Market forecasting and stock-picking are dressed-up forms of gambling, the federal bailout was an unjust grab at private enterprise and gold is an ineffective hedge against inflation. Any financial advisor who's followed Matson Money via Livestream or YouTube videos, Facebook updates or Twitter feeds has heard Mark Matson, the firm's founder and chief executive officer, push these points of view.

Specific equity recommendations to individuals and comments from clients that the SEC might deem to be testimonials, however, are notably missing. Those are the sorts of messages that might get Matson Money sanctioned under regulations governing ads by investment advisors. Social media and networking sites are indispensable components of Matson Money's marketing strategy and the firm's unusual business model, so Matson treads carefully.

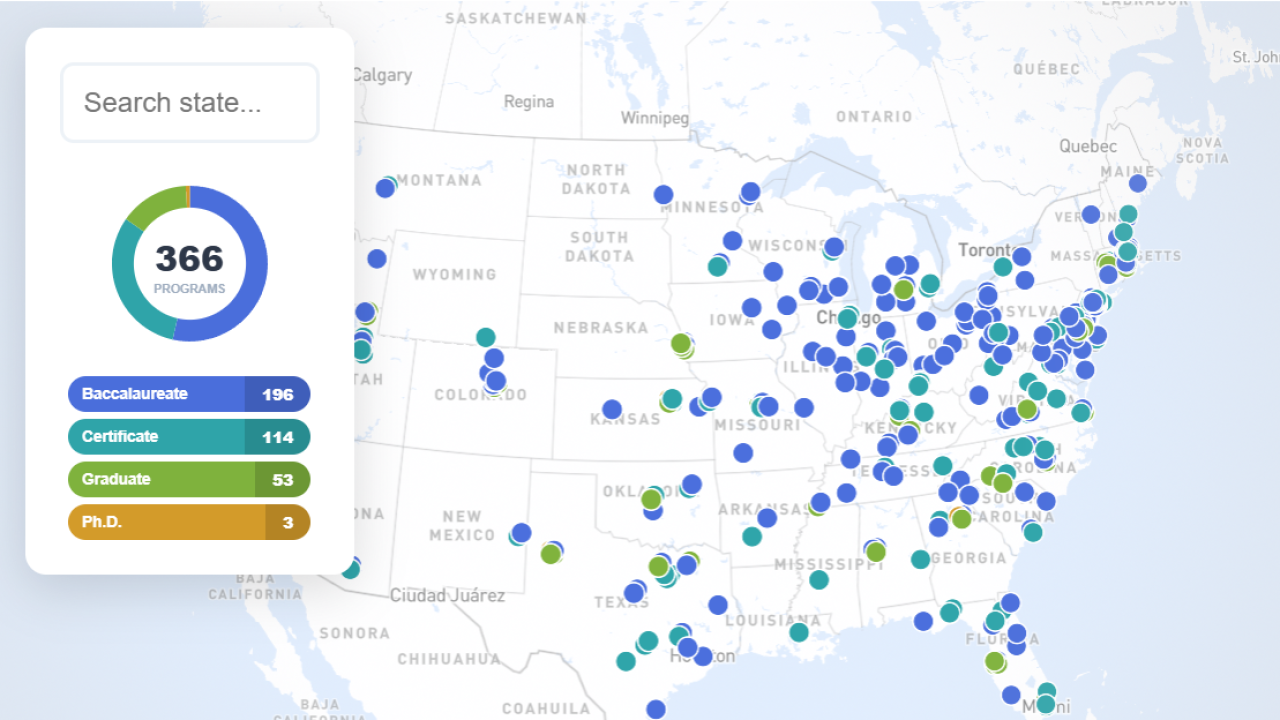

The firm, based in Mason, Ohio, doesn't have in-house planners who work directly with investors. Instead, it offers a practice coaching and money management platform to about 300 advisors. The firm runs a mutual fund of funds named Free Market, with more than $2 billion in assets. It offers shares only to investors who work with one of the advisors in its coaching program.

Matson maintains daily contact with advisors and clients through video posts and other social media messages, and regular coaching events. He sees no point in treating the firm's Internet site like a walled garden.

"I view it as a way to have ongoing communication, and to bring value to the people you care about and help them solve problems," Matson says. "It is about building a community and building better relationships than you have right now."

Matson allows that being so visible in social media requires a thick skin from dissenters. The SEC has found that his operational methods are sound. During an audit about a year and a half ago, agency inspectors looked into Matson Money's tweets, videos, status updates and other social networking activities and gave the firm a clean review.

