Top emerging market bond funds over 3 years

Emerging market bonds have returned 2.4% for clients over the past three years, according to Morningstar data. While more down-to-earth than the go-go years, that still easily surpassed emerging market equities, which posted a 2.9% loss over the same time period.

In 2016, year to date, emerging market bonds did even better, advancing nearly 8%, according to Morningstar data.

Amid the gains, however, volatility remains an issue, according to Morningstar. Even before the Brexit vote, which briefly sent investors worldwide looking for safety and stability, high volatility had been a major consideration when investing in this asset class. Over the past decade, the typical emerging market bond fund had a standard deviation three times higher than the Barclays Aggregate Bond Index, according to Morningstar.

Some market watchers expect high volatility to continue for the foreseeable future, particularly in bonds that are denominated in local currencies.

Click through to see which funds have performed the best in this asset class over the past three years. Only funds that are at least three years old and have more than $100 million in assets are listed. All data from Morningstar.

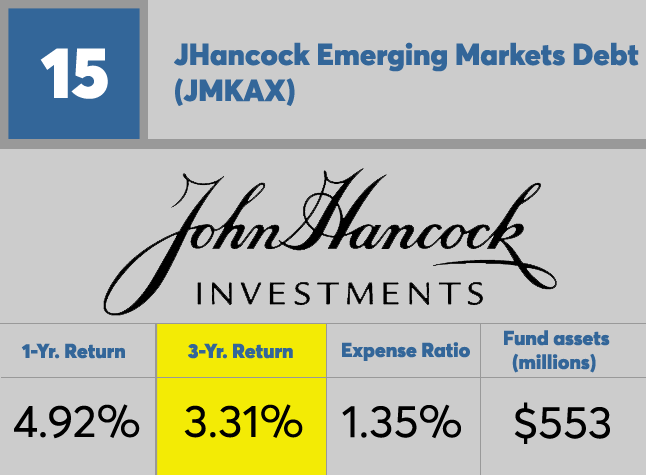

15. JHancock Emerging Markets Debt

3-Yr. Return: 3.31%

Expense Ratio: 1.35%

Fund assets (millions): $553

14. PIMCO Emerging Markets Bond

3-Yr. Return: 3.36%

Expense Ratio: 1.20%

Fund assets (millions): $1,540

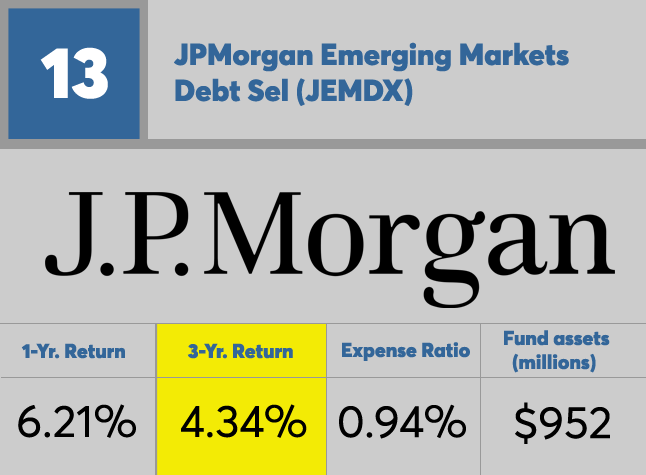

13. JPMorgan Emerging Markets Debt Sel

3-Yr. Return: 4.34%

Expense Ratio: 0.94%

Fund assets (millions): $952

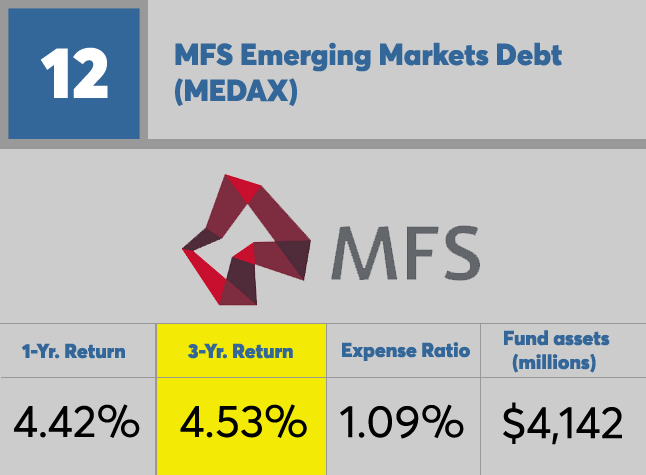

12. MFS Emerging Markets Debt

3-Yr. Return: 4.52%

