-

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

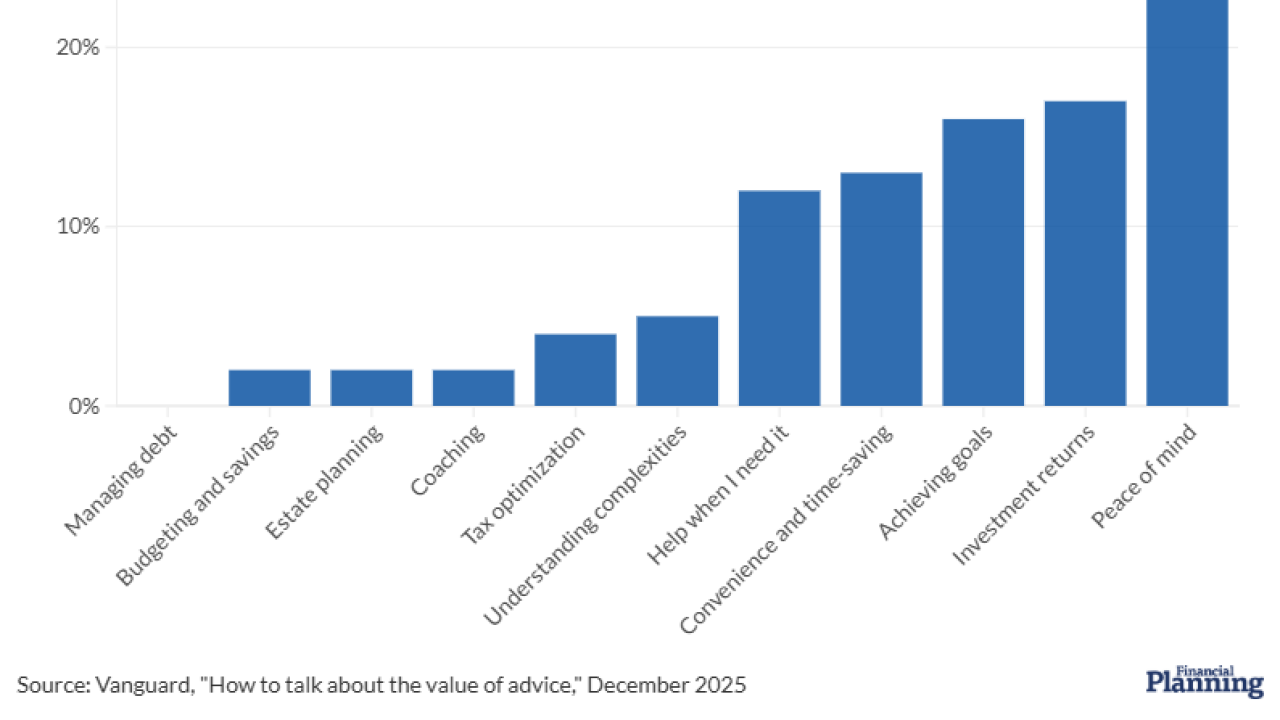

Vanguard's latest poll and analysis offers a multifaceted explanation into how financial advisors should talk about their value to clients and prospective customers.

January 8 -

Funds that primarily hold select cryptocurrencies, including bitcoin, ether, XRP and solana will be allowed.

December 2 -

Quant firm Dimensional Fund Advisors has received formal approval to adopt a fund structure that for two decades has been used exclusively by Vanguard.

November 18 -

The model they want to follow creates an exchange-traded fund as one of the share classes of a mutual fund, a move that ports the famous tax efficiency of the younger structure to the older vehicle.

October 3 -

Vanguard was accused of giving advisors incentives to enroll clients in certain financial service without disclosing how they were being compensated.

August 29 -

CEO Kunal Kapoor and other speakers explained how the shifting trends shaping the industry mean that advice is getting even more important.

June 26 -

The industry is awaiting SEC approval for dozens of applications, even as Vanguard's shareholder case highlights some of the tax complexity of the looming shift.

June 23 -

With the industry awaiting the regulator's looming actions, the index fund giant is seeking to apply its dual share class structure to actively managed strategies.

June 12 -

At the heart of the concern is a tax dynamic that exchange-traded funds were built to avoid.

May 28 -

The research and consulting firm spoke with more than 11,500 investors last year about their wealth management company. Here's how 36 firms fared in the survey.

March 20 -

Out of more than 2,000 moves reducing prices over nearly 50 years, the company says this round represents the largest in its history.

February 3 -

The Malvern, Pennsylvania-based asset manager was dinged by the SEC, which said it made misleading statements to some retirement savers.

January 17 -

The asset management giant called out the method of offsetting capital gains in this year's edition of its oft-cited study tracking the "alpha" of financial planning.

January 10 -

Joanna Rotenberg, recently of Fidelity Investments, will lead Vanguard's newly created advice and wealth management division starting in 2025.

December 10 -

Target-date fund holders who invested through taxable accounts absorbed a giant capital gains distribution because of the firm's flub, the plaintiffs say.

November 7 -

The money managers slashed their support of ESG shareholder proposals amid a Republican-led backlash against sustainable investing.

September 20 -

Investment management firm Vanguard has cut the investment minimum to access its robo advisor from $3,000 to $100 in assets.

September 4 -

Experts from Vanguard say financial advisors and clients see opportunities in active fixed income amid cooling inflation and expected rate cuts.

July 1 -

The news on retirement isn't all bad. Last year Americans saved more in their 401(k)s than ever before, according to new research from Vanguard.

June 25