-

“People didn’t want to use up their estate tax exemption,” but that has changed as a result of the new law, an expert says.

May 6 -

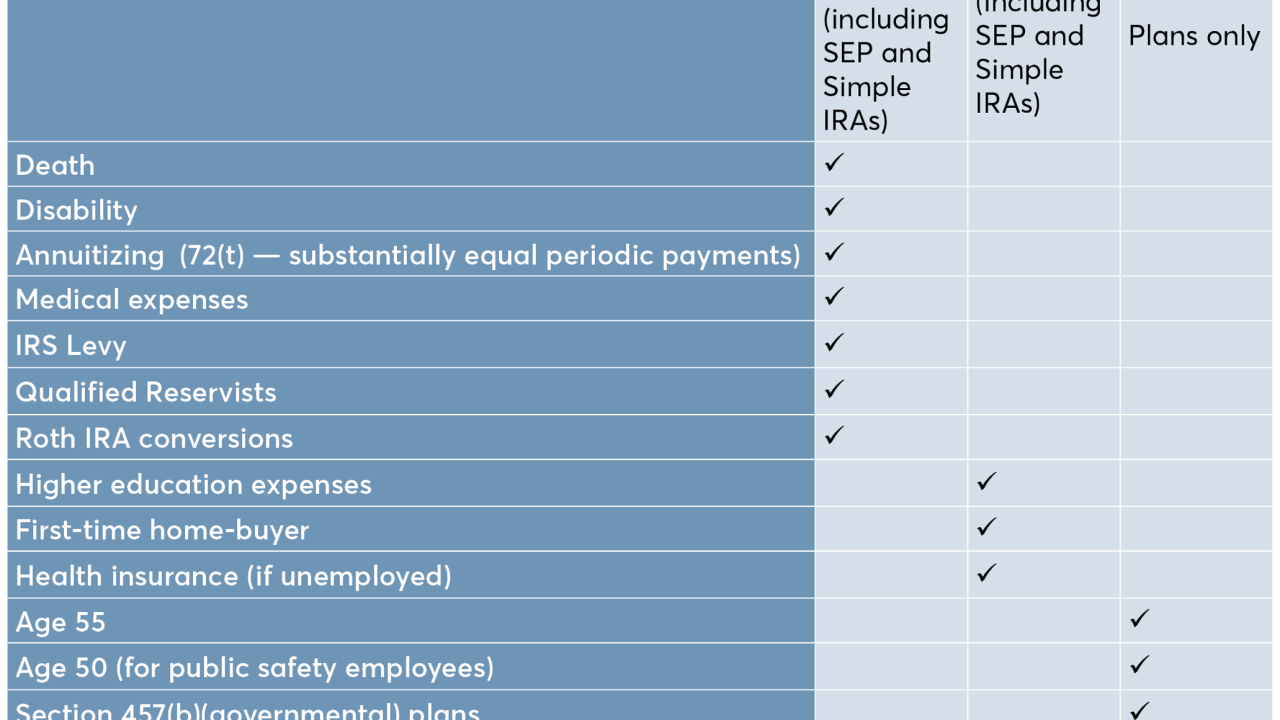

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

Cuts in Medicaid could prove disastrous for low-income retirees who rely on the program for nursing home care, experts say.

April 26 -

Promising its tech will provide more features than any target date fund, the investment research giant makes a play for the advisor-managed account market.

April 24 -

The earlier they begin planning, the easier it'll be to avoid a big tax hit.

April 23 -

Unfortunately, physical and cognitive decline are among potential side-effects.

April 22 -

A proposal to increase payroll taxes is facing opposition from some lawmakers who believe millennial workers cannot afford to bear the brunt of higher payroll taxes.

April 17 -

The custodian expects the business to grow quicker in different hands, according to an internal memo.

April 17 -

Tapping into these plans is one method used to prevent bankruptcy.

April 16 -

Clients are increasingly favoring accounts suited for emergency spending, research shows.

April 15 -

The major employer-plan group had previously been affiliated with the predecessor of Global Retirement Partners.

April 15 -

New legislation that aims to give workers greater opportunities to save may put the kibosh on a strategy for passing large individual retirement accounts to heirs.

April 12 -

Advisors who once oversaw portfolios for clients anxious to save a dollar now work more frequently with investors saving to see the world.

April 9 -

Clients who owe the IRS should pay their taxes by April 15 even if they have already secured an extension.

April 9 -

If spending $5 a day on fancy coffee puts your retirement at risk, you’ve got bigger problems.

April 4 -

Only about 20% of Americans know the amount of contributions they can make to their 401(k) plan, according to a new study from TD Ameritrade.

March 22 -

There are a lot of options — and potential missteps.

March 19 -

Heavily weighting any single stock has the potential to make a portfolio more volatile.

March 15 -

Seniors will face a 20% penalty on top of income taxes if they withdraw funds from a health savings account for non-medical expenses before the age of 65.

March 11 -

The worst thing you can do during a stock market crash is panic and sell your stocks near the market bottom.

March 6