MOVING ON

Most advisors might not be as comfortable online as Matson is. In many cases, it is a struggle to get advisors to embrace social media because they don't fully recognize its business value, says Clara Shih, founder of Hearsay Social, a San Francisco firm that provides a range of social media services, including compliance monitoring, content suggestions and analytics.

After Morgan Stanley Smith Barney said in May it would allow its advisors to interact with clients using social media sites, other advisors want to be sure that they stand out with their blog posts, tweets and status updates on Facebook, LinkedIn and linkedFA without attracting negative attention from a regulator's disciplinary committee. The SEC has not issued formal guidance on how firms should handle social media policies.

But Regulatory Notice 10-06 from FINRA provides guidance on how to use blogs and other social media sites for personal and business uses. And sources say the SEC sent a letter to independent advisors hoping to gather documents on how the firms used social media and to describe components of their compliance policies, according to Pat Burns, a Beverly Hills, Calif.-based compliance lawyer who is also president of Advanced Regulatory Compliance, a consulting firm.

When putting together a social media policy, RIA firms should clarify the purpose of using the sites. They should also show how it will respond to statements or claims made through social media, according to a widely followed research report by Burns' consulting firm titled, Navigating the Social Media Storm: Creating a Social Media Compliance Policy During a Time of Uncertainty.

The SEC would not say whether it sent a letter, or if it was considering developing guidance on social media compliance procedures for RIAs. But the FINRA and SEC initiatives provide independent advisors with a basic outline. First is supervising original content, Shih says. Second, advisors should be careful not to break suitability rules when posting investment opinions or responding to comments. Record-keeping is another. The SEC requires a minimum of three years for electronic messages.

Overall, industry professionals agree that firms should develop a compliance procedure and document it. Matson says auditors usually look for that right off.

Each practice that commits to a social media program should establish a committee and a chain of command within its marketing department to maintain it, according to Shih, who authored, The Facebook Era: Tapping Online Social Networks to Market, Sell and Innovate. It's best to have "a social media lead in each department," she says. "Usually, it is the corporate communications professional." RIA firms should also appoint registered principals to act as point persons to review and approve the firm's social media activity.

KEEP ALL THE RECORDS

The broker-dealer channel has done the most to develop formalized social media compliance programs. Commonwealth Financial Network launched a coaching program in June that offers a range of services for social media-inclined advisors. They offer advisors guidance on what to say.

More important, Commonwealth signed a contract with Erado to capture, review and archive all original and interactive content on its 1,400 advisors' Facebook, LinkedIn, and Twitter accounts and blogs. The cost is $300 per advisor. It can even capture communications from Bloomberg and other instant messaging services.

"We want to be on the front end of this," says Paul Tolley, chief compliance officer at Commonwealth. "Once we discovered a solution that worked for us, we felt that we should find a way to roll it out and let advisors use social media."

Once a Commonwealth advisor decides to create a social media site for business purposes, or post opinions about the securities markets on a personal site, the advisor needs to submit new content to the firm's compliance department for approval, Tolley says.

Matson Money uses Arkovi, a social media archiving service in Dover, Ohio, to save the content the company generates, plus reader and reviewer comments. The firm pays about $99 a month.

To be sure, the broker-dealer channel is setting most of the visible examples of how to develop social media policies. It has also generated the most visible examples of what not to do.

To the inexperienced social media user, Jenny Quyen Ta's Twitter dispatches in 2009 offer valuable lessons. They were eye-catching, and each packed a lot of punch in 140 characters or less. But they got the Southern California advisor in serious trouble.

While writing about Advanced Micro Devices, the messages "were overwhelmingly positive and frequently predicted an imminent price rise," according to a FINRA notice last year. In one message, Ta posted: "Keep an i on AMD ppl! Just brke abve $5 = margins & institutionals can now 'play ball!' Barclays upgraded to $7 ystrdy, but it should be $10!"

But Ta had failed to disclose to her firm that she had a Twitter account, and she also failed to tell readers she and family members owned more than 100,000 AMD shares. She did not sell any of her holdings during the period at issue, according to FINRA, but the regulator suspended Ta for one year, banning her from affiliating with any FINRA member firm and fined her $10,000.

Ta's run in marked the first time the authority had sanctioned an advisor for social media use. Shih cautions that "advisors are opening it up on their iPads, and iPhones, and at home. To say with certainty that none of their Facebook friends or LinkedIn connections are clients or could become clients ... is just not realistic." As a result, she says, firms must have "a policy, guidelines and training."