Private equity has upped the ante on its RIA bet.

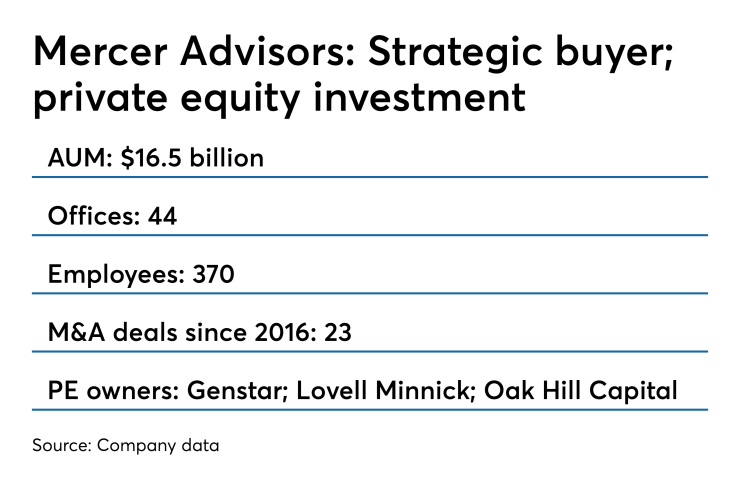

Oak Hill Capital Partners, a Manhattan-based PE firm, is taking a sizeable stake in Mercer Advisors, one of the industry’s larger RIAs with more than $16.5 billion in assets under management.

Mercer has also been one of the industry’s

Oak Hill, originally the family office for the Bass family in Texas, is acquiring its equity shares from current PE owners Genstar Capital and Lovell Minnick Partners. Lovell Minnick is selling all its shares while Genstar will remain an investor with a presence on Mercer’s board, according to a spokesman for Mercer.

Specific terms of the deal were not announced, but the spokesman said both Oak Hill and Genstar would have “significant” stakes.

Genstar is the

Industry sources estimate that while Mercer’s sale price is thought to have exceeded $500 million, it most likely fell short of the $750 million

The fact that Genstar stayed in with a stake is a very positive signal.

As for Mercer’s valuation, Park Sutton Advisors is “confident the multiple paid on this deal was in the high-teens adjusted-EBITDA,” says Dan Erichson, senior associate for the Manhattan-based investment banker specializing in RIAs.

That’s consistent “with pricing trends across the industry with firms this size,” Erichson says.

Industry reaction to the Mercer deal was overwhelmingly positive.

“This looks like a natural evolution from a mid-size PE firm to ownership under a larger firm which wants to make an even larger bet,” says industry analyst Chip Roame, managing partner of Tiburon Strategic Advisors. “And the fact that Genstar stayed in with a stake is a very positive signal.”

Strategic buyer Marty Bicknell, CEO of Mariner Wealth Advisors, agreed.

Large private equity firms are confident they can still get a high return on their investment.

“Quality well-run firms like Mercer getting capital to continue their growth trajectory is good for our industry,” Bicknell says. “Helping the independent advisor grow to compete with the wirehouses can only be a positive.”

Private equity’s continued faith in independent advisors is also a boost for the industry, according to two leading M&A consultants.

The Mercer deal is similar to the recent purchase of a majority interest in Wealth Enhancement Group by PE firm TA Associates, says Dan Seivert, CEO of Echelon Partners.

“In other industries, once a PE firm gets out, it’s often difficult to find another one to jump in,” Seivert says. “But in the case of WEG, where Lightyear went out and TA came in, and also with Mercer, large private equity firms are confident they can still get a high return on their investment.”

RIA M&A firm DeVoe & Co. “is getting calls from PE firms every two weeks,” says managing partner David DeVoe.

We're getting calls from PE firms every two weeks.

“Overall, private equity is healthy for the RIA space,” DeVoe says. “PE Firms provide capital to fast-growing firms, which means they can grow faster and can generate innovation.”

Seivert notes that industry observers were skeptical when PE firms made investments in Focus Financial and United Capital before the former went public in 2018 and the latter was sold this year.

“People thought the space may have been played out, but look what happened — they doubled the value of those RIAs before they went to market,” he says.

What’s more, private equity capital is expected to keep the

DeVoe notes that M&A activity this year has been 30% higher than transactions in the first halves of the last two years. And Echelon predicts this will be the first year in which the number of RIA deals climbs over the 200 mark.

“Oak will provide more capital for more acquisitions,” Roame says. “We should expect more and bigger deals. Mercer has around $17 billion now. I could imagine $40 billion-plus by year end 2020.”

Time will tell. But just two weeks ago, Mercer CEO Dave Welling was in attendance — and very engaged — at Echelon’s annual