9 Mutual Fund Winners With Long-Term Performance

Almost 300 separate Lipper U.S. Fund Awards were given out for the three-, five- and 10-year periods (based on November 2013 data) within their classifications recently. But only nine funds won awards for all of the eligible time periods within their respective peer group -- reflecting long-term superior performance and time-tested investment processes, Lipper analysts and fund managers say.

We asked some of the winning managers to explain their investing approach. Click through here to see the list (shown in alphabetical order), or view the list here in a single page.

<b>Delaware Extended Duration Bond Fund, Institutional: Won 3-, 5- and 10-year Lipper awards</b>

Peer group: Corporate Debt Funds BBB-Rated

3-year: 9.06% average annualized performance as of Nov. 2013 (Peer group: 5.04%)

5-year performance: 16.17% (Peer group: 9.85%)

10-year performance: 8.74% (Peer group: 5.39%)

"We're mindful of the benchmark, but it doesn't have an impact on how we select securities for the portfolio. We build from the bottom up, security by security -- leveraging the expertise of our research analysts." -- Thomas H. Chow, senior vice president and chief investment officer of corporate credit at Delaware Investments and portfolio manager for the fund

<b>Fidelity Advisor Income Replacement 2042 Fund, Institutional: Won 3- and 5-year Lipper awards; 10-year not awarded</b>

Peer group: Retirement Income Funds

3-year performance: 10.96% average annualized performance as of November 2013 (Peer group: 7.10%)

5-year performance: 14.57% (Peer group: 11.51%)

"Performance over the last three to five years has been driven largely by strong security selection by our equity and bond managers and good asset allocation decisions." -- Andrew Dierdorf, co-portfolio manager of Fidelity Income Replacement Funds

<b>Fidelity Pacific Basin Fund: Won 3-, 5- and 10-year Lipper awards</b>

Peer group: Pacific Region Funds

3-year performance: 10.52% average annualized performance as of November 2013 (Peer group: 6.32%)

5-year performance: 24.64% (Peer group: 15.77%)

10-year performance: 10.70% (Peer group: 8.57%)

<b>Janus Global Life Sciences Fund I: won 3-, 5- and 10-year awards </b>

Class I won the 3-year award. Class D shares won the 5 and 10 year awards.

Peer group: Global Health/Biotechnology Funds

3-year performance: 28.21% average annualized performance as of November 2013 (Peer group: 23.47%)

5-year performance: 23.78% (Peer group: 19.89%)

10-year performance: 12.11% (Peer group: 9.84%)

<b>MFS Global Equity Fund, I: won 3-, 5- and 10-year awards</b>

Peer group: Global Large-Cap Core

3-year performance: 16.58% average annualized performance as of November 2013 (Peer group: 13.17%)

5-year performance: 17.97% (Peer group: 15.36%)

10-year performance: 10.26% (Peer group: 8.56%)

"The Global Equity strategy is focused on high-quality companies -- sustainable, durable franchises; significant free cash flow; solid balance sheets and strong management teams -- with sustainable above-average growth and returns, whose prospects are not reflected in their valuation. In the past few years, amidst a tepid economic recovery and various macroeconomic concerns, global equity markets have provided overall positive but uneven returns across different regions. We have maintained our consistent focus on company fundamentals and valuations, taking advantage of relative valuation shifts resulting from short-term volatility in the market." -- Ben Kottler, institutional portfolio manager of the MFS Global Equity Fund

<b>MainStay Unconstrained Bond Fund, I: won 3- and 5-year Lipper awards; 10-year not awarded</b>

Peer group: Alternative Credit Focus Funds

3-year performance: 6.40% average annualized performance as of November 2013 (Peer group: 3.66%)

5-year performance: 12.18% (Peer group: 9.13%)

"The MainStay Unconstrained Bond Fund has the flexibility to capitalize on investment opportunities across the global bond markets. Our team's 20 years of experience in combining broad macro and asset allocation views with rigorous credit research has allowed us to navigate through various challenging market conditions while achieving strong risk-adjusted returns." -- Dan C. Roberts, chief investment officer & head of global fixed income at MacKay Shields

<b>Polaris Global Value Fund: won 3- and 5-year Lipper awards; 10-year not awarded</b>

Peer group: Global Multi-Cap Value

3-year performance: 17.37% average annualized performance as of November 2013 (Peer group: 11.75%)

5-year performance: 20.84% (Peer group: 15.19%)

"We focus on companies with the potential for strong sustainable free cash flow and conservative balance sheets, recognizing that such companies can grow stronger in difficult economic times, while performing admirably in growth cycles too. It is also worth noting that we recently reduced the expense ratio to 0.99%, making the fund even more attractive to institutional and individual investors as well as advisors. Moreover the fund's capital loss carryover may provide tax efficient returns for investors." -- Bernie Horn, manager of the Polaris Global Value Fund

<b>T. Rowe Price Retirement 2015 Fund: won 3- and 5-year Lipper awards; 10-year not awarded</b>

Peer Group: Mixed-Asset Target 2015 Funds

3-year performance: 10.47% average annualized performance as of November 2013 (Peer group: 7.86%)

5-year performance: 14.74% (Peer group: 8.97%)

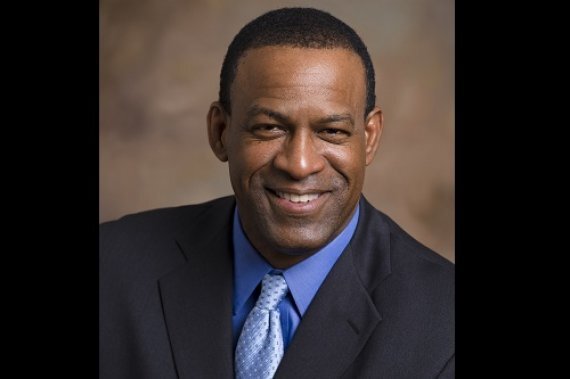

"The primary drivers of our performance this past year were a higher-than-average equity glide path that benefitted from equity market outperformance, strong active management contributions within the underlying components, and tactical allocations that took advantage of short-term market conditions." -- Jerome Clark, portfolio manager at the Retirement Date 2015 fund

<b>TCW Total Return Bond Fund, I: won 3-, 5- and 10-year awards</b>

Peer group: U.S. Mortgage Funds

3-year performance: 6.24% average annualized performance as of November 2013 (Peer group: 2.79%)

5-year performance: 9.63% (Peer group: 5.24%)

10-year performance: 7.11% (Peer group: 4.04%)

"TCW manages bond portfolios according to a value orientation over a full market cycle. In the case of the TCW Total Return Fund, our search for value led us to emphasize investments in distressed non-agency mortgages. These strategies materially contributed to the outperformance of these funds over the course of the past three to five years." -- Tad Rivelle, chief investment officer of fixed income at TCW