-

As mega firms scale up and niche advisors specialize further, profits for a vast swath of the advisory market are getting squeezed.

October 12 -

Allianz became the second multinational insurance firm to step away from the IBD space this year under a plan to shutter Questar Capital.

October 11 -

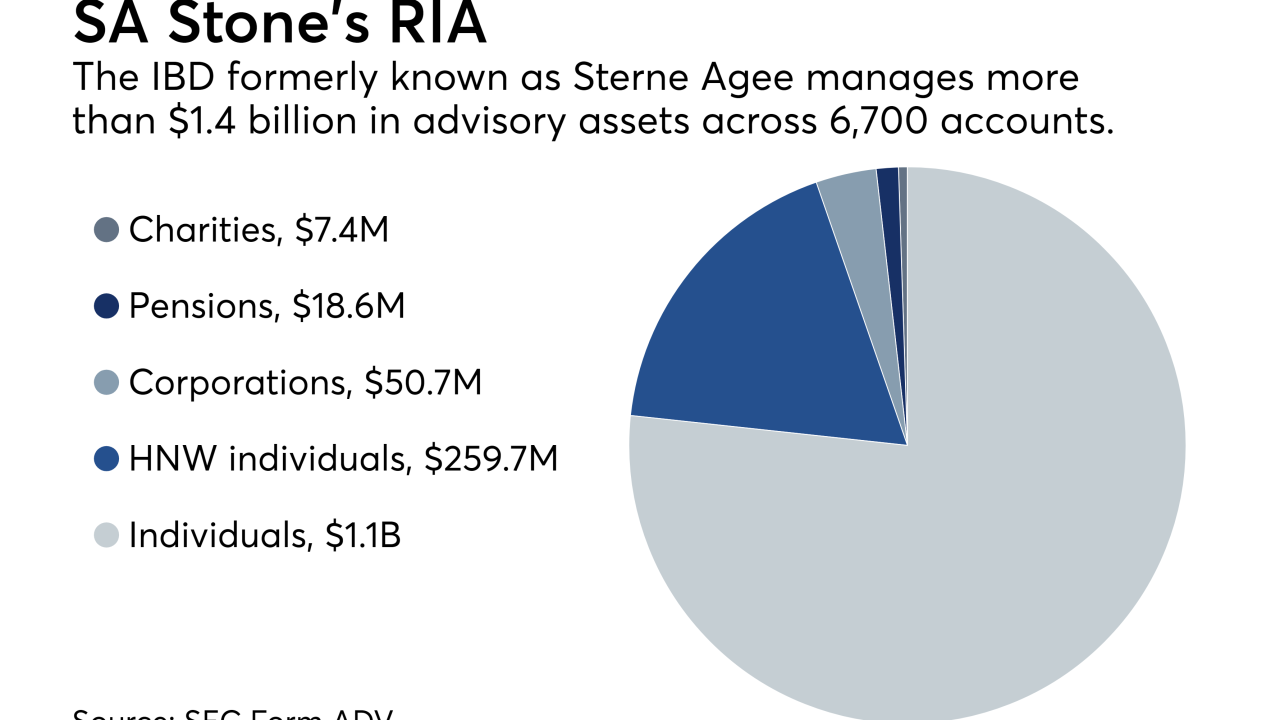

Sterne Agee changed its name after Stifel sold the firm in 2016 to INTL FCStone for about $50 million.

October 9 -

The private equity firm completed the largest IBD purchase of the year by acquiring the majority of the 7,700-advisor network.

October 9 -

Charged with leading the firm’s recruiting and sales strategy, Scott Posner will report to the recent successor to Bill Morrissey, who left the firm last month.

September 28 -

Establishing personal key performance indicators is vital, planners say at XY Planning Network conference.

September 25 -

Amid industry concerns, the largest RIA lender promises not to share data between the bank and its new wealth firm.

September 18 -

Retired former CEO Mike Sherzan ran unsuccessfully for Congress in 2016, and he became chairman of the board prior to the deal.

August 23 -

Dan Arnold says the firm remains interested if deals are a match for the No. 1 IBD.

July 27 -

The owner of RIA aggregator Mercer Advisors has pledged to maintain the IBD network’s current structure under the deal.

July 17