The active RIA M&A market: No end in sight

"I see nothing that won't lead to more consolidation," says Marty Bicknell, chief executive of Mariner Wealth Advisors, which has over $10 billion in AUM. "I think there will be a flurry of deals next year and I'm not sure the activity will crest then."

Private equity firms flush with cash are poised to pounce when the opportunity is right. Some of the industry's most prominent RIA executives are also promising to be active in 2017.

Brent Brodeski, CEO of Savant Capital Management, is eager to expand

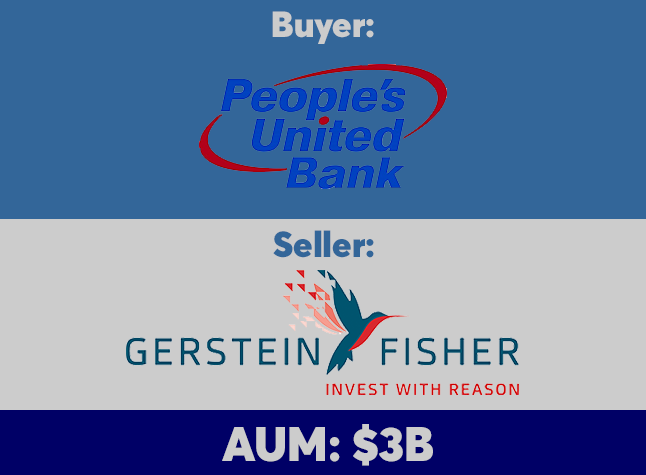

Please click on the arrow above to see the RIA market's key M&A deals in 2016. Data provided by DeVoe & Co. --Charles Paikert

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight

The active RIA M&A market: No end in sight