Recruiting

-

With unfounded rumors spreading that Osaic was about to buy its rival Cetera, a Texas-based headhunting firm started calling advisors to see if they wanted to move. Other industry recruiters say that crossed an ethical line.

February 5 -

UBS Americas reported $14 billion in net new asset outflows in Q4, marking its worst period since the firm announced major compensation changes in November 2024.

February 4 -

In a Q&A interview, Christine Brown explained her plans for the role leading a team of a half dozen specialists assisting Kestra financial advisors.

February 3 -

NewEdge Advisor's recruiting win from Ameriprise is the third recent big win for the New Orleans-based company.

February 2 -

Ahead of the expected closing of Fifth Third Bank's deal to acquire Comerica Bank, Ameriprise CEO Jim Cracchiolo provided few new details.

January 29 -

Stifel CEO Ron Kruszewski said a surge in advisor recruiting and record wealth management results could lead the firm to invest even more in hiring in 2026.

January 28 -

Two teams and one advisor managing a combined $1.3 billion choose to set up shop at Wells Fargo's channel for independent advisors.

January 27 -

An wealth management duo from Ohio chooses LPL's unit for direct employee advisors to found Moto Wealth Partners.

January 27 -

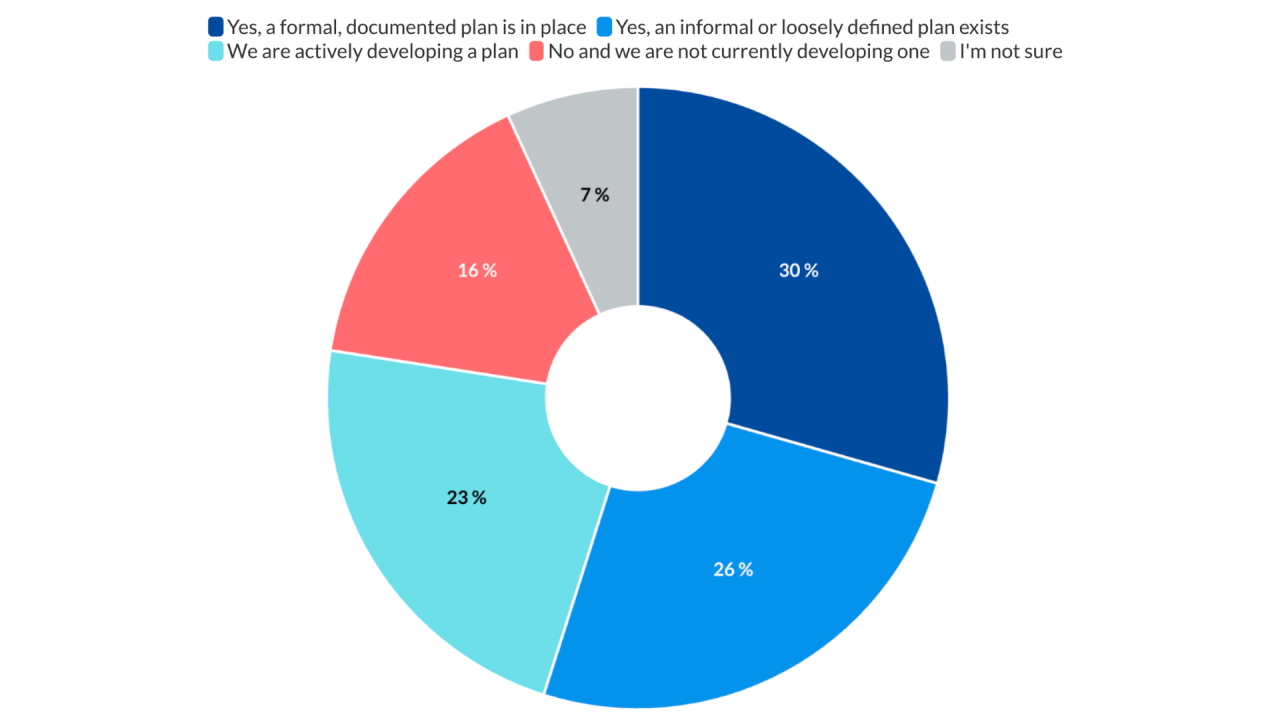

As valuations continue to rise across the industry, more firms are using compensation to invest in their top talent and future growth, Succession Resource Group says.

January 27 -

Plus, Cetera adds a $1.9B tax-focused firm, Choreo acquires two RIAs, and Modern Wealth expands in New York.

