-

Clients who owe the IRS should pay their taxes by April 15 even if they have already secured an extension.

April 9 -

Grandchildren won't be able to have their own accounts until they are earning their own income, but they can be named beneficiaries.

April 8 -

Picking up on a client's unspoken wishes led an advisor to an unexpected asset allocation — one that benefited the client's daughter.

April 4 Mercer Advisors

Mercer Advisors -

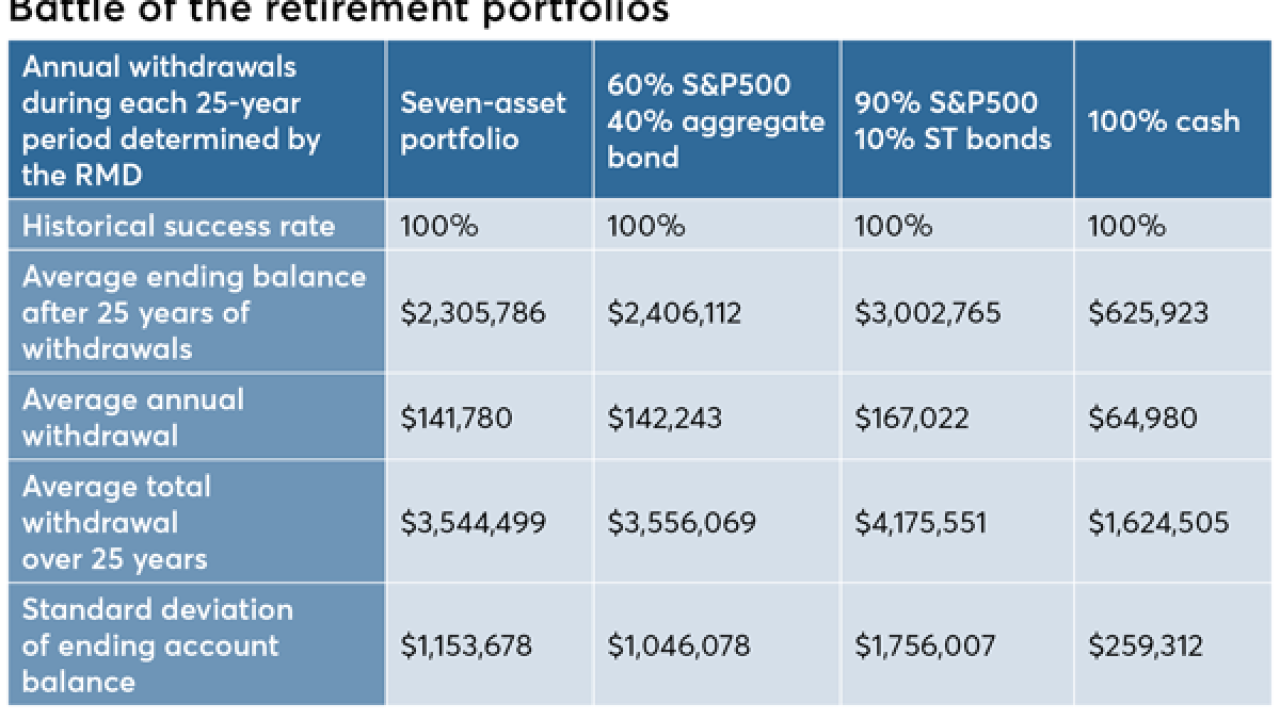

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

Annuities with guaranteed lifetime withdrawal benefits tout longevity protection, but naysayers warn of added complexity on an already confusing instrument.

April 3 -

After 30 years and a monster merger with Financial Engines, the firm is doubling down on its AUM fee structure.

April 3 -

The bill has bipartisan support in the House and Senate.

April 3 -

Those who fail to meet the cutoff face a penalty equivalent to 50% of their required minimum distribution.

March 29 -

This interactive tool challenges conventional wisdom about planning for retirement and offers a smart and streamlined way to plan for your future.

-

As an alternative to placing restrictions on lump sum withdrawals, clients could provide retirees more distribution flexibility.

March 28 October Three Consulting

October Three Consulting -

A higher standard deduction makes itemizing deductions less valuable.

March 26 -

Changing filing statuses and maxing out deductible contributions to IRAs and HSAs are some ways clients received bigger reimbursements.

March 12 -

-

Those who fail to repay their loans on time may face early withdrawal penalties.

March 5 -

Make sure your conversations with clients include variations of this theme. It's not a bad way to approach your own big decisions, as well.

February 28

-

In the land of tech startups, there's real demand for planners — ones who can embrace the best of robo practices while keeping the human touch.

February 28 -

Some clients may experience a taxable event that pushes them into a higher tax bracket.

