-

Clients are increasingly favoring accounts suited for emergency spending, research shows.

April 15 -

New legislation that aims to give workers greater opportunities to save may put the kibosh on a strategy for passing large individual retirement accounts to heirs.

April 12 -

Grandparents are advised to give cash gifts without putting their future financial security at risk.

April 11 -

There are still several moves that clients can make to reduce their 2018 tax bill.

April 1 -

New innovations increase participation by making it easier to save and invest for retirement, an expert says.

March 28 -

Parents should have a smart plan on how to help their adult children returning to their home without putting their own retirement at risk.

March 26 -

Dental expenses can eat away a considerable amount of retirees’ savings, but these costs are important to prevent health complications and other medical expenses.

March 21 -

There are a lot of options — and potential missteps.

March 19 -

Heavily weighting any single stock has the potential to make a portfolio more volatile.

March 15 -

The U.S. is one of the few countries that doesn’t have paid family leave, and it can cause families hardship around the time of a birth, says an expert.

March 14 -

The Trump administration unveiled its proposed budget that includes provisions that would enable Medicare beneficiaries to contribute to a health savings account.

March 13 -

Not having a full understanding could hurt workers’ retirement prospects by causing them to possibly miss out on their employer’s match or not reducing their taxable income as much as possible.

March 8 -

The Pension Benefit Guaranty Corp. is facing a $54 billion deficit for insuring multiemployer plans in unionized industries, says the GAO report.

March 7 -

The worst thing you can do during a stock market crash is panic and sell your stocks near the market bottom.

March 6 -

To qualify for this feature, clients should have reported a minimum amount for at least 11 years.

March 5 -

For many workers, moving assets from old 401(k)s into a traditional IRA may not be a smart move. One reason: IRAs often don’t offer stable value or guaranteed fund investment options as do most 401(k)s.

March 4 -

The government needs to improve cost-of-living adjustments to ensure that retirees can cope with inflation, says an expert.

March 1 -

If the client makes a mistake, they are advised to take the RMD as soon as they discover it so they can ask the IRS for a waiver of the penalty.

February 28 -

Those who signed up in the past year will get a smaller pension than they would under the old system, but they can expect additional benefits from the tax-advantaged Thrift Savings Plan.

February 27 -

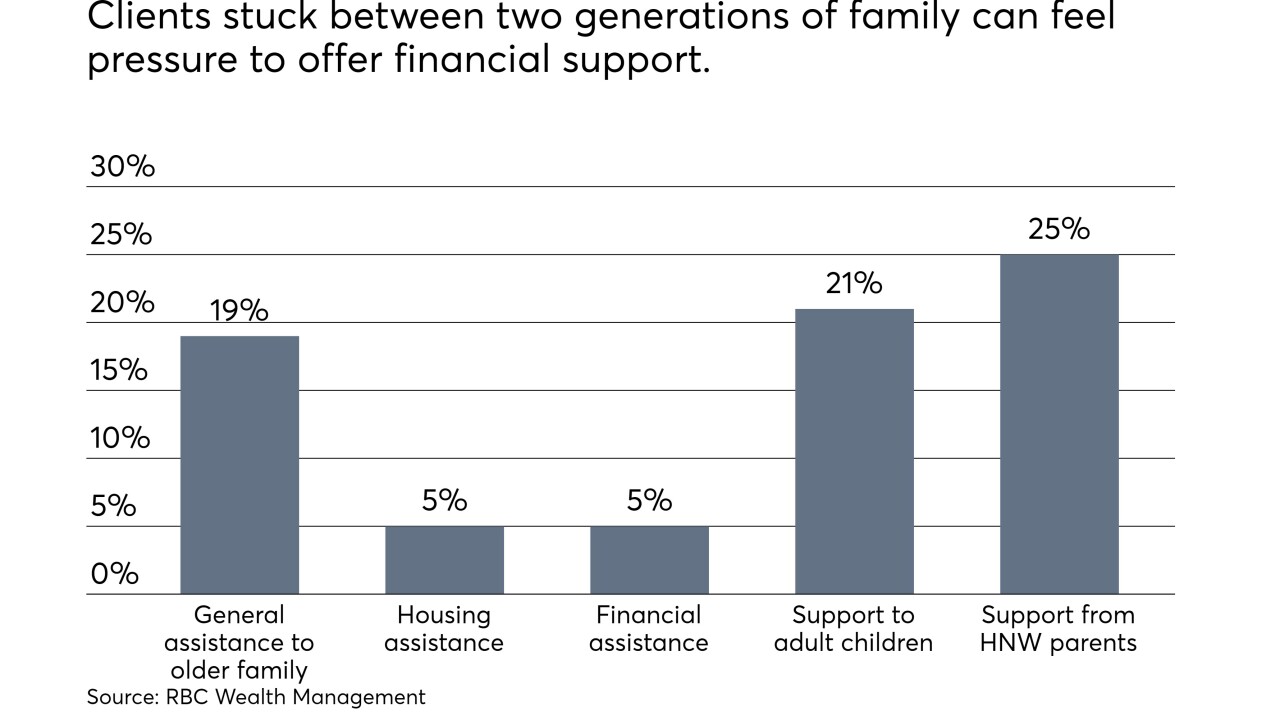

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 26