-

The major employer-plan group had previously been affiliated with the predecessor of Global Retirement Partners.

April 15 -

New legislation that aims to give workers greater opportunities to save may put the kibosh on a strategy for passing large individual retirement accounts to heirs.

April 12 -

Advisors who once oversaw portfolios for clients anxious to save a dollar now work more frequently with investors saving to see the world.

April 9 -

Clients who owe the IRS should pay their taxes by April 15 even if they have already secured an extension.

April 9 -

If spending $5 a day on fancy coffee puts your retirement at risk, you’ve got bigger problems.

April 4 -

Only about 20% of Americans know the amount of contributions they can make to their 401(k) plan, according to a new study from TD Ameritrade.

March 22 -

There are a lot of options — and potential missteps.

March 19 -

Heavily weighting any single stock has the potential to make a portfolio more volatile.

March 15 -

Seniors will face a 20% penalty on top of income taxes if they withdraw funds from a health savings account for non-medical expenses before the age of 65.

March 11 -

The worst thing you can do during a stock market crash is panic and sell your stocks near the market bottom.

March 6 -

To qualify for this feature, clients should have reported a minimum amount for at least 11 years.

March 5 -

For many workers, moving assets from old 401(k)s into a traditional IRA may not be a smart move. One reason: IRAs often don’t offer stable value or guaranteed fund investment options as do most 401(k)s.

March 4 -

The government needs to improve cost-of-living adjustments to ensure that retirees can cope with inflation, says an expert.

March 1 -

The transparency of a fee charged to other fund firms for use of the platform is allegedly questioned.

February 27 -

Medicare will charge a high-income surcharge if seniors reported more than $85,000 (or $170,000 for joint filers) in modified adjusted gross and tax-exempt interest income.

February 20 -

Retirement plans may decline to offer delayed RMDs, plan loans, stretch and hardship distributions and a host of other legally sanctioned tax maneuvers.

February 19 -

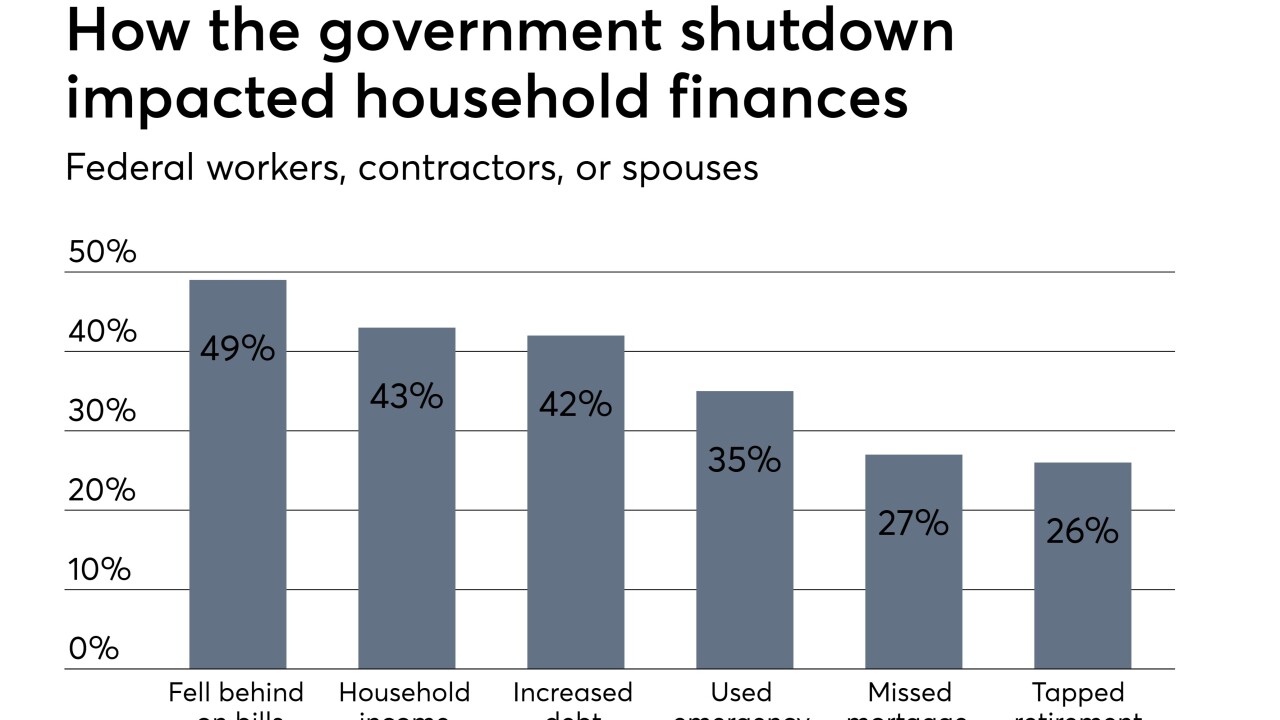

The last government shutdown highlighted how many Americans ignore basic planning lessons.

February 19 -

Retirees who opt to file at a much later date can earn delayed retirement credits that could boost their benefits by as much as 32%.

February 15 -

It would raise enough new revenue to more than restore long-term balance of the program.

February 13 -

Lawmakers and policymakers should make retirement savings plans universally available if they want to help Americans secure their golden years.

February 11