Top Cash Holders in the S&P 500

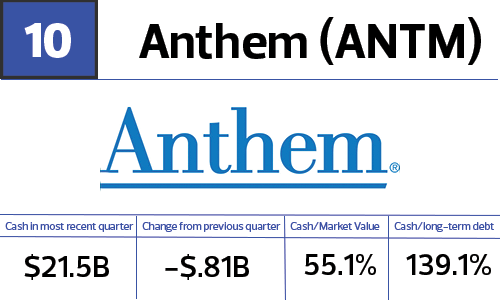

Company officials expect the transaction to close in the second half of 2016. But opposition has appeared. The American Hospital Association has asked the Department of Justice to consider that the merger may be anticompetitive. If it goes through, there will be three giants (UnitedHealthcare, Aetna, and Anthem) controlling health insurance in much of the country. The AHA has said that the merger would result in billions of dollars in higher health care costs.

Some Wall Street analysts have also criticized the deal, saying that Anthem is overpaying. Others defend the move, arguing that Anthem had little choice in light of the massive consolidation in health care.

Top Cash Holders in the S&P 500

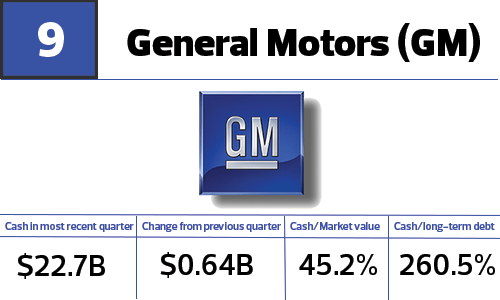

The automaker began paying an annual dividend of $1.20 a share last year and raised it 20% to $1.44 this year. In addition, GM announced a $5 billion share buyback program in the first quarter of 2015.

As an automaker, GM is in a capital-intensive industry. In April, the company announced manufacturing investments totaling $5.4 billion spread across plants in five states.

There are 172 actions against GM in federal and state courts alleging death or injury resulting from auto defects, principally ignition shutoff problems. In April, the Bankruptcy Court affirmed that bankruptcy shielded the current company from liability for actions or omissions of its predecessor. The plaintiffs have appealed. GM says it is unable to estimate costs should the plaintiffs prevail.

Top Cash Holders in the S&P 500

In the four years ended 2014, AMGN spent $14 billion on research and development, not surprising for a company that depends on new biotechnology products for growth. It currently has 11 new major biotech drugs in its pipeline and six biosimilar products (the biotech version of generic drugs). Amgen expects to launch its first biosimilar drug in 2017.

Over the past four years, the company has had $3 billion in capital expenditures, mainly to streamline its manufacturing processes. New facilities, expected to be operational in 2017, will be roughly 80% smaller than existing operations, but with the same capacity. Amgen says its new manufacturing technologies will have 25% lower capital costs and will take half the time to construct.

In the four years ended 2014, the company spent $14 billion on share buybacks, though no shares were repurchased last year.

Top Cash Holders in the S&P 500

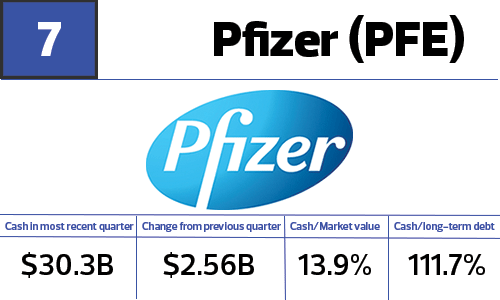

Pfizer has traditionally deployed its cash for acquisitions. Last year, it tried and failed to buy AstraZeneca for about $120 billion. The most recent large purchase was announced in February, when the company agreed to buy Hospira (HSP) a major producer of injectable drugs, for $17 billion in cash. The deal is expected to close later this year. Although not as large as previous purchases including its 2000 buy of Warner-Lambert for $90 billion, the 2003 acquisition of Pharmacia for $60 billion, or the 2009 takeover of Wyeth for $68 billion, the Hospira deal continues PFEs tradition of bulking up as older products go off patent.

Although Pfizer has a decent yield and has boosted payments annually since 2010, the dividend was cut in 2009 around the time of the Wyeth acquisition. Late last year, PFE announced an $11 billion share repurchase plan that it is currently implementing.

Top Cash Holders in the S&P 500

Dividends have always been a major use of cash at JNJ. The company currently pays $3 a share annually in dividends and has increased the amount for 53 consecutive years. That makes total dividend expenses for this year about $8.3 billion. In contrast, JNJ completed its most recent share repurchase program in April at a cost of $5 billion.

Although the company makes acquisitions, they are generally not of the scale of Pfizers purchases. In 2012, JNJ paid $19.7 billion in cash and stock for Swiss medical device maker Synthes. R&D expenses were $8.5 billion in 2014 and were running at about 12% of sales in the most recent quarter.

Top Cash Holders in the S&P 500

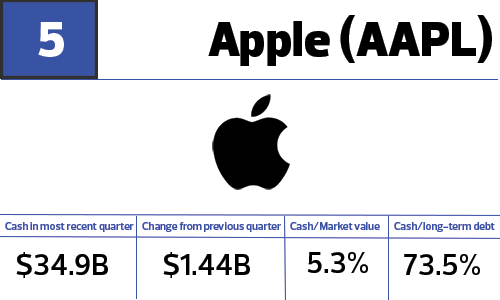

What Apple categorizes as cash represented only 5.3% of the companys market value at the end of June, APPLs fiscal third quarter. Cash holdings were $1.4 billion higher than at the end of the previous quarter.

