-

Commissioner Rettig is promising not to use the nearly $80 billion his agency will be receiving to increase audits of small businesses or taxpayers who earn less than $400,000.

August 17 -

The service is taking steps to increase its audit rates of higher-income taxpayers after coming under sharp criticism in Congress over its lagging audit numbers.

June 1 -

Advisors tend to avoid clients' tax issues when they involve the IRS. It's a missed opportunity to add value.

April 26 -

The service is gearing up for a potentially massive tax-enforcement push if Congress passes a plan including $40 billion to expand audits on the wealthy.

June 28 -

Employees who move to low-tax states may still be taxed by their former residence, as more states levy taxes on cross-border business.

April 7 -

Fewer than two out of every 100 taxpayers reporting over $1 million in income were audited by the Internal Revenue Service in fiscal year 2020, according to a new report.

March 19 -

Moving to a lower-tax state is more attractive than ever with the $10,000 cap on state tax deductions.

November 26 PKF O'Connor Davies

PKF O'Connor Davies -

Technology, declining budgets and other factors are radically changing how and which tax returns get looked at.

November 22 -

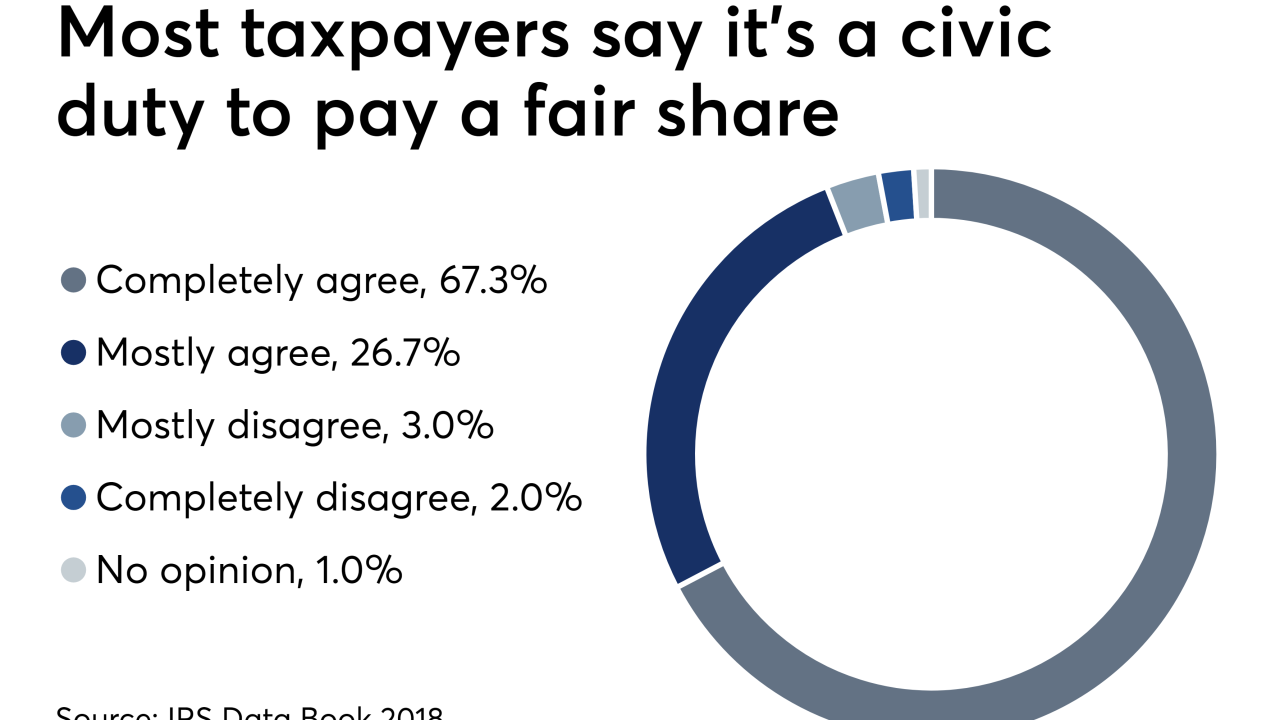

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

May 22 -

They’re rare, but terrifying. Bear these points in mind when you or your clients face a tax exam.

April 9 -

The regulator is looking into whether brokers made appropriate share class recommendations for the plans as a result of the new law.

March 19 -

It’s one of the most consequential — and misunderstood — concepts for clients with properties in more than one state. Where should they call home?

March 7 -

IRS data provides all the information needed to figure out the answer.

January 29 -

Audit rates are dropping, but there are still triggers that taxpayers can avoid to further reduce their risk.

April 9