-

New proposals in seven states could soon subject over half of all U.S. millionaires to targeted high-earner tax rates.

February 13 -

After nearly a century of trying, Washington state Democrats could finally pass an income tax — a move that would hit 30,000 or so top earners.

February 12 -

Even though advisors doubt it will pass, California's proposed billionaire tax is already reigniting residency and wealth planning conversations.

February 6 -

The ballot initiative was proposed by a California union as a way to fund health care.

January 20 -

Rhode Island Governor Dan McKee proposed a higher tax on millionaires to help fill a hole in the state's budget.

January 16 -

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

December 8 -

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

Voters in 20 states will be asked to weigh in on ballot referendums and measures concerning an estimated total of $3.1 billion in potential tax hikes.

October 30 -

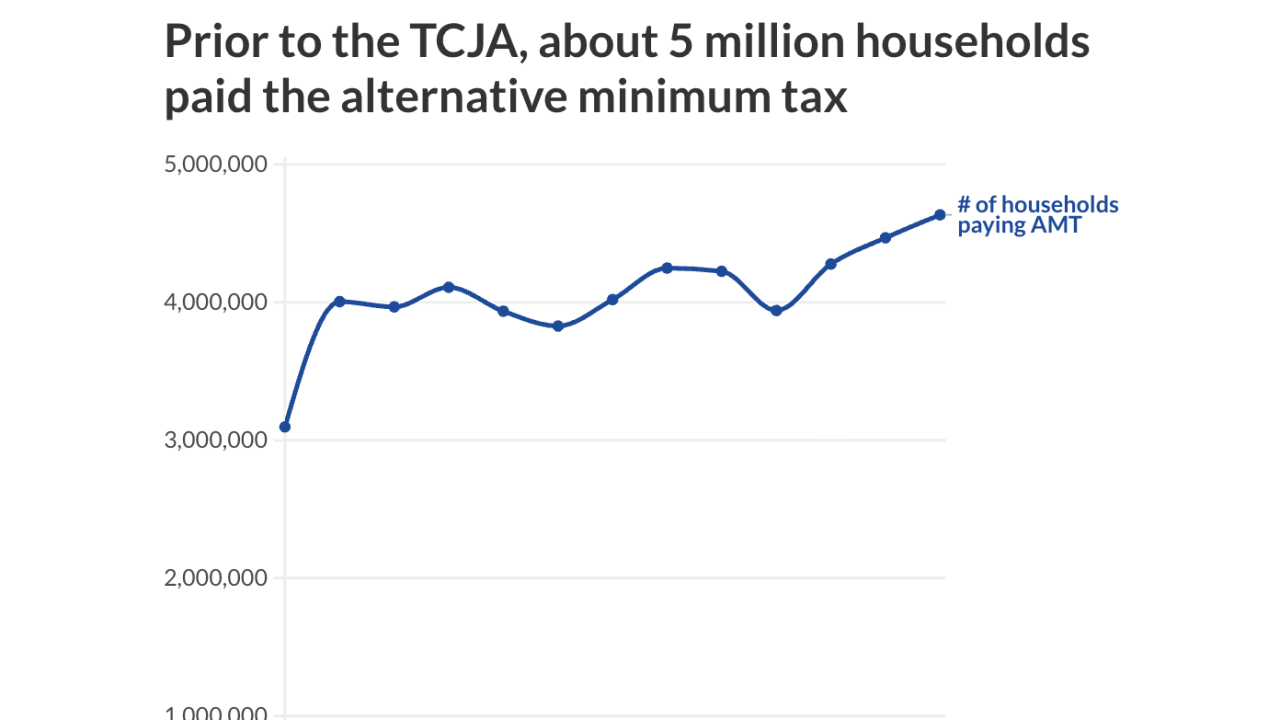

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

It's time to revisit the $10,000 cap considering a new $40,000 limitation under the OBBBA.

September 30 University of Colorado Boulder

University of Colorado Boulder -

The use of multiple entities as a means of shifting a high net worth client's yearly income could help rack up bigger breaks, with some caveats.

August 25 -

A new study predicts the One Big Beautiful Bill Act will reduce federal taxes on average for individual taxpayers in every state, but the impact will differ.

August 13 -

The One Big Beautiful Bill Act presents some complexities for wealthy families, alongside its extension and expansion of provisions in the Tax Cuts and Jobs Act.

July 30 -

Republicans will be planning a victory lap and Democrats will be thinking about their election strategy. But financial advisors and tax pros will be preparing their clients.

July 3 -

Areas around Jackson Hole, Aspen, Palm Beach, Miami, New York, Dallas and Austin are in the group. Other top performers may come as more of a surprise.

May 29 -

When a company considers adding new jobs or making new investments, many state and local authorities offer tax incentives to support that growth.

May 28 McGuire Sponsel

McGuire Sponsel -

The headache of filing dozens of state or international returns due to the so-called jock tax comes with opportunities to tap into savings, experts say.

April 23