February 26 -

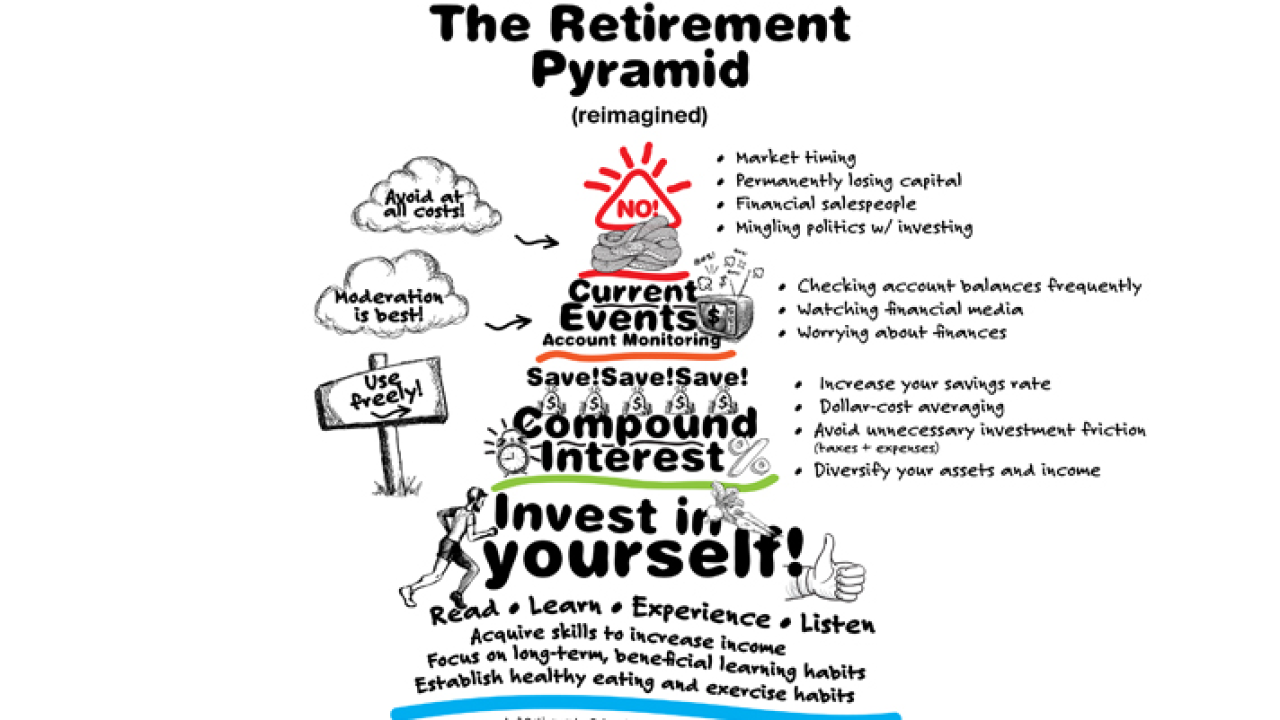

A portfolio that minimizes the frequency and magnitude of losses, while maintaining an equity-like overall return, may be worth emulating.

February 21 -

Retirement plans may decline to offer delayed RMDs, plan loans, stretch and hardship distributions and a host of other legally sanctioned tax maneuvers.

February 19 -

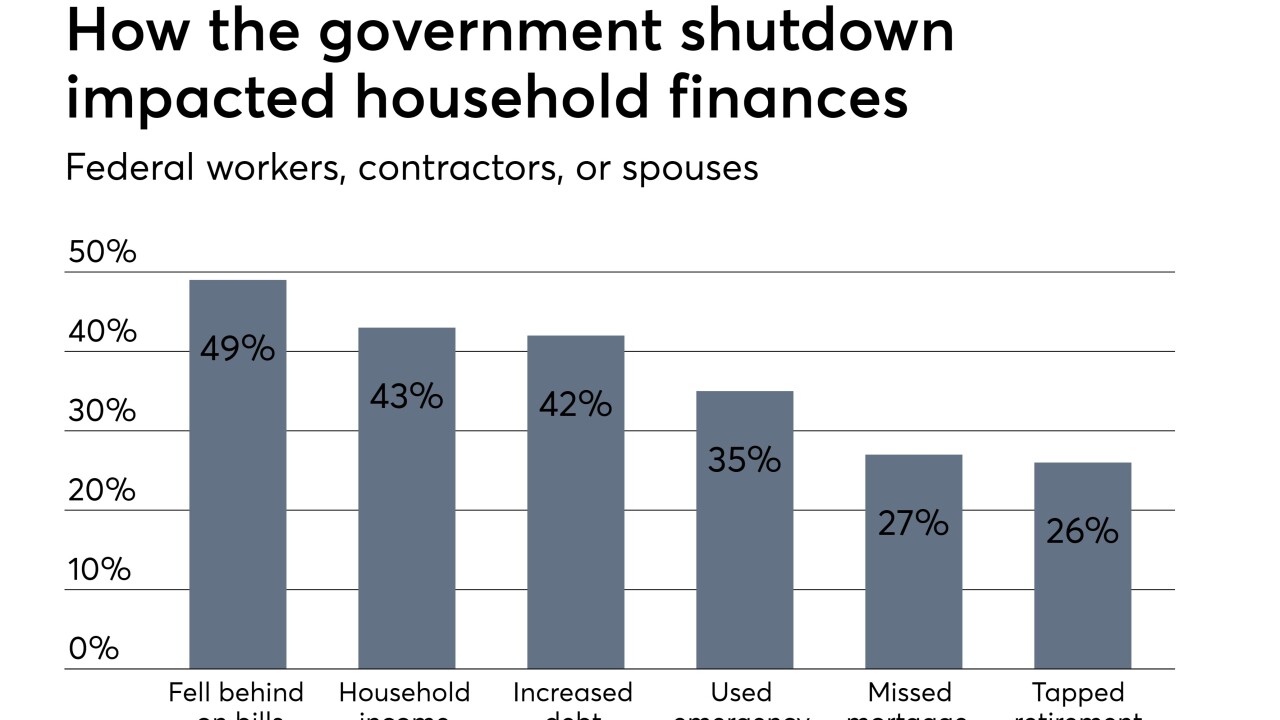

The last government shutdown highlighted how many Americans ignore basic planning lessons.

February 19