-

The outflows have rekindled a popular concern that the funds could portend the start of a liquidity crunch.

June 2 -

A tweak in accounting guidelines the firm helped to modify is expected to make the funds cheaper and easier to own.

May 30 -

Index funds may not be the ideal choice, but there are better options than the active bond funds pushed at a Morningstar panel.

April 27 Wealth Logic

Wealth Logic -

Money has flowed out of the vehicles as growth favors stocks.

April 24 -

The firm's latest offering provides access to international equity markets. Plus: Other launches.

January 27 -

Leaders in domestic stock, international stock, fixed income, and allocation and alternatives funds are recognized for standout performance.

January 27 -

These popular choices for asset allocation also have a history of solid performance.

January 4 -

The search for low-touch mutual funds has shifted "disproportionate" client money into fixed income, an analyst says.

November 16 -

Wide adoption by global money managers and ETFs could set off a new wave of buying, according to Morningstar.

October 6 -

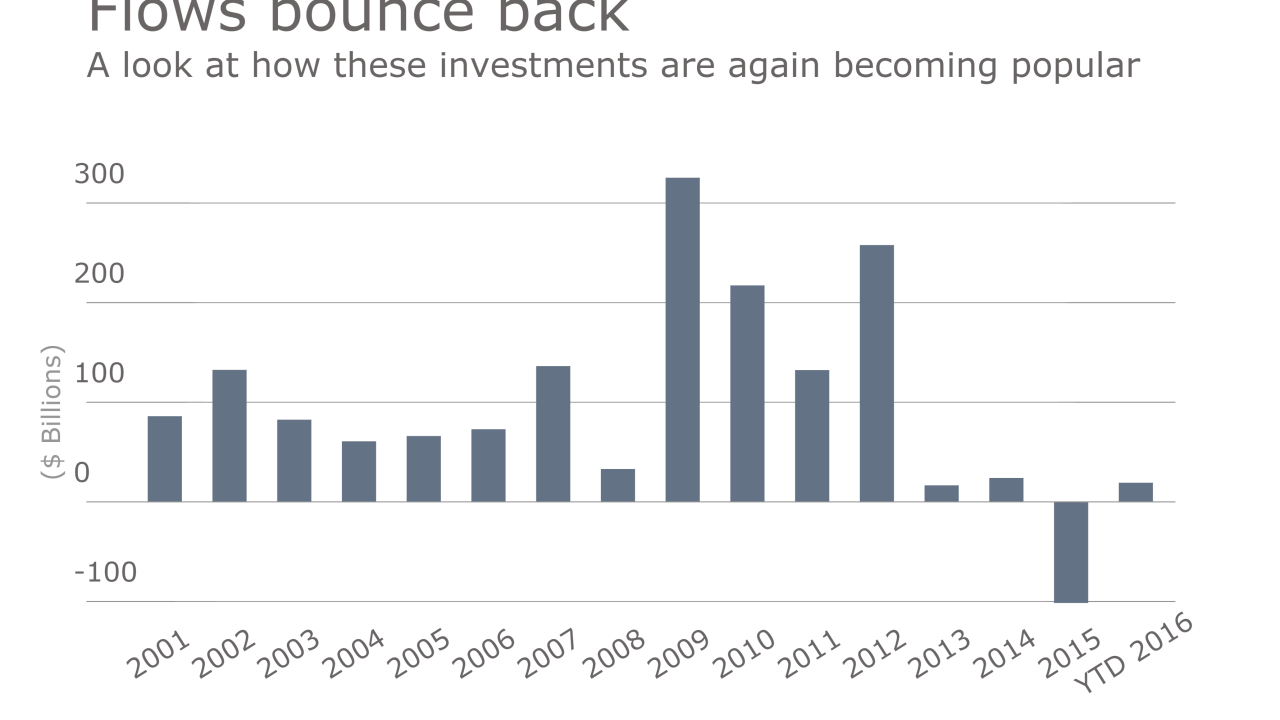

The funds have had the fastest growth since 2012, with nearly $100 billion of inflows, helped by record emerging-market investments.

October 4 -

Fund providers should consider digital platforms and outsourcing to reach more advisers, according to Nuveen's head of alternative strategies.

September 7 -

Performance demonstrates instruments’ strength and ability to offer protection.

August 10 -

Investors have once again taken a liking to taxable bond funds — a marked difference from last year. Advisers may find that clients are taking notice, too.

August 4 -

Fixed income has posted steady returns in these markets, while once high-flying equities have come crashing down.

June 29 -

A planner at the Morningstar conference sees too many risks, not enough rewards

June 14 Wealth Logic

Wealth Logic -

Fixed-income yields may feel low, but foreign investors facing negative yields at home are making the U.S. markets popular.

June 6 -

BlackRock’s Larry Fink warns there will be a "massive shift" into passive investing amid consolidation in the asset management industry.

June 2