-

Some unresolved issues haven’t received as much attention as those related to federal securities laws.

September 26 Withersworldwide

Withersworldwide -

Part of the problem stems from how slow regulators have been to define their views of virtual currencies.

August 13 -

Although funded with after tax dollars, what clients owe will be lower than the liability on traditional IRA withdrawals in retirement.

March 20 -

Congress created a juicy new tax break, yet hundreds of thousands of clients still don’t know if they can claim it.

March 13 -

The test will also be modified to account for the new tax law while aiming to plug leaks in the pipeline from college to CFP certification.

February 22 -

Battles will ensue over the Trump tax plan’s treatment of payments to former spouses.

February 16 -

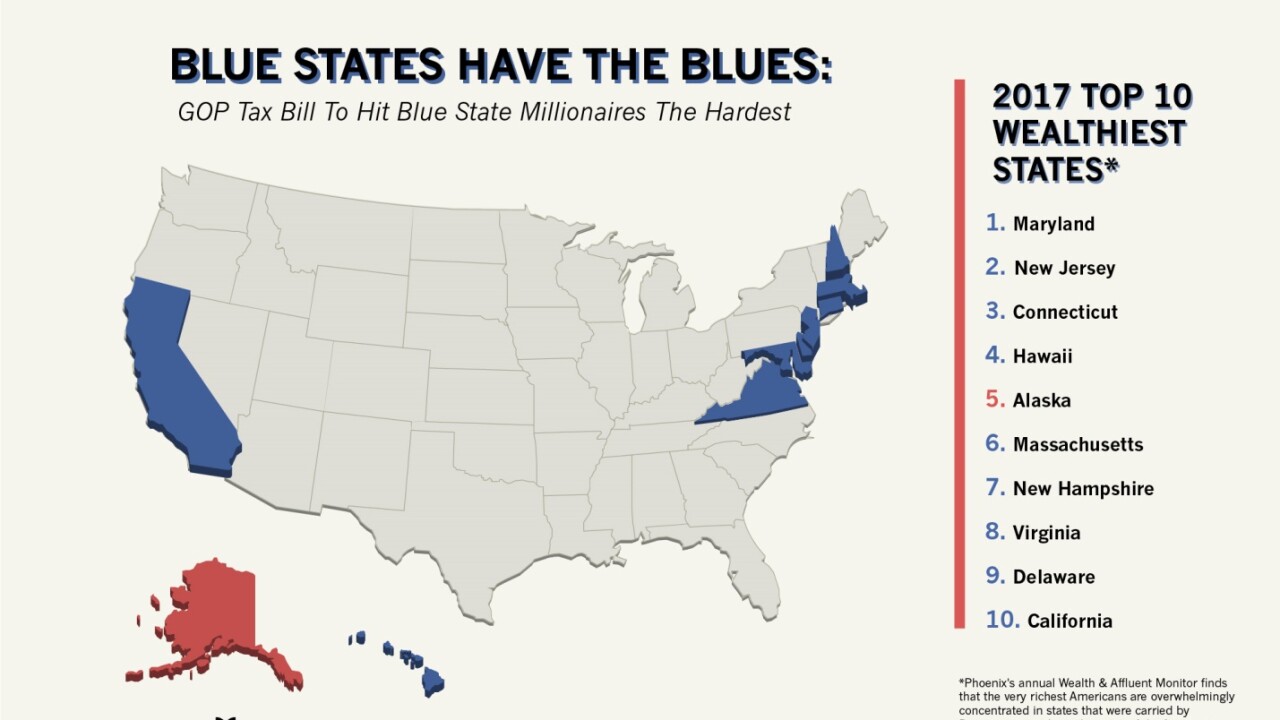

Advisors need to be aware of how the new tax law will affect high-net-worth clients across the country.

February 7 -

Entrepreneurs who suffer continuous losses could find their work classified as a hobby by the IRS.

February 1 -

Geography, occupation and family size will determine whether the bill helps or hurts.

December 20 -

The proposal includes changes in everything from the corporate tax rate to Obamacare.

December 19 -

Who would the changes help — and hurt? Baird’s director of advanced planning weighs in.

November 2 Baird Private Wealth Management

Baird Private Wealth Management -

Clients could face a 100% penalty of taxes owed for filing late.

September 19 -

The agency says its adoption of WebEx will allow for improved outreach with clients in the more rural regions of the country.

July 28 -

Only 3% of households earning under $50,000 a year benefitted from the mortgage interest tax deduction.

July 21 -

The last time the percentage was greater was when the S&P 500 was near its previous peak before the financial crisis.

July 19 -

With smaller paychecks and longer life expectancies than men, one strategy includes moving their IRA assets into a Roth to reap the tax advantages.

July 14 -

Lawmakers are considering scrapping individual deductions, including tax breaks for certain plan contributions.

June 30 -

Claiming the earned income tax and child tax credit may get tougher under Trump’s 2018 budget plan.

June 2 -

A 2014 law lets clients disabled before the age of 26 to save as much as $14,000 annually without facing any tax burden.

May 19 -

Regardless of whether President-elect Trump rolls back the rule, these products are here to stay.

November 23