Rising medical costs and longer life expectancies have advisors facing thorny questions from clients about health care coverage in retirement. A three-year old fintech startup claims all the answers can be found in your DNA.

Genivity, a Chicago-based fintech firm, collects medical data from clients and inputs it into an AI-driven algorithm. Called the Health Analysis and Longevity Optimizer, the tool creates detailed health projections to help understand long-term medical costs, the firm says.

By collecting basic information like tobacco use and exercise, along with past family medical histories, advisors get a better idea about a client’s long-term health care costs — and can plan accordingly.

The startup partnered with BMO Wealth Management, a subsidiary of BMO Harris Bank that manages $47 billion in client assets, according to the firm. “We know that health care costs are one of the biggest concerns that clients have and we have to be planning for all eventualities,” says Purva Sule, director of BMO’s Partners Team. “The engine spits out a detailed forecast of health care costs which is useful input for advisors to create a custom plan and to be more accurate as well.”

BMO will pilot the program in suburbs around Chicago and in Florida’s retiree communities, says the firm. “They have mined a lot of historical data,” Sule says.

Genivity works with RIAs, independent broker-dealers and insurance advisors including Principal Financial Group, among other firms, says Graham Thomas, head of Genivity’s enterprise sales unit. While Genivity charges a flat-fee for services, the firm declined to provide specific pricing.

“Really, it’s about a conversation,” Graham says. “Clients start to think about what’s most important — their spouse and their children, the next generation — in a non-sales way. This is basically the next step out in planning, where financial plans include the entire family and introduces them into the conversation naturally.”

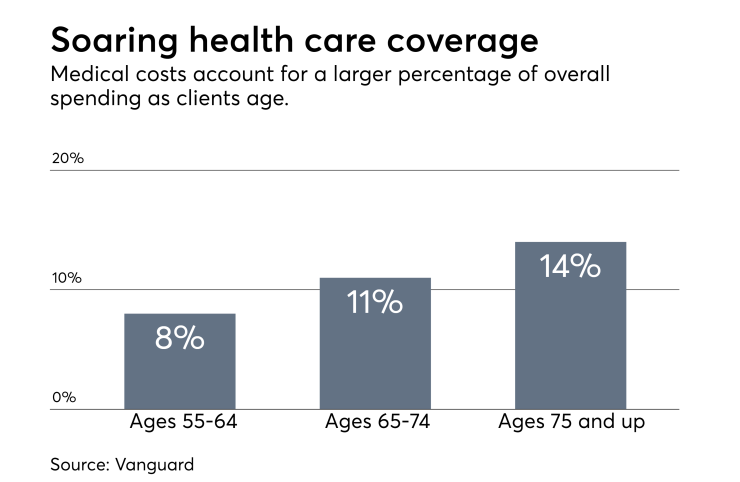

The effort to develop new tools to tackle healthcare headaches comes as Americans are increasingly ill prepared for medical expenses. The

“Healthcare cost in retirement is a top concern for many of our clients,” says Darrel Hackett, BMO Wealth Management president. “Our team of advisors will not only be able to prepare our clients in this area better, but also manage the risks that come with planning for unforeseen circumstances.”

Health care insurance advising could become a ripe growth area for advisors and a way to differentiate themselves from competitors, according to experts — if they can gain the expertise needed to help clients. “In a time when advisors aren’t getting paid for investment management, there is this huge issue that the health care industry just isn’t taking care of,” Thomas says. “When clients leave the doctor’s office, they’re on their own.”

-

Advisors have very little power to fix the health care system, but they can help others manage skyrocketing medical costs.

May 17 -

As sales of LTC insurance plummet, combination products — annuities with LTC riders — are picking up some of the slack, serving as a useful alternative for some clients.

May 16 -

As baby boomers exit the workforce, they perpetuate a problem that has long dogged Social Security in that there aren’t enough workers to replace them.

June 26

To that end, wealth management firms, both large and small, are forming partnerships to help further their ability to provide health insurance guidance — without bearing the costs of bringing in experts in house. Last year, Raymond James began a partnership with HPOne, a Shelton, Connecticut-based health insurance company. Raymond James gets access to expert advising, while HPOne gets access to some of Raymond James’ clients.

“Clients have a much better confidence level after talking about their health care needs,” Frank McAleer, vice president of retirement solutions at Raymond James told

A Nashville, Tennessee-based health care services provider, Bernard Health, has teamed up with a handful of RIAs to provide health care advising, costing anywhere from $10,000 a year to almost $100,000 for some of the larger firms.

“Our mission is to make sure that no one runs out of money in retirement due to health and elder care costs,” says Heather Holmes, Genivity founder and CEO.