-

People in higher income brackets can consider replacing less of their pre-retirement income than the 80% usually suggested by financial planners; Plus, five things retirees can do to navigate the current environment.

December 1 -

Market performance under different U.S. presidents highlights the importance of heeding this key economic measure.

December 1 -

Retirement investors who want a new approach to asset allocation may consider one that classifies securities based on how long they intend to keep the investments in their portfolio to achieve their targets; Plus, which retirement savings plans are best for teachers?

November 30 -

Considering a tactical adjustment for your client portfolios to benefit from the holiday season? Here's how each of the 10 sectors in the S&P 500 performed in Q4, on average, since 1990.

November 30 -

Recent jittery markets give advisors a terrific chance to judge liquid alt funds. Better yet, a close look can help you better position the portfolios of clients worried about global markets.

November 27 -

Bank stocks are generating buzz among investors and if rates rise, the outlook is even better. Here are the best-performing funds with a concentration in banking.

November 23 -

Seniors who have no need for required minimum distributions from their retirement accounts may re-invest the funds so the money can start generating an income again; Plus, seven retirement money wasters to avoid.

November 23 -

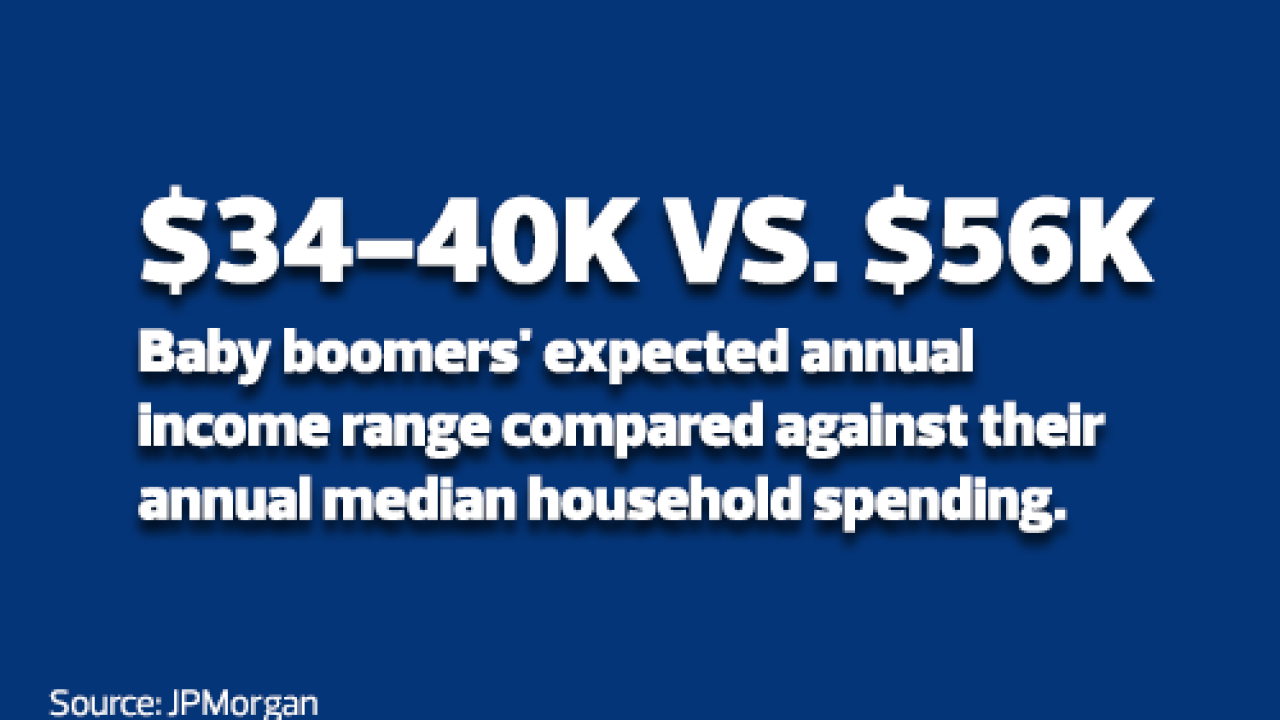

A J.P. Morgan study shows baby boomer spending needs could face funding constraints as they grow older, challenging advisors helping these aging clients maintain their lifestyles.

November 19 -

Advisors can point clients to undervalued investments in the energy sector for tax-loss harvesting. Plus, avoiding the cost of MLPs in retirement accounts.

November 19 -

Sen. Patty Murray, D-Wash., introduced legislation that would enable unmarried, divorced and widowed women to collect bigger Social Security benefits; Plus, protecting your client's portfolio from the downside.

November 18