Long-Term Care: Families Face Steep Costs Even When It's 'Free'

While professional LTC is expensive, "free" care provided by family members can be financially burdensome as well. Many people who end up relying on unpaid care do so out of necessity, says Jesse Slome, executive director of the American Association for Long-Term Care Insurance. "A significant number of people wait too long and the cost gets too high," he says.

But family members who end up acting as caregivers can incur significant losses. On average, those 50 and older who leave the workforce to care for a parent can incur income-related losses of $303,880, according to an earlier Metlife study cited in AARP's 2015 "Valuing the Invaluable" report. This takes into account the loss of wages and Social Security and pension benefit losses due to leaving the workforce early.

Whether clients choose unpaid care or rely on it out of necessity, it's important to understand the hefty costs of such care. -- Rajashree Chakravarty

Click through to see the data or view as a single page here.

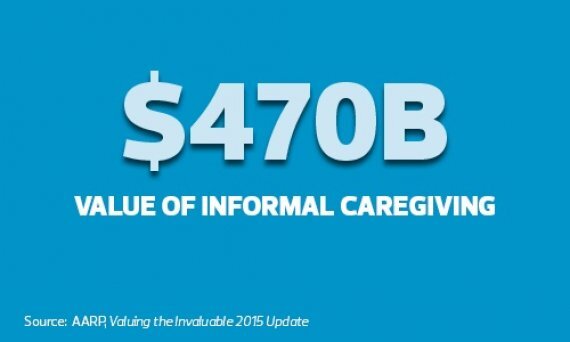

THE VALUE OF INFORMAL CARE

This value -- which surpassed total Medicaid spending ($449 billion) -- has risen steadily, up from $450 billion in 2009, $375 billion in 2007 and $350 billion in 2006, according to the AARP study.

HURDLES AT WORK

Of those surveyed for another 2015 AARP report, "Caregiving in the U.S.," 49% made adjustments with working hours, 15% took a leave of absence, 7% received warnings about performance or attendance, and 5% had to turn down promotion offers as a result of caregiving.

"Workplace challenges often arise when children become primary caregivers of their parents," says Birkofer. "These challenges can include having to take time off in the middle of the day, using personal time to take the parent to doctors' appointments, and using vacation time to visit their parents in other cities or locations."

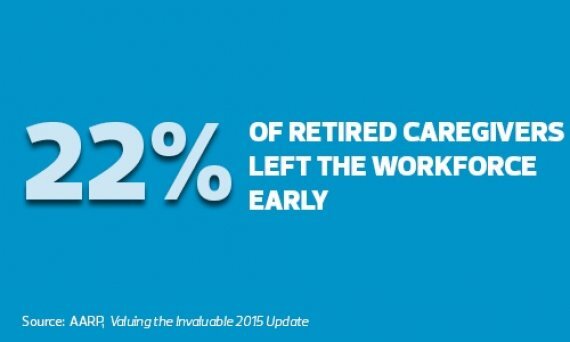

EARLY RETIREMENT

Around 83% of people in their prime working years (ages 51 to 54) may need to take care of their own parents or their parents-in-law, according to research cited in the AARP study. For those nearing retirement (60 to 69 years), more than 45% face the risk of needing to care for a parent.

RELYING ON FAMILY

"Most people don't think of long-term care," says Susan Reinhard, senior vice president and director of the AARP Public Policy Institute, and lead author of the "Valuing the Invaluable" report.

"We all think that we will live and be very healthy; the wife knows that she is going to take care of her husband. It's not something they plan on."

FINANCIAL STRAIN

Families often have to put other important financial goals -- like saving for retirement or a child's education -- on hold. "Putting off these events or borrowing money to pay for them can lead to stress for all family members," says consultant Allen Hamm, founder of Superior LTC Planning Services in Pleasanton, Calif.

"Children want their parents to be taken care of," says Birkofer. But think about this typical situation, he cautions: A father who is 30 years older than his children will be in his late 80s when his children are in their 50s, who in turn will be paying for the college education of the grandkids.

'PSYCHOLOGICAL BURDEN'

While families do incur financial losses by providing care, they also experience stress and emotional challenges. Around 88% middle-income people, ages 49 to 67, said that family caregiving was harder than what they had expected, according to the AARP study on valuing informal care. It required more patience, emotional strength and time than estimated.

"Many people have the notion that a family member will take care of them, but that notion becomes very uncomfortable when you are talking about personal care like bathing or helping one go to the bathroom," says Birkofer. "That poses a physical and psychological burden."

BUSINESS LOSSES

U.S. businesses face $25 billion in lost productivity due to absenteeism among working caregivers. The losses reflect a range of costs including absenteeism, shifts from full-time to part-time work, replacing employees and workday adjustments, according to the AARP study.

'MONEY & TIME'

Meanwhile Reinhard notes that 24% of caregivers report spending five years or more in caregiving and 26% said between one and four years.

And those providing care for 21 hours or more every week are twice as likely to have been in the caregiving role for 10 or more years, according to the "Caregiving" survey.

According to Birkofer, the paradox of improved medical treatment for diseases like Alzheimer's is that while medicine can reduce symptoms, it can make the caregiving period substantially longer. "The challenge in planning long-term care is two factors: money and time. Time is the hardest," he says. "Time depends on the kind of infirmity that the family member experiences."

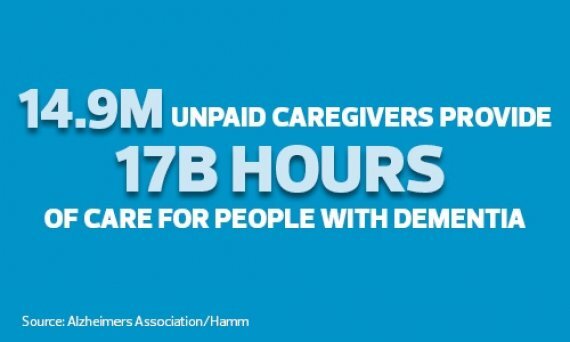

ALZHEIMER'S & DEMENTIA

IS LTC A WOMEN'S ISSUE?

The majority of caregivers (60%) are women and among those receiving care, 65% are women, according to the AARP "Caregiving" survey. Additionally, caregivers more often care for their mothers (73%) while those caring for a spouse more often do so for the male partner (55%).

Reinhard disagrees. It's everyone's issue, she warns.