-

While FINRA rules spell out what brokers generally need to determine a client's financial situtation, there can be gray areas, an expert says.

November 16 -

But the regulator also ordered record payouts in 2020, including restitution through a self-reporting program that drew industry ire.

November 5 -

The rule has faced a host of criticism from investors, environmentalists, asset managers and others.

November 3 -

Unclear — or no — disclosures were among a number of concerns regulatory officials expressed about initial examinations.

October 29 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

Although in-person hearings aren’t banned outright, none have taken place since the onset of the coronavirus pandemic.

October 23 -

The former J.W. Cole advisor’s practice allegedly sold more than $40 million worth of unsuitable and unregistered promissory notes.

October 22 -

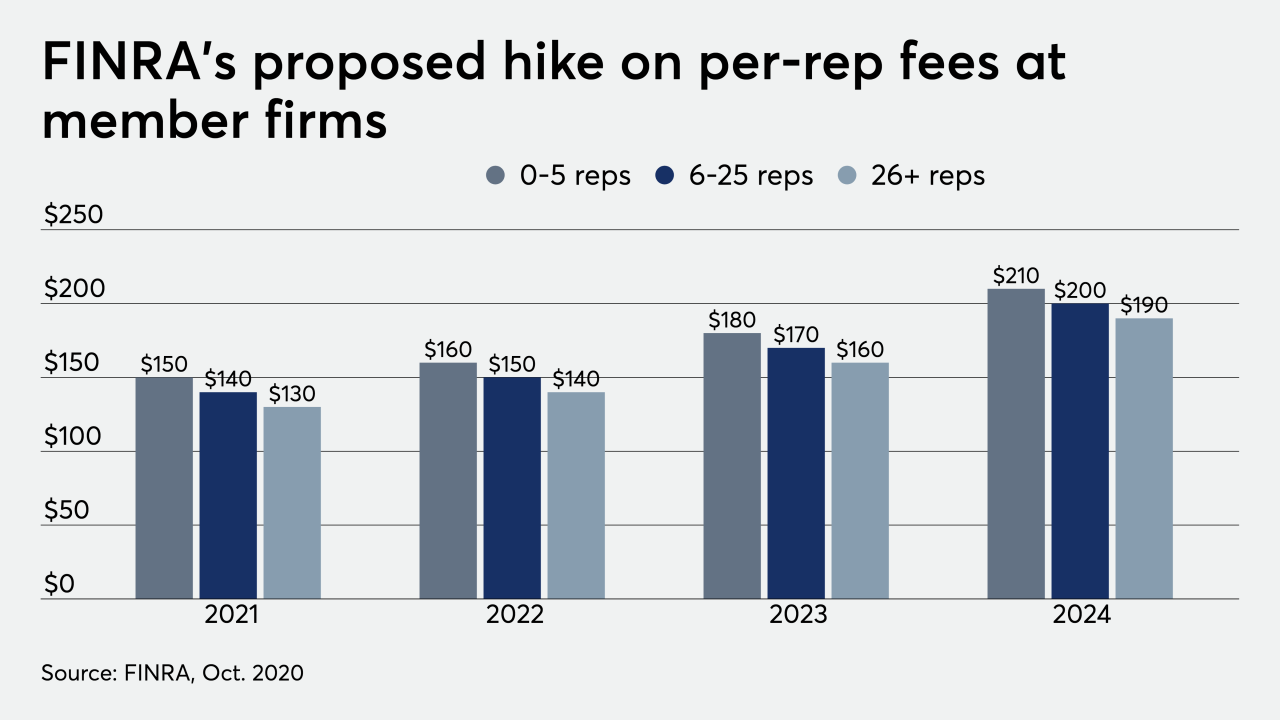

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7 -

The advisor allegedly used an omnibus trading account to help himself and hurt his clients to the tune of tens of thousands of dollars, according to the regulator.

October 5