-

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

As adoption of the dual-wrapper products accelerates, so will questions about timing, pricing and residual balances.

January 21 Nottingham

Nottingham -

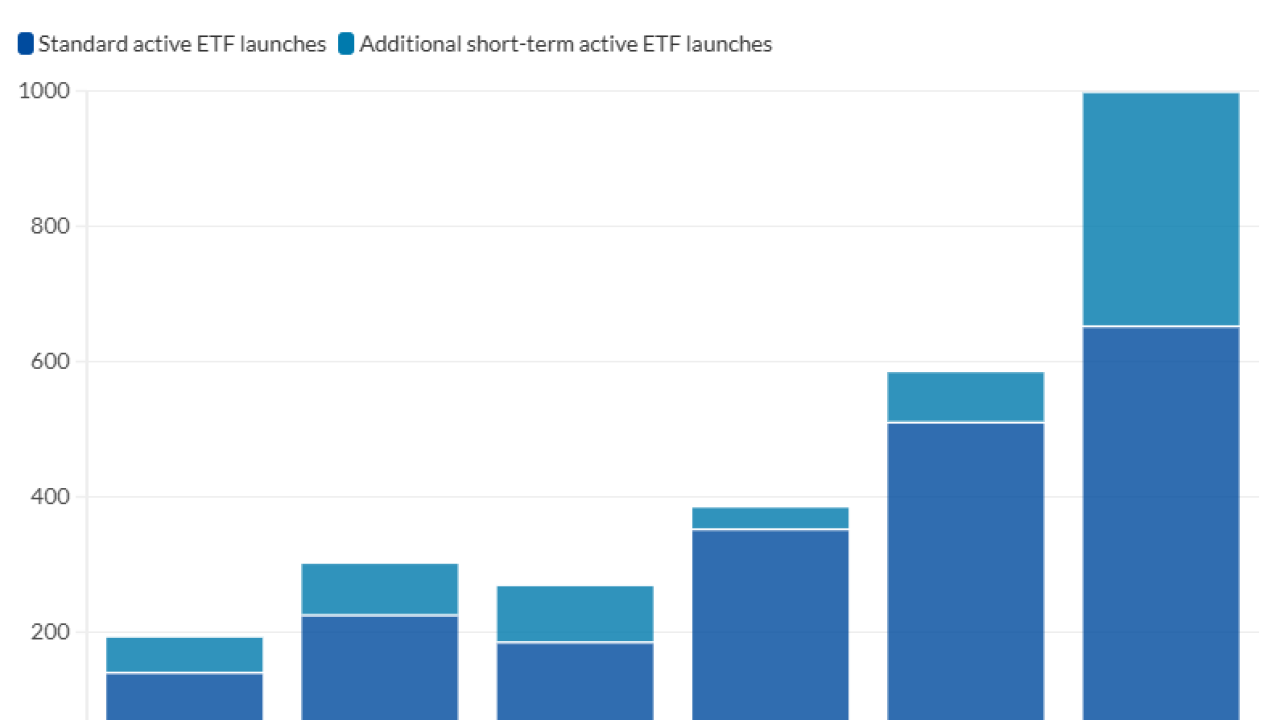

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

The model they want to follow creates an exchange-traded fund as one of the share classes of a mutual fund, a move that ports the famous tax efficiency of the younger structure to the older vehicle.

October 3 -

Two studies from Morningstar dive into the subtleties across the various categories of funds and the sources of the gap between actual and total investment returns.

September 18 -

Panelists at the Morningstar conference acknowledged the difficulties, even as they pointed out the ongoing opportunities from active management.

July 11 -

The industry is awaiting SEC approval for dozens of applications, even as Vanguard's shareholder case highlights some of the tax complexity of the looming shift.

June 23 -

Net of expenses, many financial advisors and investors could find similar yields and exposure for their portfolios elsewhere, according to a Morningstar study.

June 12 -

With the industry awaiting the regulator's looming actions, the index fund giant is seeking to apply its dual share class structure to actively managed strategies.

June 12 -

A unique mutual fund type is gaining ground with advisors, according to the FPA's newest survey. Advisors say the data points to a broader trend of planners shifting away from investment management.

June 6 -

With billions of dollars in revenue at stake, wirehouses and broker-dealers are keeping an eye on a potential regulatory change in favor of the ETF industry.

May 8 -

Only two out of nine firms included the total amount of money involved in revenue sharing — a practice critics say should be ended entirely — in their disclosures.

May 7 -

The industry conflict of interest takes many common, controversial or outright confusing forms. Here's what financial advisors and investors should know.

May 6 -

Dimensional Fund Advisors' latest research adds to existing literature highlighting sometimes-overlooked downsides with the ongoing rush to low-cost ETFs and other products.

February 12 -

Out of more than 2,000 moves reducing prices over nearly 50 years, the company says this round represents the largest in its history.

February 3 -

Edward Jones stood accused of not properly supervising advisors who were charging clients commissions for mutual funds and then moving the fund shares over to fee-generating accounts.

January 8 -

FINRA charges restitution but forgoes punitive fines for the three firms after crediting them for cooperating in its investigation.

December 20 -

Target-date fund holders who invested through taxable accounts absorbed a giant capital gains distribution because of the firm's flub, the plaintiffs say.

November 7