Expense Ratio: 1.09%

Fund assets (millions): $4,142

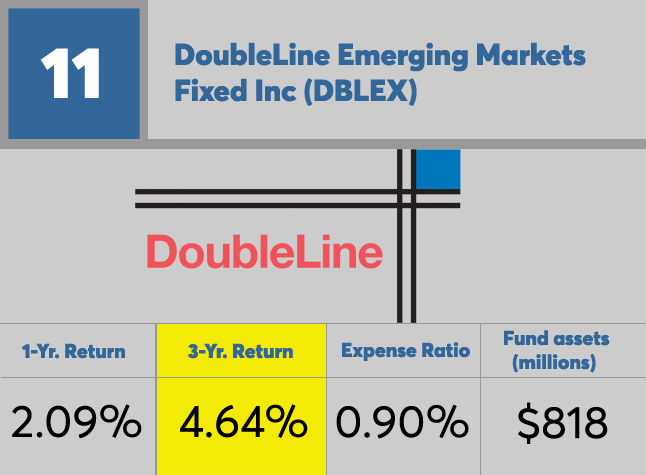

11. DoubleLine Emerging Markets Fixed Inc

3-Yr. Return: 4.64%

Expense Ratio: 0.90%

Fund assets (millions): $818

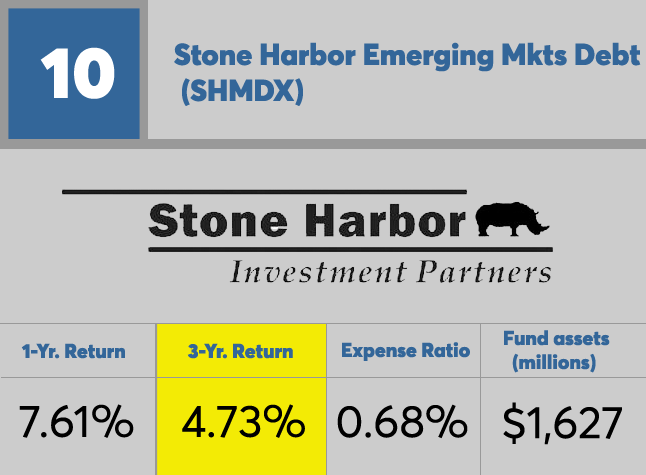

10. Stone Harbor Emerging Mkts Debt Instl

3-Yr. Return: 4.73%

Expense Ratio: 0.68%

Fund assets (millions): $1,627

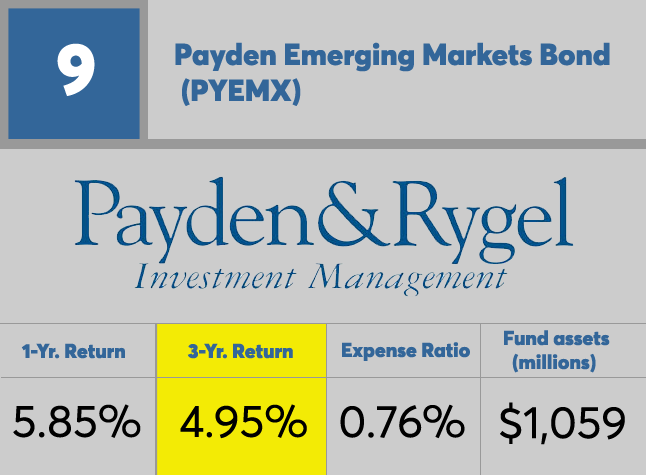

9. Payden Emerging Markets Bond

3-Yr. Return: 4.95%

Expense Ratio: 0.76%

Fund assets (millions): $1,059

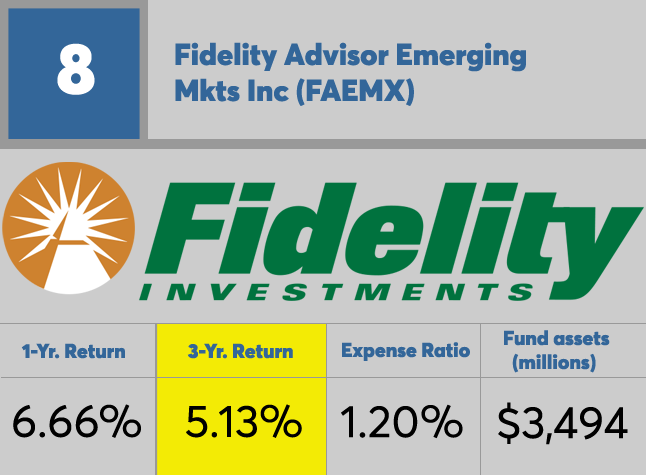

8. Fidelity Advisor Emerging Mkts Inc

3-Yr. Return: 5.13%

Expense Ratio: 1.20%

Fund assets (millions): $3,494

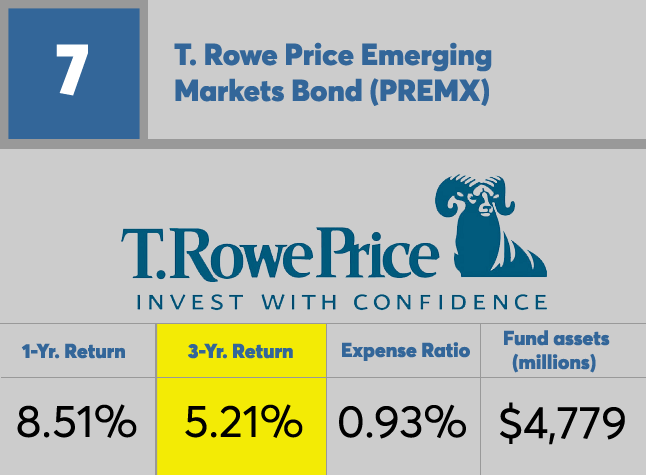

7. T. Rowe Price Emerging Markets Bond

3-Yr. Return: 5.21%

Expense Ratio: 0.93%

Fund assets (millions): $4,779

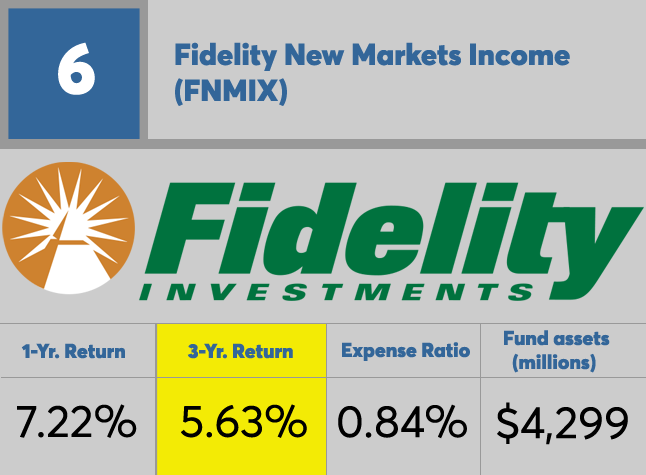

