While investment firms have always had to distinguish their offerings over seemingly equal business rivals, the advent of digital investing has opened up an entirely new chapter in the competitive landscape, raising the stakes to a new level.

The millennial wild card and changing needs of more affluent baby boomers are just a start. Tech-savvy millennials have demonstrated a willingness to use robo advisory services as a way of lowering the threshold for management fees, while their Boomer parents or grandparents have a dawning sense that asset management can come at a lower price.

Many consumers are willing to price shop for investment advice while also demanding more sophisticated delivery models that harness the best of traditional and digital approaches.

This shift is pronounced within the mass affluent market — defined as those with $50,000 or more in household investable assets, according to A.T. Kearney’s 2016

Investors are aware to varying degrees of the changes toward automation, digital, and even mobile offerings in investment services, and are in the process of working out how much of the human touch they're willing to give up in favor of lower fees.

HOW TO SURVIVE

If providers want to survive in this new environment, they’ll need to adjust their business models to the new reality. Not only will these firms need to ramp up and refine their digital and automated/semi-automated offerings, they must get proactive about stepping into an educational role with their clients, whose new interest in transparency may not be the most comfortable conversation for anyone to have, initially. Here are some ways providers can respond to these changes.

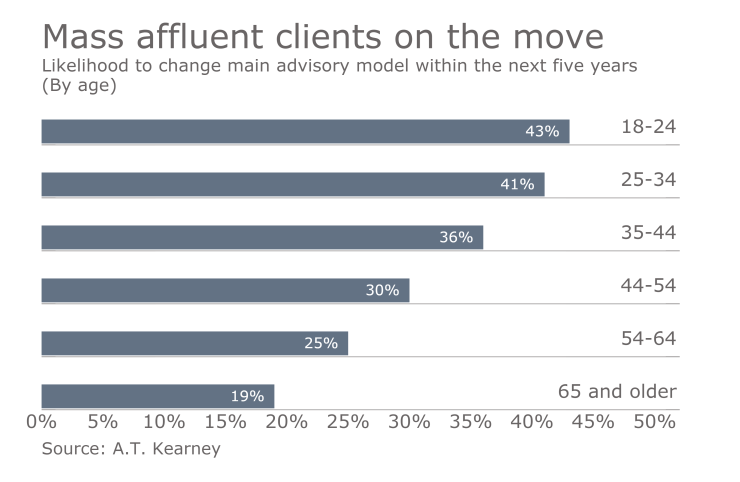

- Anticipate increasingly explicit price competition and a higher level of switching. Today, 63% of mass affluent advised investors lack awareness of the fees they are paying for investment advice. Expect this to change as increasing transparency transforms investing. An overwhelming 72% of investors who know how much they pay for advice expressed a willingness to switch investment providers for lower fees. As awareness of alternative investment models and pricing transparency increase, investment provider switching rates could, as well. Advisors need to be prepared for explicit price competition and have a plan to communicate how they add value. They also need to develop new services and programs to reinforce their brand differentiation.

- Incorporate digital capabilities into all investment offerings and services. As mass affluent investors become older and wealthier — and as their comfort with technology increases along with pricing transparency — they are likely to change their approach to investing. Hybrid models — which combine automated services and human touch — are likely to make the bigger gains, versus the 'dedicated advisor' (a point person who provides investment advice) or digital-only models. This mindset shift applies to both products and engagement experiences.

- Understand that digital investing is about client interfaces and access to relevant information and reporting rather than investing algorithms. Digital advice as the main service delivery model among mass affluent investors could grow 50% in the next five years, our research found. Interest in and likelihood to adopt robo advisory services are high among mass affluent investors, but that is only part of the story. The new investment services model will be about creating frictionless and emotionally engaging experiences. To stay competitive, investment service providers will need to embrace digital communication as a fundamental principle of how they do business. Digital needs to be integrated across the full experience: how consumers do research, how they talk to their advisor, how they get their information, and how they execute on their decisions. Moreover, the experience needs to be a positive one for consumers.

- Make human access available as a resource for both interpretation and digital help desk support. The rise of digital models for investment doesn’t supplant the expectation of human support, both in terms of interpreting investment recommendations and, more basically, how to use the technology. Access to human advisors, when needed, will continue to be very important to mass affluent consumers. In fact, as investors grow older and wealthier, they will graduate to higher-touch human-advised models, still bringing that expectation of stronger digital support with them. Investment advisors need to make sure their offerings are set to keep pace with all of these demands.

- Expect mass affluent investor migration in both directions, toward more human advisor support and toward increased digital capabilities. As investors grow older, they are likely to migrate to models that provide more advice — either digital, human or both. In addition, our research suggests that over the next five years, the platform that uses technology to deliver investment advice, but access to a person is still available — will make the greatest gains. To compete, advisors will have to offer a strong, user-friendly online platform that harnesses technology and delivers on-demand access and investment advice based on information and preferences provided by the investor. This will need to happen in tandem with traditional capabilities.

- Plan for a world with much greater competition and many more flavors of hybrid advice and service delivery models. Looking ahead, investment service providers will need to embrace consumer behaviors and preferences, and use them in a transparent way to inform service offerings, delivery models, and pricing decisions. They’ll need to stay flexible and open-minded as this multi-platform future unfolds.

Times are changing for investors and, perhaps more critically, for their advisors, who previously often didn’t have to account for their pricing at all.

The change in this trend should help to usher in a new era of greater provider switching and a decrease in advisory and other service fees. The good news for investment services providers is that the changing market dynamics represent an opportunity to be innovative and capture market share.