Maintaining merger momentum

Only 24 deals in the fourth quarter are needed to break the previous record of 132 transactions, set last year.

“Q3 2016 is the eighth successive quarter of 30 or more transactions,” says David DeVoe, managing partner at DeVoe & Co., which has released the third quarter results for its RIA Deal Book survey. DeVoe also spoke on the topic at the annual Schwab Impact conference in San Diego.

What started as an apparent spike in RIA sales two years ago has sustained itself as a perceived surge, and now, according to DeVoe, "has evolved into an apparent new normal of heightened M&A activity.”

To learn more, click through our slideshow.

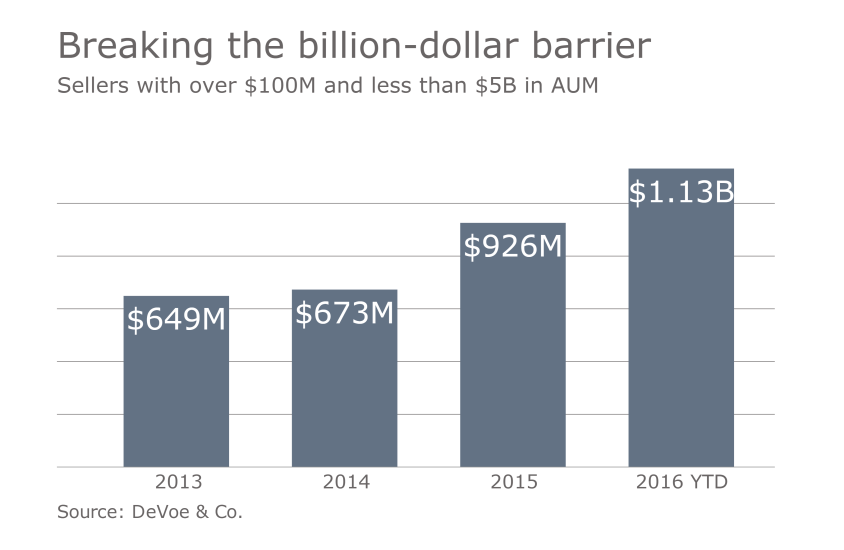

“These highly-prized firms are sought after by the widest breadth of acquirers, including consolidators, banks, RIAs and private equity firms,” according to Tim Forest, a DeVoe & Co. managing director.

With the parent company’s capital backing and M&A expertise behind them, affiliates have the ability to acquire more aggressively and with greater success than a typical RIA.