-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

February 27 -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

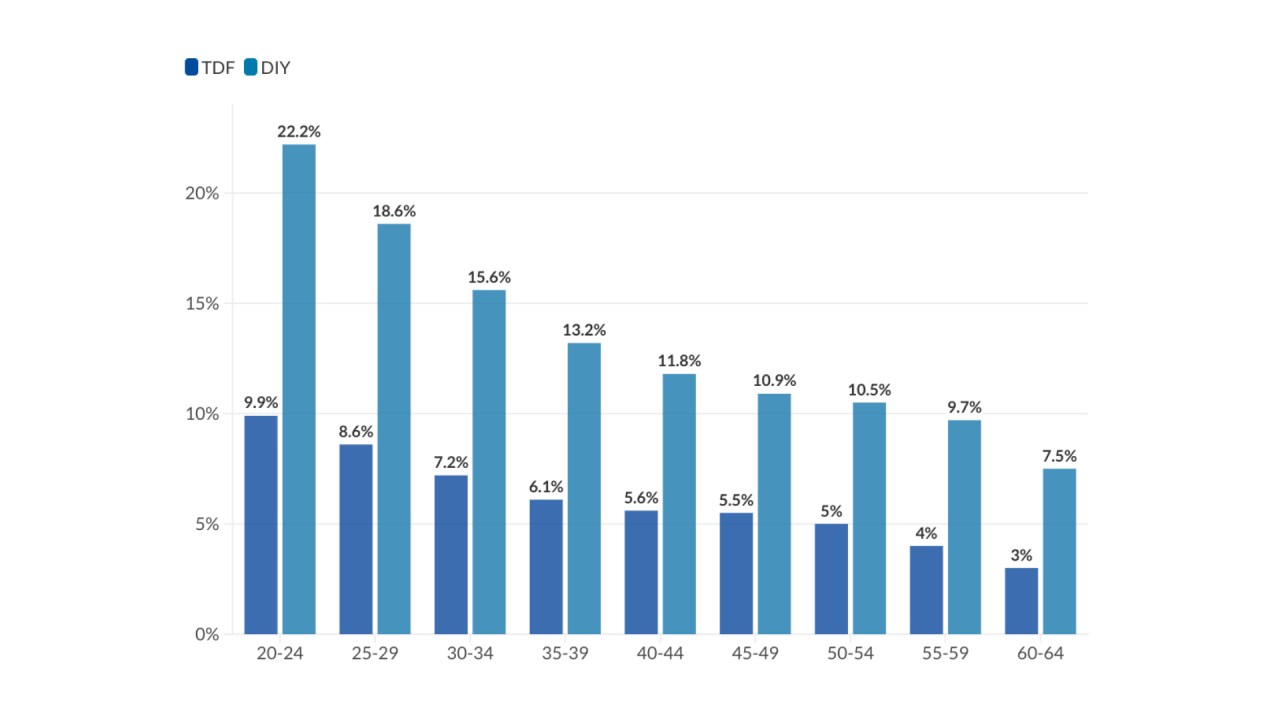

A new Morningstar study suggests managed accounts can significantly boost retirement wealth, particularly for younger workers and those currently managing their own portfolios.

