-

In September, the inflation rate was 2.23%, slightly higher than the proposed Social Security increase. So realistically, recipients "will not be better off at all."

November 24 -

Tax cuts today will increase deficits and future retirees will bear the brunt in reduced Medicare and Social Security benefits, according to one expert.

November 22 -

High-yield or junk bonds, equities, and real estate investment trusts are excellent investment options for IRAs.

November 17 -

The tax cut proposal would not benefit retirees because most of them either owe no federal income taxes or face a modest tax burden.

November 15 -

Under the rules, seniors face a tax liability for HSA contributions if they carry health coverage other than the high-deductible policy.

November 7 -

Seniors might get the policy again if they decided to drop it, but the rules "aren’t really super specific about what should happen in this situation,” one expert says.

October 23 -

Retirees can change their Part D prescription-drug plans, Advantage plans, and/or switch from traditional Medicare to Medicare Advantage during open enrollment, which ends December 7.

October 16 -

Clients should not assume that Medicare will cover all their medical expenses, or that they'll see a decrease in their expenses after they retire.

October 6 -

Certain laws may require them to maintain the coverage with their former spouse.

August 25 -

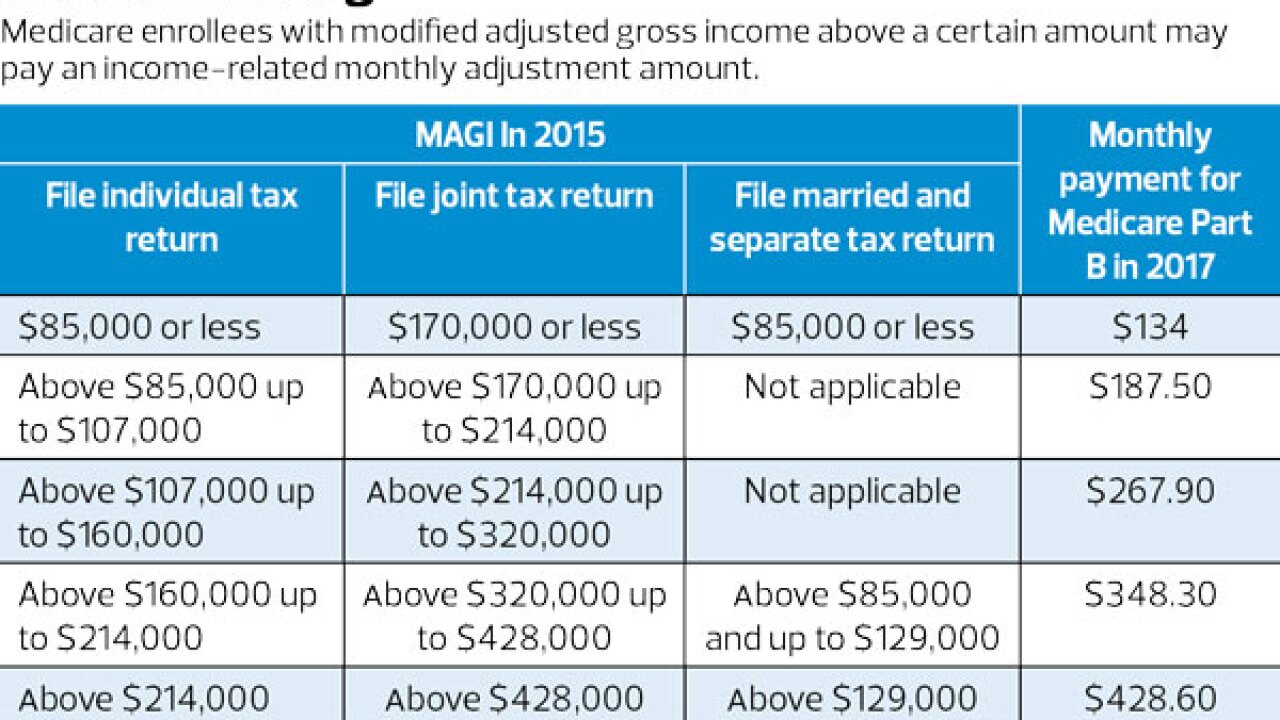

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

High-earning seniors are advised to carefully plan when they file for Social Security benefits.

July 6 -

Beneficiaries owe no federal tax on collected payouts after the policyholder dies.

June 26 -

Health savings accounts are not only for funding immediate medical needs. They offer three distinct tax benefits that make them a powerful form of retirement savings.

June 16 -

Many people plan to have an active lifestyle in retirement, but are not engaging in activities to stay fit.

June 7 -

Seniors are advised to sign up for Medicare when they are about to reach the age of 65, or they face a hefty penalty for the rest of their golden years.

May 24 -

Here’s one reason why beneficiaries should consider setting up a life estate.

May 15 -

10 planning strategies from analysts and experts.

May 10 -

The partner who first reaches 62 should consider delaying Social Security until the age of 70, and they should continue contributing to the retired spouse’s IRA if possible.

May 1 -

Clients may leave an adviser's office with a terrific filing strategy. But the actual process can prove daunting. Here's how missteps can be avoided.

April 20 -

ESG investing is one way to motivate young clients and boost their contributions.

April 18