6. Fidelity New Markets Income

3-Yr. Return: 5.82%

Expense Ratio: 0.84%

Fund assets (millions): $4,299

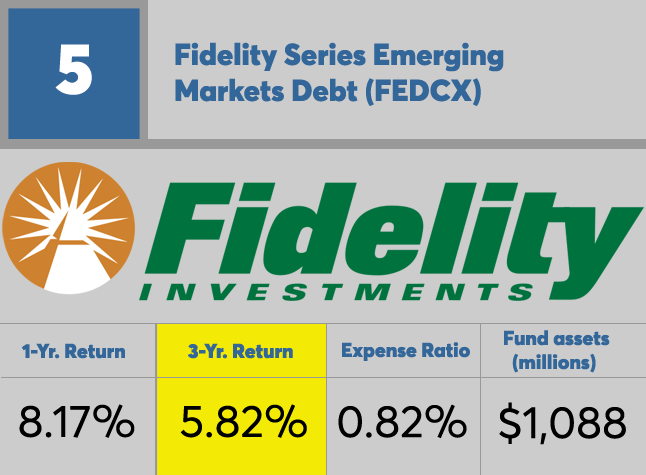

5. Fidelity Series Emerging Markets Debt

3-Yr. Return: 5.82%

Expense Ratio: 0.82%

Fund assets (millions): $1,088

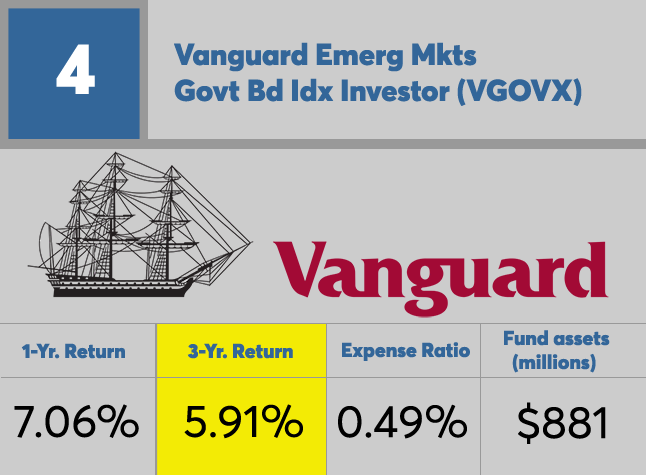

4. Vanguard Emerg Mkts Govt Bd Idx Investor

3-Yr. Return: 5.91%

Expense Ratio: 0.49%

Fund assets (millions): $881

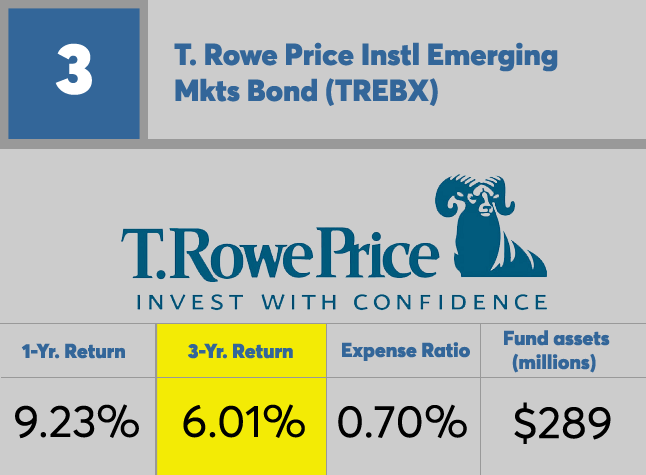

3. T. Rowe Price Instl Emerging Mkts Bond

3-Yr. Return: 6.01%

Expense Ratio: 0.70%

Fund assets (millions): $289

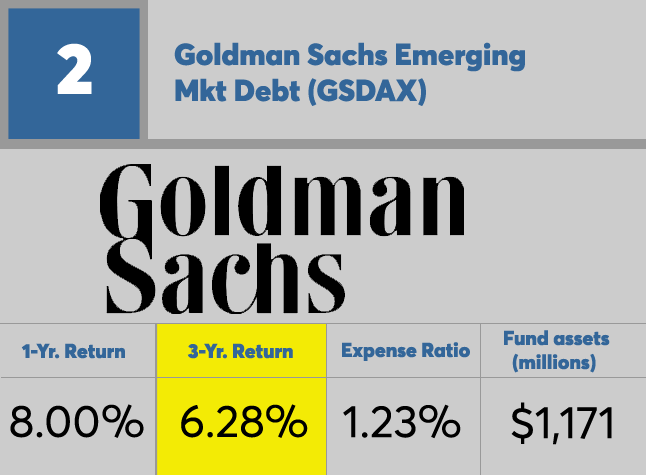

2. Goldman Sachs Emerging Mkt Debt

3-Yr. Return: 6.28%

Expense Ratio: 1.23%

Fund assets (millions): $1,171

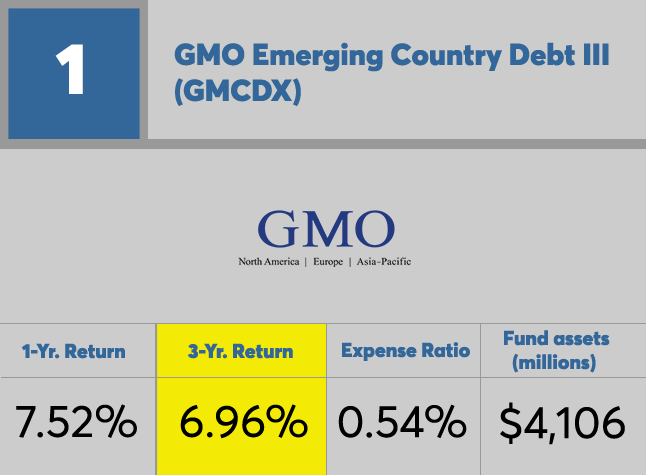

1. GMO Emerging Country Debt III

3-Yr. Return: 6.96%

Expense Ratio: 0.54%

Fund assets (millions): $4,106