'Hottest' Issues in Advisor Compliance

Among RIA compliance professionals, cybersecurity remains a leading area of concern -- and more firms are rethinking how they protect their data. Nearly 88% of respondents name issues around security, privacy and identity theft as the "hottest" compliance topics for 2015, up from 75% last year, according to a new study from the Investment Adviser Association, ACA Compliance Group and asset manager OMAM.

While regulators at the SEC and FINRA have been taking a close look at how firms are protecting their information systems and sensitive client data, cybersecurity is just one of a host of compliance challenges advisors are juggling.

Here's a closer look at how advisors are thinking about cybersecurity and other key compliance issues. Page through for highlights from the survey, or click here for a one-page version. --Kenneth Corbin

'Hottest' Issues in Advisor Compliance

"It is ironic, isn't it?" says Duane Thompson, senior policy analyst at fi360, a fiduciary training firm. "Cybersecurity is probably top of mind for most advisors since it's in the headlines almost daily. However, it may require prodding from the regulators since many of the smaller firms may think the odds of a breach are much less since it's only the big firms in the headlines."

Sanjay Lamba, assistant general counsel at the IAA, counters that the trend line indicates that cybersecurity is becoming an area of increased focus within RIA shops.

"I would point out that the number of firms responding that they have a standalone policy has gone up significantly in just the past year," Lamba says. "So at the end of the day, the results show that an overwhelming majority of respondents have considered and attempted to implement appropriate measures to deal with cybersecurity."

'Hottest' Issues in Advisor Compliance

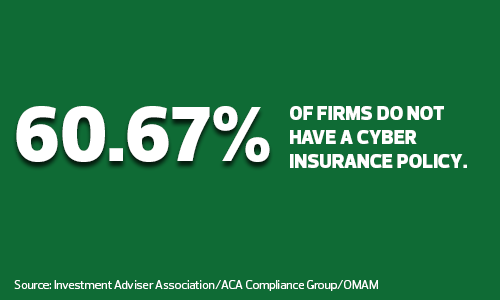

Only 17.22% of those surveyed have a policy, and another 14.4% are considering buying one. "I would expect this to be a growing trend, especially as advisors become more aware of the types of coverages available," Lamba says.

'Hottest' Issues in Advisor Compliance

"From what I can tell from the SEC and FINRA [security sweep exams], as a rule of thumb, the larger the firm, the more resources are being allocated to all aspects of cybersecurity including reviews of third-party vendors," Thompson says.

'Hottest' Issues in Advisor Compliance

'Hottest' Issues in Advisor Compliance

"I think the survey results show that CCOs consider SEC-type mock exams as another effective tool from the toolbox they can use to improve their compliance programs," Lamba says.

'Hottest' Issues in Advisor Compliance