-

Many deductions are likely to disappear if Congress passes the reform bill into law.

December 8 -

Retirees should ensure that they take their first required minimum distribution from their tax-deferred retirement account in the year they reach 70 1/2 or face a 50% penalty.

November 27 -

The proposal aims to simplify tax subsidies by increasing qualified withdrawals from 529s in exchange for scrapping the Coverdell account.

November 13 -

The tax plan would make itemized deductions less valuable so some seniors would lose a deduction that covers payments for nursing homes, assisted living or inpatient hospital care.

November 9 -

The Roth 401(k) is more flexible than a Roth IRA, and it is funded with after-tax dollars, which can help "diffuse the potential tax bomb."

November 6 -

Here are some traditional and under-the-radar ways to help clients earn more after taxes.

November 6 -

While contribution limits are expected to remain untouched, the country is still facing a retirement crisis, one expert says.

November 3 -

Clients should consider the next market downturn as an opportunity to invest in stocks that are "on sale."

October 25 -

The first step is to account for any obligations or costs, an expert says.

October 16 -

The right debt strategy can help clients make better decisions with capital allocations.

October 10 -

Most retirees said they adapted to their situation of having limited retirement income and they have had few regrets, according to a survey.

October 5 -

Owning a home can bring tax benefits, as well as equity that can be used to create an income stream, but in some cases a rental can be a better deal for retirees.

October 2 -

Can your clients use the increasingly popular "still working" rule? Yes, but get a handle on the rules first.

October 2 -

Some consumer advocates worry that this will negatively affect small businesses and middle- and low-income Americans.

September 29 -

Are you taking full advantage of the tools at your disposal? Advisors share insights about approaches.

September 25 -

The answer is in the investment details. If your employer offers a match, contribute at least enough money to get it since matches amount to "free money."

September 12 -

Clients under 35 are the only age group with a negative savings rate. These tools can help them prepare.

September 11 -

Each pre-retiree couple is in a unique circumstance, and needs to account for their health and longevity, as well as their willingness and ability to work.

September 5 -

Not tapping tax-deferred retirement accounts until the age of 70 1/2 can be a wrong move, as required minimum distributions can be big enough to push retirees to a higher tax bracket.

August 28 -

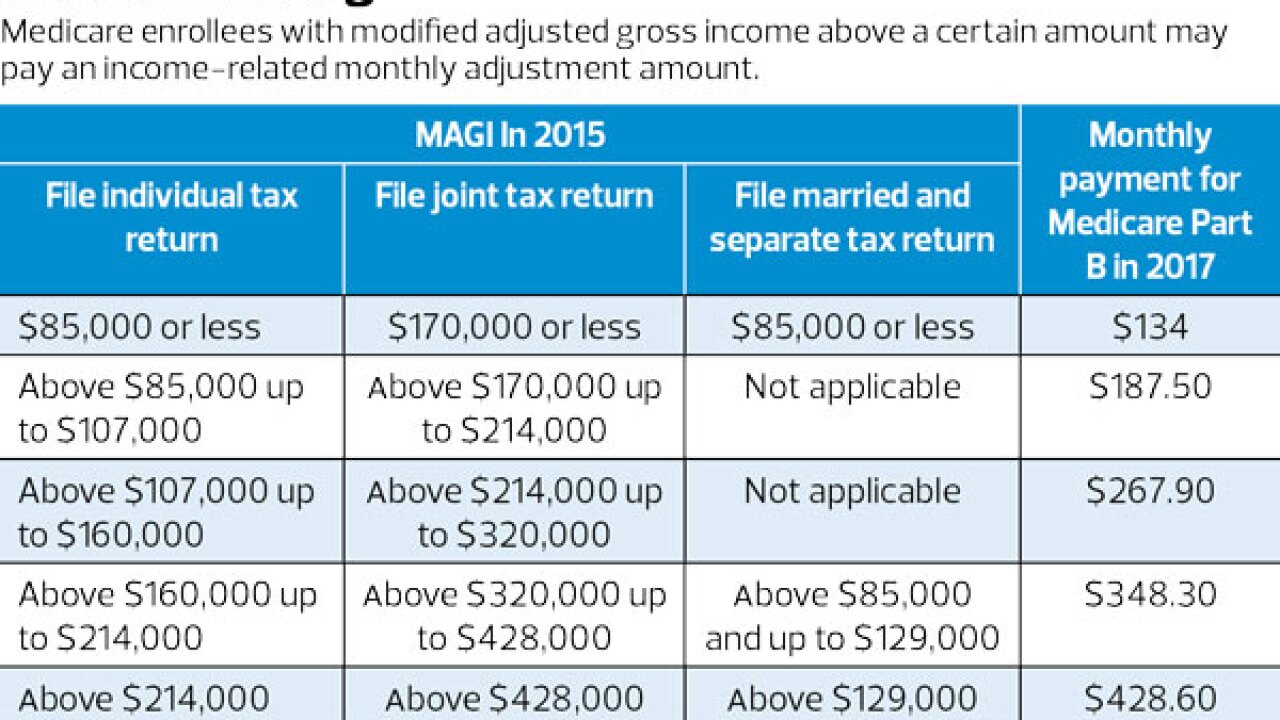

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8