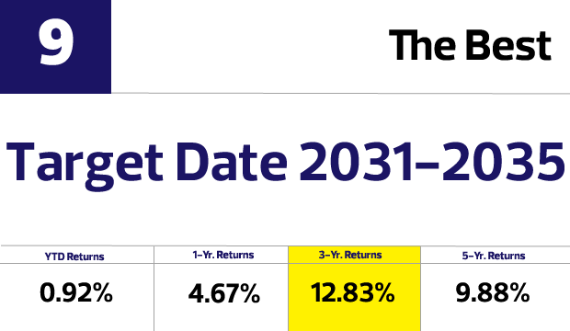

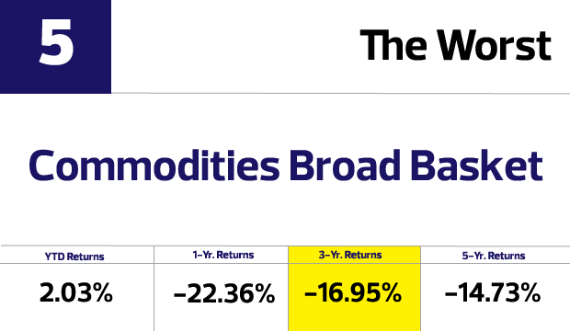

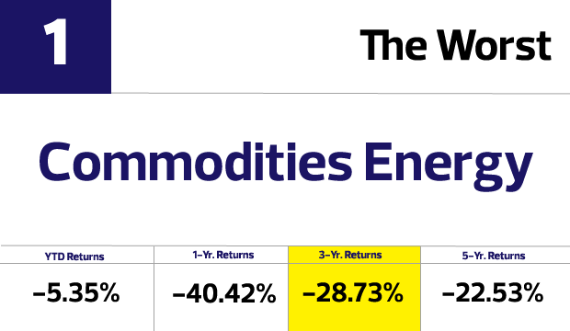

To that end, we ranked the best and worst ETF categories over the past three years as tracked by Morningstar. The good news? Almost all retirement categories, as measured by various target-date funds geared to clients from age 30 to 55, are in the top 10 categories. The bad news? Clients who stuck with their energy holdings have seen better days. Although in the name of buying low, those losing categories come with a silver lining for clients who havent already bought in. After all, for investors who like to follow Warren Buffett's advice, losing investments can offer an opportunity to be greedy when others are fearful.

Click through to see the 10 best ETF categories over three years, followed by the 10 worst, or click here to view the list as a one page version.

All data is from Morningstar.

Image: Fotolia