Although most investors dont realize it, Apple paid a small dividend from 1987 through 1995. The heftier payments began in 2012 with a quarterly dividend of $0.379 (adjusted for a subsequent split). Today, the companys quarterly rate is $0.52.

From the first quarter of fiscal 2013 through the most recent period, Apple has repurchased $41 billion of its shares. Furthermore, in April the companys board increased its share repurchase authorization from $90 billion to $140 billion.

As a technology company, Apple regularly buys other firms to acquire their products and knowhow. Most are relatively small purchases. The biggest recent buy was $3 billion in 2014 for Beats, a headphone and music service company.

Top Cash Holders in the S&P 500

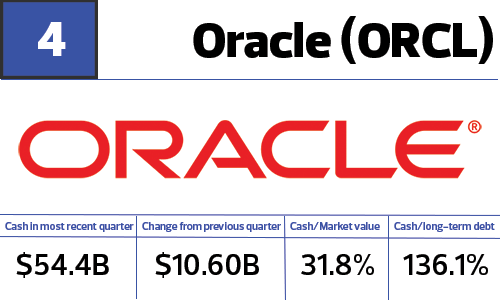

Because it is costly for companies to switch database providers, Oracle is seeing success in efforts to switch users to cloud versions of its programs. Software-as-a-service and platform-as-a-service revenues grew 29% in the fiscal fourth quarter, but would have been up 35% had they not been depressed by a strong dollar.

Oracle regularly buys other tech companies, but it is difficult to say how much it spends because most deal prices are not disclosed. In August, it bought cloud-software company Maxymiser for an undisclosed amount. Last years biggest announced price was the $5.3 billion Oracle paid for MICROS Systems, a maker of software used in hotels and retail establishments.

ORCL began paying a quarterly dividend of $0.05 a share in 2009; it now pays $0.15 a quarter. The company repurchased 46 million shares in the quarter ending in May and had $9.2 billion remaining of the boards repurchase authorization.

Top Cash Holders in the S&P 500

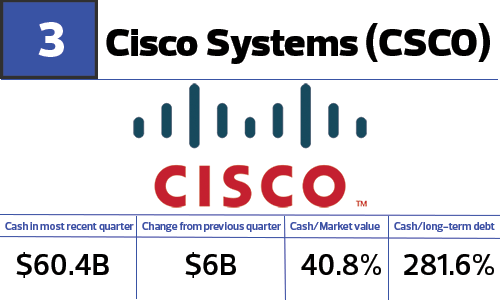

Cisco began paying a dividend of $0.06 a quarter in 2011. In its most recent quarter, the company paid $0.21 a share. For the full fiscal year, it paid $0.80 a share for a total of $4.1 billion. Thats close to the $4.2 billion the company spent on share repurchases during the fiscal year. An additional $4.3 billion is available for share buybacks under existing board authorization, with no termination date.

The company regularly makes acquisitions and lists three completed and three pending for this year, but no prices. Ciscos $2.7 billion acquisition of computer security firm Sourcefire in 2013 is the most recent large purchase for which a price was disclosed.

Top Cash Holders in the S&P 500

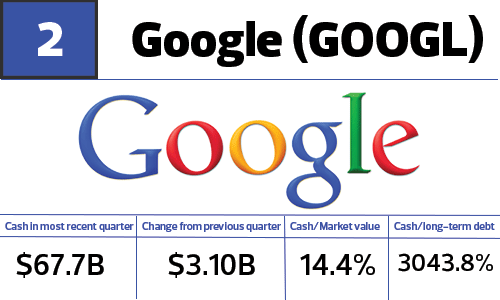

Google regularly acquires other companies, though in the six months ended June 30, it spent only $149 million on purchases. Previous major deals include YouTube, acquired in 2006 for $1.65 billion in stock; DoubleClick, an online advertising service bought in 2007 for $3.1 billion in cash; and Nest Labs, a home automation company bought in 2014 for $3.2 billion in cash.

Googles biggest acquisition was phone handset maker Motorola Mobility for $12.5 billion in cash in 2012. In less than two years, Google had sold off most of Motorola Mobility in several transactions. It was left with about 20,000 patents at a net cost of about $3 billion.

Top Cash Holders in the S&P 500

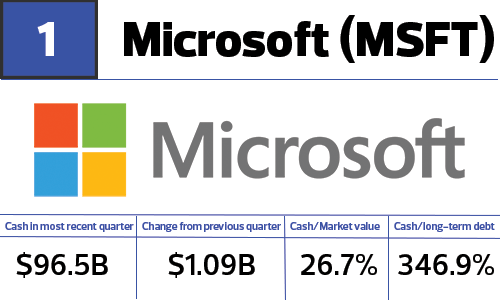

That represents more than 25% of the companys market value and almost 3.5 times its long-term debt. If past history is a guide, the company will likely use some of its cash to boost its dividend from the current $1.24 annual rate. Since it first paid a dividend of $0.08 in 2003, the company has increased it substantially and fairly steadily. Look for more share buybacks, too. The company has only completed part of a $40 billion buyback authorized in 2013.

Microsoft is active on the acquisition front, like most tech firms. Through August 3, it completed eight acquisitions so far this year. Investors can only hope they are not in the tradition of the companys purchase of Nokias phone assets. That deal, completed a little more than a year ago, resulted in a write-down of $7.6 billion in the most recent quarter.