Clients Want Real Estate? 8 Things Advisors Should Know

As noted in Financial Planning's cover story on real estate's new rules, more expensive properties eat up more cash and can mean servicing a bigger loan. They occupy a bigger proportion of a less-diversified portfolio; and if prices increase faster than rents, the properties will return less cash, making the owner -- that is, your client -- more vulnerable to the financial hits of vacancy, maintenance costs and careless or destructive tenants.

Want to understand these clients a little better? A recent survey from the National Association of Realtors took a deep look at investment real estate buyers and identified several characteristics that set them apart. Page through to see the details, or see this as a one-page version here. -- Rachel F. Elson

1. They're Looking for Income

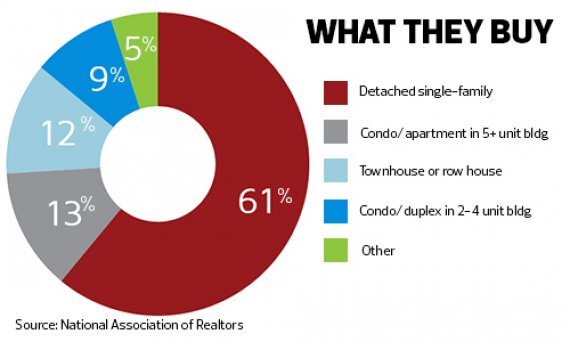

2. They Like Single-Family Homes

3. They Prefer the Suburbs

4. They Stay Close to Home

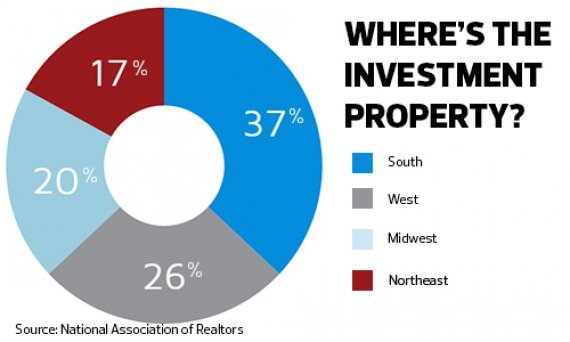

5. They Vary by Region

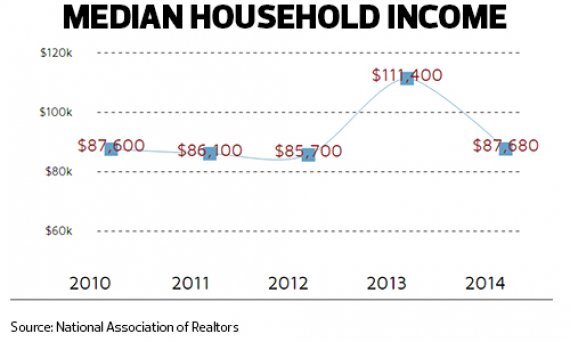

6. They're Not Ultrahigh Earners

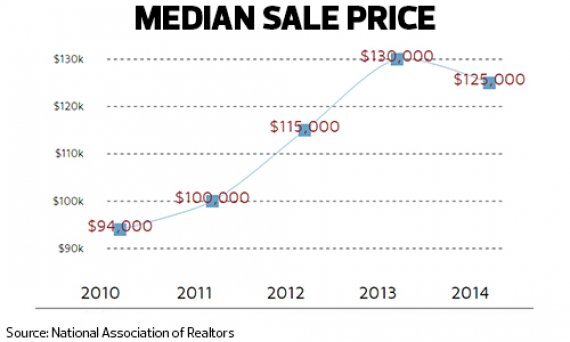

7. They Paid Less Last Year