January 20 -

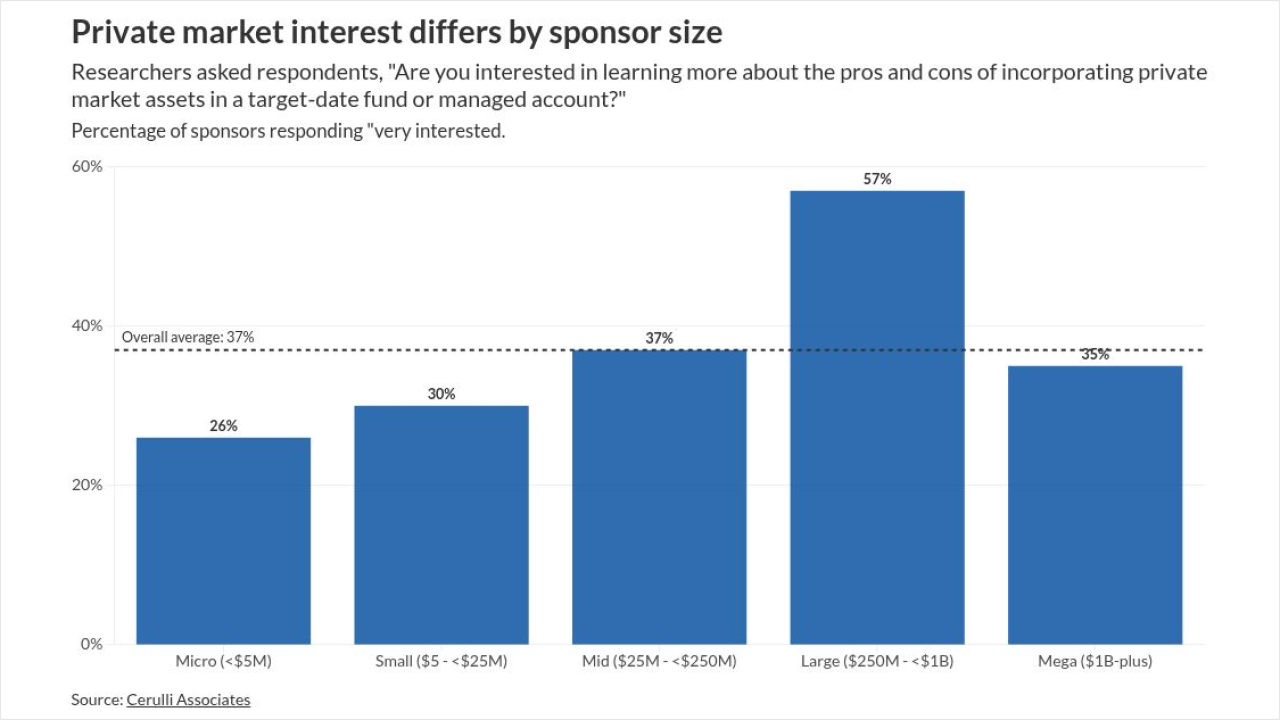

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

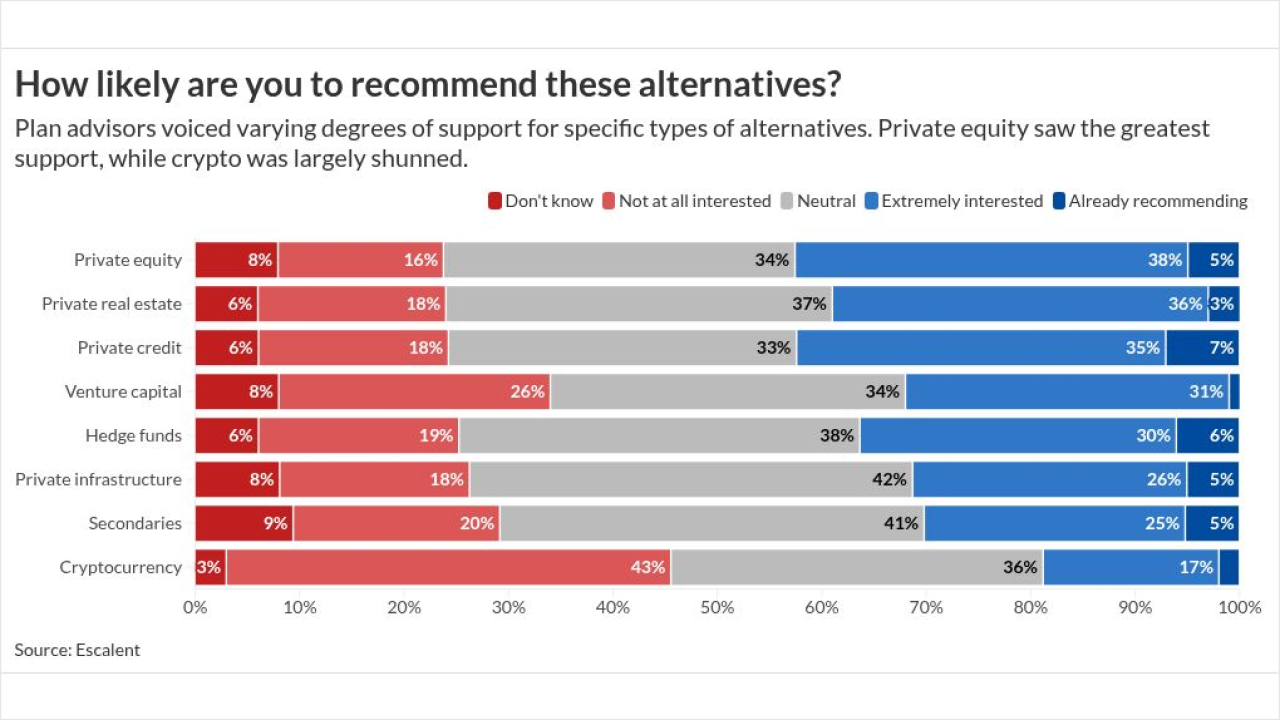

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows. Here's why younger investors are betting on post-tax retirement savings.

November 20 -

A similar measure stalled years ago, but some advisors say the current bill has more momentum among lawmakers.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5 -

An expert adviser explains the many considerations to take into account before deciding on this as an option for employees.

October 30

-

Millions of small 401(k) balances end up in safe harbor IRAs, where fees and low returns erode growth. But advisors can help reclaim lost savings.

October 23 -

Business owners often can't rely on standard retirement strategies. Advisors explain how goal-setting, diversification and exit planning can secure their financial future.

October 8 -

Rising costs and competing financial priorities are making it harder for younger workers to save for retirement. Goldman Sachs highlights six strategies to help clients get on track without simply "saving more."

October 6 -

Starting in 2026, high earners over the age of 50 must make 401(k) catch-ups after-tax. Savers may not be celebrating, but advisors say the shift will benefit them over the long term.

October 3 -

At 50, a Seattle-based financial professional has the means to retire by 60. Advisors say the plan is realistic, but one significant challenge stands out.

September 26 -

New Fidelity research shows a surge in plan sponsors offering financial wellness programs that could overlap with traditional advisor services, raising questions about future roles.

September 23 -

As college costs rise, parents are resorting to increasingly costly means to pay for their children's educations. Financial advisors say the loss in retirement savings is rarely recovered.

June 30 -

A new TIAA Institute survey found that a vast majority of 401(k) plan participants are interested in accessing fixed annuities through their retirement accounts. Plan providers are listening.

June 23