Top Funds That Invest in U.S. Banks

Fixed-income may be the first thought, but bank stocks are generating buzz and will be even stronger if rates rise.

There are two caveats to consider: The notion of higher rates may already be baked into bank stocks; and the Fed may not raise rates. But for those interested in seeing the strongest mutual funds with high concentrations to the U.S. banking sector, click through to see the 10 funds ranked by three-year annualized returns.

All data from Morningstar. Each fund listed has at least 50% of its assets in U.S. banks. To see a single-page version, click here.

Rydex Banking

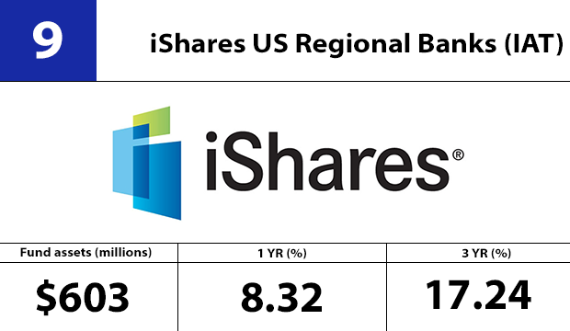

iShares US Regional Banks

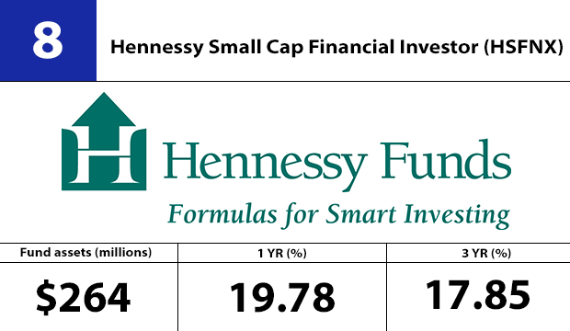

Hennessy Small Cap Financial Investor

SPDR® S&P Bank ETF

JHancock Regional Bank

First Trust NASDAQ ABA Community Bk ETF

SPDR S&P Regional Banking ETF

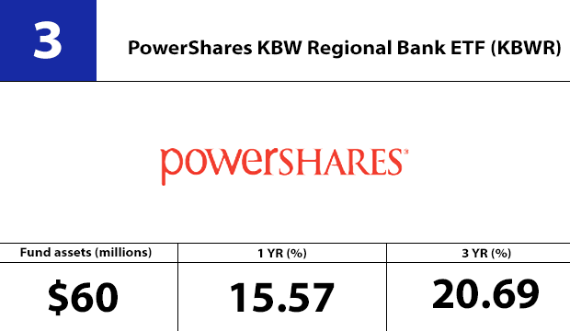

PowerShares KBW Regional Bank ETF

Emerald Banking and Finance