-

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 16 -

Although smaller companies could be volatile, those that pay dividends tend to be more mature and profitable.

February 14 -

Raising the payroll tax is the easy way (in theory); here are other solutions for funding the Social Security shortfall.

February 13 -

Younger investors may see the market's swing as just another fluctuation in the market, while assuming that time is on their side. Older investors, on the other hand, may be far more stressed.

February 12 -

Retirees are advised to step back to get a better perspective and then review their asset allocation in their portfolio.

February 8 -

Investors are advised to liquidate some assets or transfer them to certificates of deposit and money market funds.

February 7 -

Even if those assets are used to pay for nonmedical expenses, an HSA can still be ahead of a 401(k) plan or an IRA.

February 2 -

Clients have a hundred—if not a thousand—possible options to consider when claiming Social Security benefits.

February 1 -

Younger employees could be too confident in the abilities of automated retirement investment tools, study finds.

January 31 -

A more comprehensive approach to low-cost investing could save thousands for retirement age clients.

January 31 -

Personal income is not subject to state taxes in Alaska, Florida and five other states, while 31 states do not impose taxes on Social Security benefits.

January 30 -

Investors are starting to take money out of their 401(k) accounts—despite taxes and penalties involved—assuming it will be replaced as markets continue to surge upward.

January 29 -

A data firm and a hospital network are betting that advisors can utilize precise cost forecasts for clients' health needs.

January 26 -

Retirees should consider that state laws may differ on who may be legally recognized as a beneficiary's spouse and thus whether their partner would be entitled to spousal benefits.

January 25 -

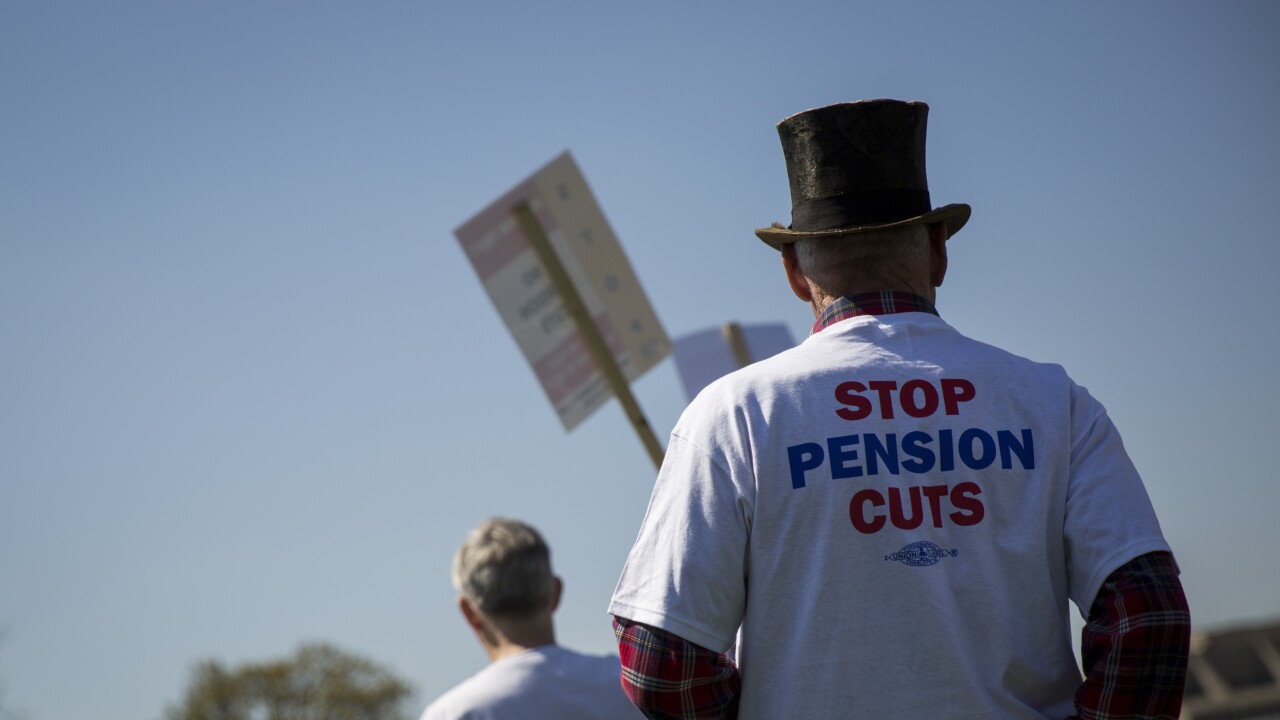

With many private and public pensions in the red, clients are advised to look for options that will improve their prospects, such as Roth IRAs.

January 23 -

Clients shouldn't let their egos get in the way when making investment decisions. They will be better served with a dispassionate asset mix that's rebalanced annually, rather than making investing decisions "in purely personal terms."

January 19 -

While the stock market remains strong, clients should stress-test their portfolios and ensure that they reflect their risk tolerance levels.

January 18 -

If estate planning documents don't use the right language, it can sometimes lead to costly and time-consuming alternatives.

January 17 -

Adding five years to their working years will enable clients to replace their pre-retirement income by up to 90% instead of 60% in some cases.

January 16