January 23 -

A Ninth Circuit appellate panel ruled that10 advisors recruited to LPL from Ameriprise have the right to resist turning over their personal devices to a forensic examiner to be searched for evidence of misappropriated client data.

January 21 -

An internal successor, a seller and an acquirer dish out the most common mistakes they say advisory firms must avoid to address the challenge.

January 21 -

Plus, Wells Fargo and Raymond James pull more teams from Commonwealth/LPL, and Elevation Point takes a stake in a UBS breakaway.

January 16 -

The massive intake preceded the BNY-owned custodian's rollout of a new financial advisor matchmaking service aimed at conversions from institutional clients.

January 13 -

Wells Fargo stands out among wirehouses with FiNet, its dedicated channel for independent advisors. Wells Fargo Advisors head Sol Gindi says this structure gives the firm a competitive advantage rivals will find difficult to replicate.

January 13 -

Wells Fargo lands big teams from Merrill and Citi, while Cerity Partners and Mercer Advisors continue their aggressive M&A streaks.

January 9 -

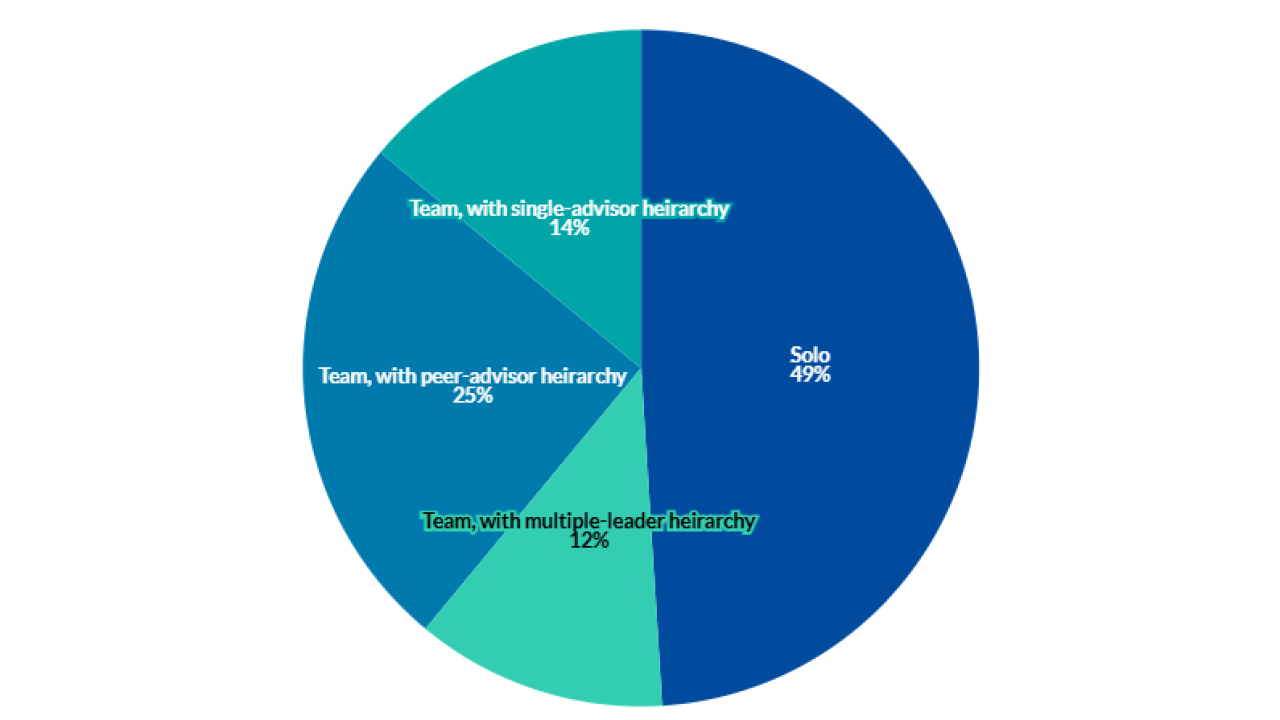

Logic (and compelling Cerulli Associates data) explain why advisor teams are gaining momentum. But teaming is not the only option for growth.

January 6 -

The loss of a $129 billion team for Merrill set the high-water mark in a year that also saw the departure of huge teams from UBS, JPMorgan, Wells Fargo and Oppenheimer.

December 29 -

Rockefeller becomes the latest firm to benefit from a steady stream of advisor defections from UBS this year.

December 26 -

Also, DayMark Wealth Partners sells a minority stake to Constellation Wealth Capital.

December 18