-

“It’s bad when this happens on a Friday, because then people get freaked out over the weekend.”

April 6 -

The money manager has been shorting a group of technology stocks, which he’s described as a “bubble basket.”

April 2 -

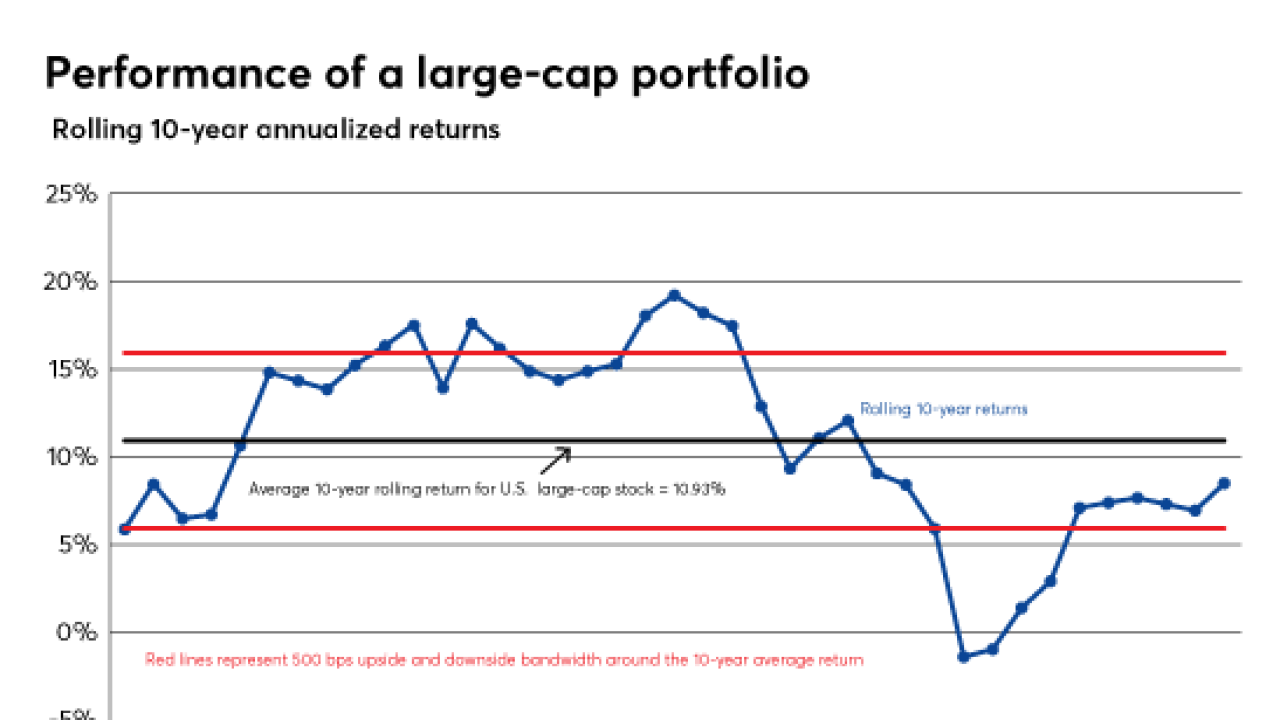

Booms and busts both have the potential to create unrealistic outlooks on both ends of the performance spectrum.

March 29 -

While the S&P 500 has risen or fallen by more than 2% six times this year, it swung by twice that amount nine times in October 2008.

March 28 -

S&P 500 enjoys its biggest one-day jump since August 2015.

March 26 -

It’s been a miserable week for higher-risk markets, as a trade war edged closer and the tech sector was roiled by Facebook’s scandal.

March 23 -

ETF Managers Group accused the exchange of favoring interests in a competing product.

January 29 -

The delay was partly prompted by BlackRock’s testimony that policymakers, not index compilers, should set corporate governance standards.

November 3 -

After the tech bubble and the 2008 financial crisis, the younger generation has little reason to trust the markets.

October 30 -

As the Dow tops 23,000, remember the largest percentage drop in history.

October 18 -

Sept. 4: As managers acquaint themselves with the AI and automation industries, one firm has been deeply invested in the burgeoning field.

September 1 -

JPMorgan projects net corporate issuance of emerging market debt at just $22 billion for the rest of the year.

August 17 -

This is about precision, accuracy and clarity because where we are in a market cycle is a pretty big deal.

March 14 -

The index climbed to record highs as investors grew increasingly confident global economic growth is accelerating.

March 1 -

A seventh straight day of gains marks the S&P 500's longest run since 2013.

February 15 -

Stocks added to records and Treasuries fell after the Fed chairwoman said growth may warrant higher interest rates.

February 14 -

Historically, the average has performed better when NFC teams have won over the past 50 years.

February 3 LPL Financial

LPL Financial -

With Brexit and the presidential elections sending stocks into the biggest tailspins since the flash crash, almost everyone lost their nerve at some point. But investors who didn’t flinch are reaping the rewards.

January 25 -

Valuations are high from a fundamental perspective, but increasing consumer confidence has historically pushed them even higher.

January 25 Commonwealth Financial Network

Commonwealth Financial Network -

But to get to where bulls think earnings are going, the economy would have to pull off a feat of strength that is unprecedented since at least 1937.

December 30