-

Lower interest rates are just one of many factors weighing on the $1.7 trillion market for private debt.

September 20 -

The money managers slashed their support of ESG shareholder proposals amid a Republican-led backlash against sustainable investing.

September 20 -

Large exchanges argue some of the changes could make it more costly for them to offer rebates to brokers in return for order flow.

September 18 -

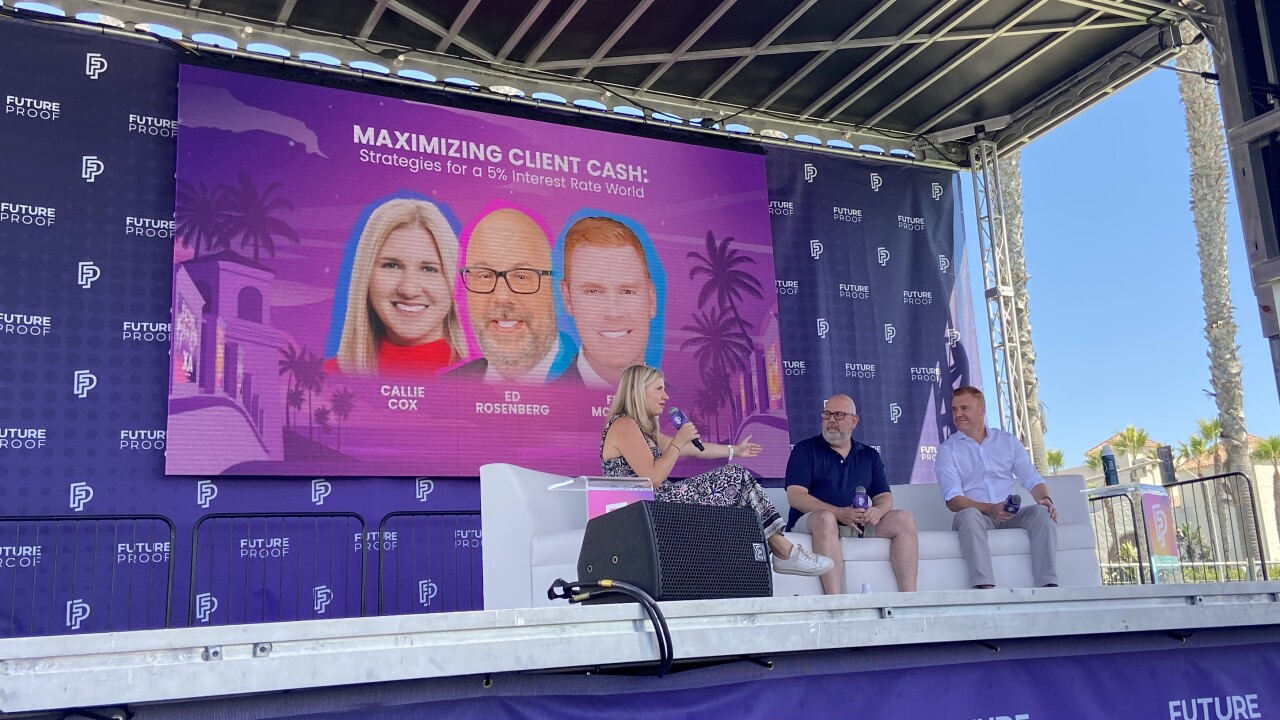

Clients must understand that having too much of their portfolios allocated in cash can mean lower returns over time.

September 18 -

Experts expect the rate cuts to continue, but for how long and how effective they will be in achieving a "soft landing" remain to be seen.

September 18 -

Fintech startup Intelligent Alpha has launched a chatbot-powered ETF that claims to harness the investment brainpower of Warren Buffett, David Tepper, and more.

September 18 -

Advisors and industry experts say a historical perspective of the past and a long-ranging view of the future are key in this moment of change.

September 17 -

Demand from retail investors for the closed-off securities has boomed, with private markets now worth more than $13 trillion.

September 17 -

Edward Jones is also lowering its fees on certain asset ranges and seeing faster-than-expected adoption of the MoneyGuide investing systems.

September 16 -

The accounts are expected to grow by another trillion dollars over the next decade because of their tax and flexibility advantages, Daffy CEO Adam Nash said.

September 16 -

New offering would allow advisors to connect with more than 20 external asset managers.

September 16 -

With the increasing use of artificial intelligence-powered tools across the industry, experts remain confident that the technology could usurp human professionals, but isn't quite there yet.

September 13 -

-

The "reverse churning" case highlights the regulatory gap investors can fall into when moving between brokerage and advisory relationships.

September 12 -

The offering comes amid a slowdown in large insitutional investors' funding of private credit and equity.

September 12 -

Fund managers are betting that nuclear energy, an area traditionally off-bounds for investors with environmental mandates, is set to make a comeback.

September 12 -

The recommendation relies on the "circular economy."

September 11 -

A lawyer suing Wells and other firms argues the recent rate changes do nothing to repair harm already suffered by his clients.

September 10 -

The offering, a mix of liquid credit and private investment, still needs regulatory approval.

September 10 -

Unlike the U.S., where the federal government can offer tax breaks, EU taxation rests with member states, leaving the bloc to work largely through loans and grants.

September 9