In the opening salvo of a year promising more mergers, two of the country’s top RIAs acquired firms totaling around $250 million in assets under management.

Mercer Advisors added Novos Planning Associates, an RIA managing $100 million in assets, Mercer announced Wednesday. Meanwhile, Beacon Pointe Wealth Advisors merged Jan. 1 with Walden Capital Advisors, which has $150 million in AUM, according to Beacon Pointe.

Newport Beach, California-based Beacon Pointe grew by nearly $800 million in 2016 to $2.2 billion in AUM, while Mercer’s AUM shot up by $3.3 billion to $9.3 billion in 2016. Executives for both firms say they expect even more M&A activity at their respective companies over the rest of the year.

“We want to be in every major market in the United States in 24 months,” says Mercer CEO David Barton. “There’s no national family office out there, so we’re going for it.”

-

Beacon Pointe’s latest deal puts the wealth manager over the $2B AUM milestone, and it’s eyeing new markets.

September 30 -

“Q3 2016 is the eighth successive quarter of 30 or more transactions,” says David DeVoe, managing partner at DeVoe & Co.

October 25 -

GROWING FOOTPRINTS

Mercer hopes to grow its national footprint to 40 offices from its 22 current outposts, according to Barton. Beacon Pointe is in “several open conversations,” and executives foresee at least two more acquisitions and as many as six others in 2017, according to President Matthew Cooper.

Jill Steinberg leads a team of five advisers at Walden Capital, a Philadelphia-area RIA. The merger worked because Walden takes the same approach as Beacon Pointe in terms of focusing on the client experience and placing women in leadership roles, Cooper says.

“It gives us further presence on the East Coast. It gives us additional talent,” Cooper says in a phone call. “Culturally, it was a fantastic fit. I think, from their perspective, they want to continue to grow.”

'A NICE TUCK-IN FOR US'

Executives with Novos Planning, which operates out of Manhattan, finalized the deal to join Mercer last week, according to Barton. He declined to discuss financial terms in a phone call from Mercer’s Santa Barbara, California, offices but says Novos’ location had been a key motivator.

“We look for like-minded teams that want to comprehensively serve their clients. And they have to be in the right market,” Barton says. “They’ve been there a long time, they’re very respected. So it was a nice tuck-in acquisition for us.”

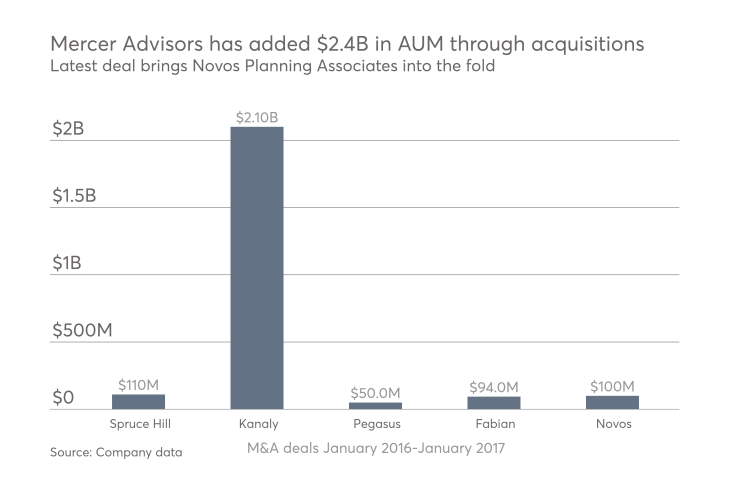

Mercer added over 1,000 clients with more than $1 billion in AUM in 2016 organic business alone, according to Barton. Five mergers since January 2016 brought over 1,000 other clients into the fold, company-provided data shows.

The 109 overall M&A transactions in the first three quarters of 2016 placed RIA M&A’s on track to break the 2015 record of 132 deals, according to consulting firm DeVoe & Co. The third quarter of 2016 saw 37 transactions, which is more than the 34 deals in all of 2013.

GLUT OF DEALS

Beacon Pointe added to the momentum in October when Dallas RIA Ironmark Advisers brought $340 million in AUM into its fold. Principals of firms acquired by Beacon Pointe receive equity in the company, along with a national platform providing compliance help and other services. Beacon Pointe parent Beacon Pointe Holdings also owns the $7.5 billion RIA Beacon Pointe Advisors, making the overall company a nearly $10 billion organization.

The current glut of M&A deals reflects both concerns around technology and the Department of Labor's new fiduciary rule, according to Cooper. Advisers also “don’t want to wait through another cycle to find liquidity,” Cooper says, noting the Walden deal.

“We could give them the resources to free them up from non-moneymaking activities to focus on the clients and getting more of them,” Cooper says. “If we can allow them to turn their focus directly on the client, then good things happen.”