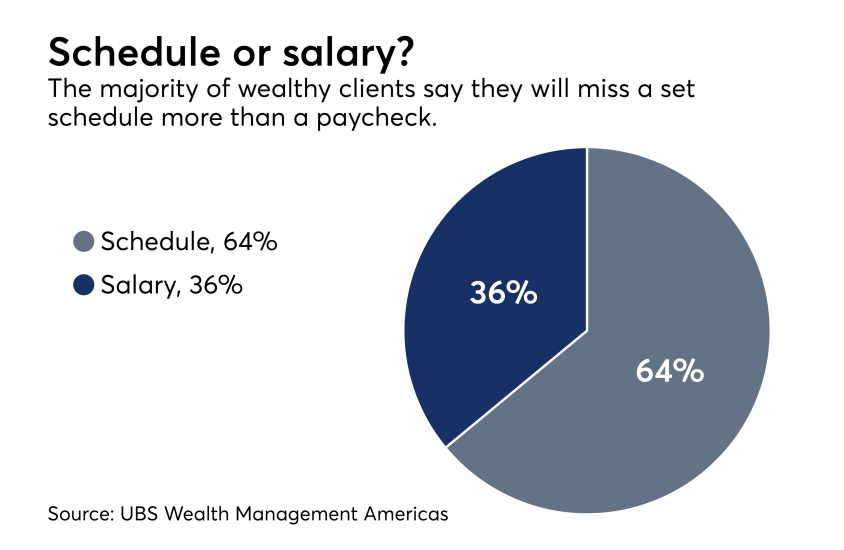

Instead, pre-retirees are focused on emotional anxieties like leaving colleagues (57%), losing a sense of purpose (36%) and filling the hours of free time (34%).

“We found that what’s really keeping people up at night are the emotional barriers,” Aurora says. “It’s an opportunity [for advisors] to make sure you’re not just covering the bases on the rational side in terms of numbers, but are also handholding and advising on some of the emotional angles.”

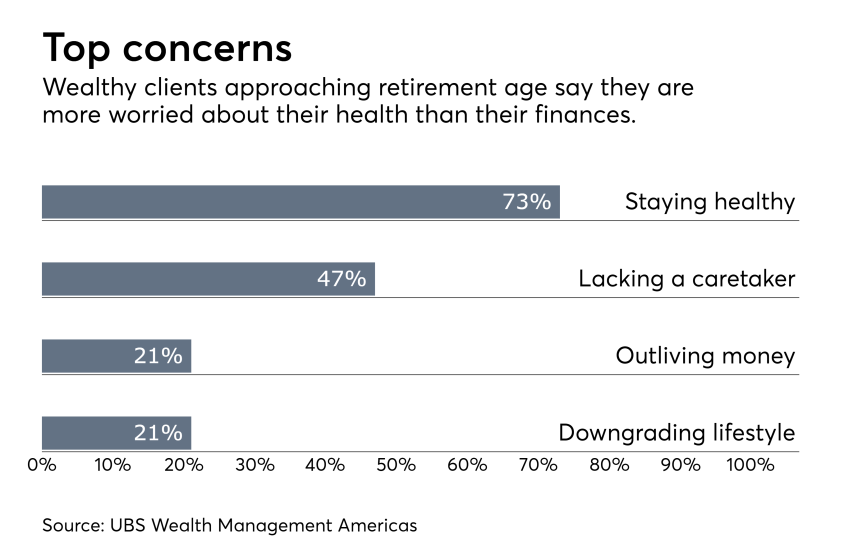

The most prevalent concerns among respondents are staying healthy (73%) and not having a caregiver (47%).

“My biggest worry,” says one anonymous respondent, a 61-year-old retired woman, “is one or both of us having a serious health issue that will impact our independence.”