10 Easy, Actionable Marketing Tips for Advisors<br><br>

But the perfect strategic path to go down is less important than selecting a viable path and then focusing on flawless execution.

This is the essence of marketing. Find a need and fill it, repeatedly. Marketing is not about one and done, and is not about a perfect solution, nor finding a silver bullet. It is about consistency, perseverance and repetition so that you can generate predictable results.

Here are 10 actionable marketing ideas to help get you and your firm headed in the right direction.

Remember that marketing is important because whether we like it or not, assets are going to walk out the door and new client acquisition is important to offset distributions, grow AUM and increase income/equity in the practice.

Source: Eric Sheikowitz and Michael Silver, senior managing partners at Focus Partners, LLC.

1. Create a Practice Focus Statement<br><br>

Interestingly, all of us know about elevator speeches but how many of us have them? After all this time, don’t you think it’s time? Here are a few examples:

-- I have a great job. I help people retire with peace of mind.

-- I help busy and successful people organize their finances.

-- I help successful professionals and

-- I teach people how to keep their financial lives on track.

2. Identify Your Ideal Clients<br><br>

-- Clients you like

-- Client that like you

-- Refer you to others on a regular basis

-- Assets

-- Revenue

Review all five lists and ask:

-- Which clients are on all five lists?

-- What traits do they share? (demographic, psychographic, financial)

-- Is there a niche that is working for you?

-- How can you further develop that niche?

3. Form a Client Advisory Board<br><br>

-- Builds stronger relationships with your clients.

-- Gains critical insights into the client experience with your practice.

-- Creates advocates and build referral sources from clients truly invested in the success of your business.

-- Allows you to receive direct client feedback on how your services are delivered and perceived.

-- Provides face-time with a number of key clients at once.

4. Client Appreciation Events<br><br>

-- Invite affluent or receptive/supportive clients. Ask them to invite two or three couples as their guests.

-- Introduce the idea during client reviews.

-- Offer to provide a small event to celebrate a milestone (birthday, retirement, etc.).

-- Choose a high-profile location (i.e. private club, exclusive restaurant, etc.).

-- Let your clients tell the story.

-- Follow-up with guests.

5. Have a Formal System for Referrals<br><br>

-- What is it about this relationship that would have this client be my advocate and introduce me to their best and wealthiest friends, colleagues, clients, etc.?

-- Exactly how would I ask this client for an introduction, word for word?

-- How will I narrow the request for introductions so particular names will quickly pop up in the clients mind?

-- What are the exact conditions under which I will initiate the introduction conversation?

-- Where will we be when I initiate the introduction conversation?

-- What do we deliver to this very high value client that will increase the likelihood of receiving the requested introductions?

6. Hit the phones<br><br>

You have to do your research first. Find out everything there is to know about the market. What makes it tick and most importantly, what are the areas of opportunity for financial education. Once you have a handle on this, think about your approach. You can go with seminar invitations, second opinions, or even a survey approach where you just try to strike up a conversation with the person on the other end of the line.

Whatever approach you decide to use, make it your own, and remember, cold calling is still a numbers game, so track your dials, contacts and qualified leads.

7. Network to success<br><br>

-- Start with the Core 4: You, an estate attorney, a CPA and one more (property and casualty, mortgage banker, etc.) Find people who are just as hungry to grow their business as you are.

-- Meet formally and on a regular basis to discuss the goals of the group.

-- Educate on what you do, how you do it, who you do it for, the benefits, and whats a good referral for you.

-- Talk about joint marketing opportunities where you can really help each other grow your respective practices.

-- Over time, grow the group to between eight and 12 professionals.

8. Use Education as a Marketing Tool<br><br>

There are many approaches in this area such as an Educational Dinner Seminar Series with client bring a friend and even mass mailing seminars. An idea we like is Workplace Education (Lunch & Learn sessions) where you discuss 401(k) rollovers or How much do I need to retire?

9. Offer a Second Opinion<br><br>

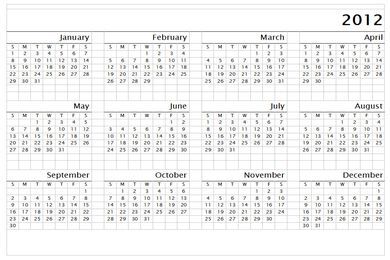

10. Live by a 12-Month Marketing Calendar<br><br>

Also see:

7 Marketing Tips Used by Elite Financial Advisors

9 Marketing Tips for Retirement Plan Advisors and TPAs

10 Critical Social Media Tips for Advisors

Chicken and Egg: How to Grow Your RIA Practice From Scratch