Five months into Reg BI’s reign, initial regulatory exams reveal wealth managers are making a bona fide effort to meet new requirements — but the industry is hardly up to snuff, according to regulatory officials.

Some firms have failed to disclose how they make compensation. Others inaccurately reported their disciplinary history. And at least a few firms haven’t even filed a Form CRS, SEC and FINRA officials said at a Reg BI public roundtable Oct. 26.

“A few were completely unaware of Form CRS,” said Jim Wrona, associate general counsel at FINRA. “That’s not particularly good.”

Some firms that did complete Form CRS would also do well to make it easy for clients to find on their company websites.

“Seriously, we had a hard time locating some,” Wrona said. “It became quite the game. Where’s Waldo? Where’s Form CRS?”

SEC Chairman Jay Clayton and nine other regulatory officials, speaking at a recent roundtable, said most firms had made good faith efforts to implement new policies and procedures. However, shortcomings — and in some cases, blatant inaccuracies — underline that there’s work ahead for broker-dealers and RIAs.

The regulatory speakers did not specify how many broker-dealers or RIAs had failed to properly comply with new requirements.

Some of the concerns highlighted by the roundtable “seem pretty serious,” says Barbara Roper, director of investor protection at the Consumer Federation of America, who had listened to the panel. “How do you not disclose compensation conflicts in a good faith effort? How do you not include your disciplinary record in a good faith effort?”

Regulation Best Interest, which the SEC adopted last year, became effective at the end of June, along with a new requirement that firms file the concise and readable disclosure document

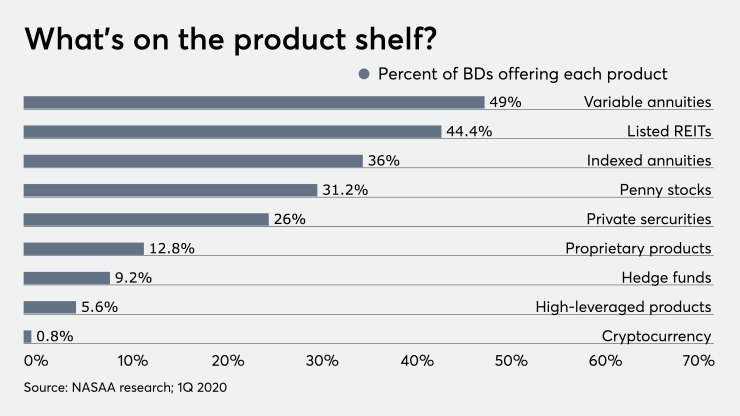

NASAA, an organization representing state and provincial securities regulators, hoped the new regulation would address discrepancies in the advice investment advisors and brokers give to clients, according to Andrea Seidt, the Ohio Securities Commissioner, and chair of the Reg BI implementation committee at NASAA. For example, broker-dealers were seven times as likely as RIAs to recommend private placements in 2018, and eight times as likely to recommend variable annuities, according to a recent NASAA

Initial regulatory scrutiny suggests that many firms are, indeed, addressing some of these disparities, according to panelists. Some wealth management firms have developed internal systems to compare investments and document the basis of their recommendations. Firms had also adjusted the mutual fund share classes or variable annuities they were offering clients, panelists said. In some cases, firms had fined their registered reps who hadn't completed required training on time.

Federal regulators “are seeing firms make some changes and look more closely at alternative products,” says Seidt, who spoke withFinancial Planning Oct. 29. She was encouraged to hear that some firms had begun collecting client information such as education level and debt as part of their due diligence process. Despite the importance of that kind of information when providing investment advice, NASAA research shows that few firms had included it in their processes, she says.

However, initial examinations have also uncovered wealth managers with unsatisfactory recordkeeping requirements and an unclear understanding of what constitutes a recommendation. Further, some firms had published confusing explanations of their relationship with clients in Form CRS. Others had delivered staff training “way after June 30,” according to Bill St. Louis, senior vice president of member supervision at FINRA, (St. Louis noted that FINRA is working to understand how COVID-19 may have impacted that lag.)

Another failing? “A number of firms” did not accurately report their disciplinary record, according to Wrona. Indeed, aWall Street Journal

“So far, this is the biggest issue that we've seen — followed by firms failing to file [a Form CRS] that should have been filed,” Wrona said.

Firms also failed to disclose conflicts related to how brokers or financial advisors make money. “We are concerned that some firms did not disclose conflicts created by compensation, which seems a rather odd one to kind of leave out,” said Wrona.

A more controversial discrepancy: Melissa Gainor, assistant director of the division of investment management at the SEC, said some RIAs had declared themselves to be fiduciaries in Form CRS, which is not allowed under the regulation.

“That language is neither required nor permitted by the instructions, and shouldn't be included,” she said.

Roper was concerned that the SEC prohibits fiduciary language in the disclosure document.

“I think it is emblematic of just how bad Form CRS is that advisors can get into trouble for making factual statements about the standard of conduct that applies,” she said, noting that the form obscures, rather than clarifies, broker and advisory standards of conduct.

Seidt was inclined to cut broker-dealers and RIAs a little slack. While “you might find some stragglers” whenever there is significant new rulemaking with multiple complex compliance obligations, she says, deadlines for Reg BI also hit in the middle of a global pandemic.

“I'm a little sympathetic to firms, especially smaller firms that don't have as significant resources as some of the larger broker-dealers do,” Seidt says.

NASAA will conduct further research in the first quarter of 2021 to gauge whether firms have adjusted their procedures to comply with Reg BI, and how effective the regulation has been.

“A lot of people might want to predict and speculate what it's going to show,” Seidt says. “We're going to wait and see on that front.”