M&A

M&A

-

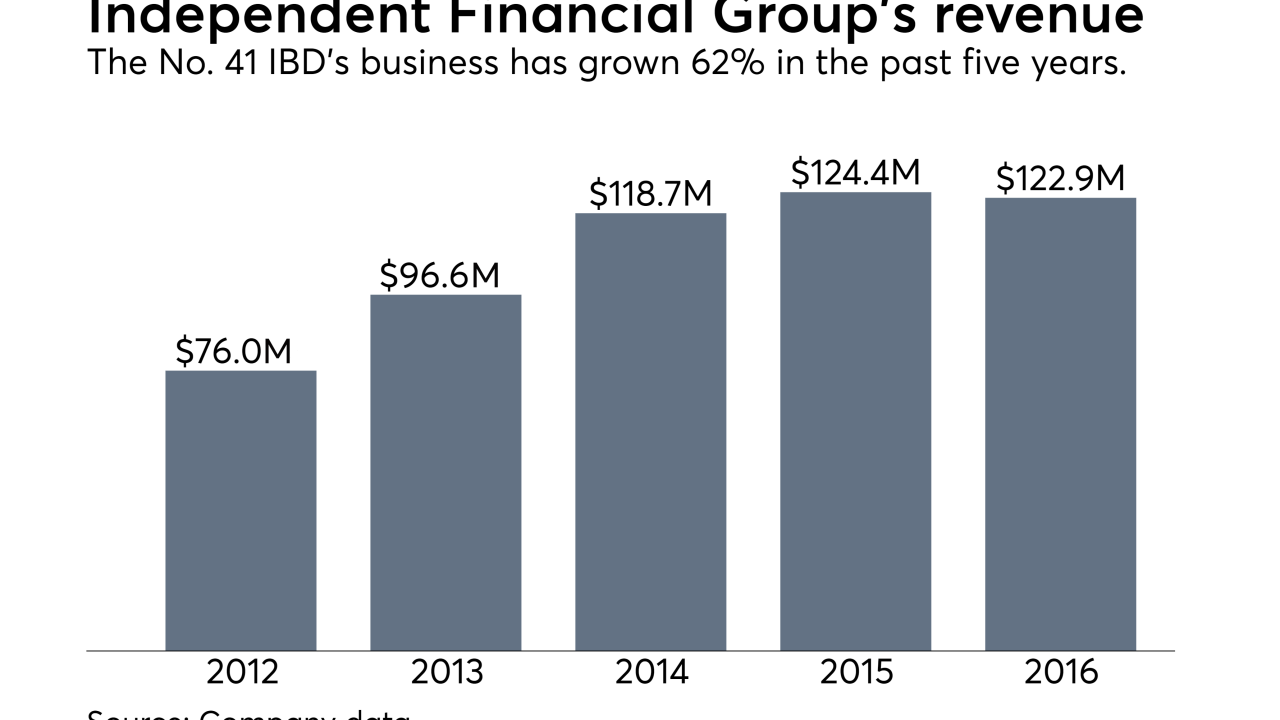

The IBD’s parent has increased its investments in advisory services while other insurers exit the space.

January 9 -

Hanson McClain and Simply Money plan to leverage complementary traditional and social marketing skills in bid to build national planning firm.

January 8 -

Independent Financial Group has grabbed 14 practices with 44 advisors from NPH firms since the LPL deal.

January 3 -

The two broker-dealers have a new owner eager to grow the businesses considerably.

January 3 -

CEO Greg Friedman says the popular CRM will stay client-focused under new ownership.

January 2 -

-

Capital is pouring into the RIA market, resulting in more deals, more competition and higher prices.

January 1 -

Kestra Financial’s James Poer offers advisors his three predictions for the new year.

December 22 -

The deal marks the largest acquisition for the firm year to date.

December 22 -

The No. 20 IBD unveiled a total of 15 practices joining its ranks in the fourth quarter.

December 21 -

H. Beck’s incoming president brings experience with her new firm’s earlier ownership structure and its custodian's platforms.

December 20 -

The five consultants spent a combined 55 years at the No. 1 IBD, and they set up shop near two of its main corporate offices.

December 18 -

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

December 18 -

How tomes of years past contain keys to succeeding in today's world of low fees and increased M&A.

December 18 -

Exclusive: The No. 4 IBD unveiled a new bank-based team even as its competitor began revealing its retained firms under the acquisition.

December 15 -

The IBD network says it has added 583 advisors so far this year.

December 14 -

Roughly 300 ex-NPH advisors have chosen smaller IBDs over LPL Financial after its massive acquisition.

December 13 -

Sellers should focus on what buyers are really looking for, not just price or assets.

December 12 -

Team of 9 advisors is latest to depart amid transition to LPL.

December 12 -

Breakaway uncertainty is forcing the RIA to re-evaluate its growth strategies.

December 10