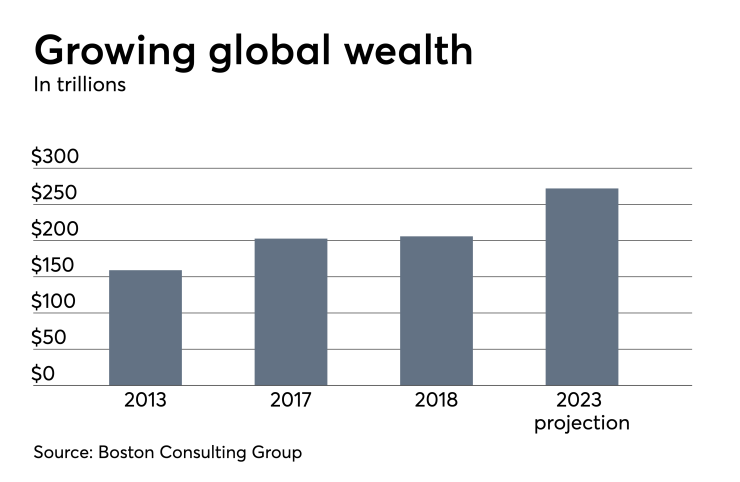

Gains in global personal wealth ground to a near-halt in 2018, rising just 1.6% for the weakest growth in five years.

The slowdown is a steep drop from the 7.5% gain in personal global wealth in 2017, and the 6.2% compound annual growth rate from 2013 to 2017, according to an analysis by Boston Consulting Group released Thursday.

Factor in the effect of a rebounding U.S. dollar and asset values actually declined 1.6% last year, wiping out any gain, says Anna Zakrzewski, global leader of BCG’s wealth-management practice.

“For the first time since 2008, we saw wealth growth was negative when you take into account all the factors,” she says.

Still, the amount of personal financial wealth sloshing around the world remains enormous: $206 trillion, according to Boston Consulting Group’s tally.

Although overall growth was down, some regions did well. Increases ranged from 8.9% and 7.1% for Africa and Asia, respectively, to anemic gains of 0.6% for Western Europe and 0.4% for North America.

Estimates of how much money sits in offshore centers varies, but BCG estimates that $8.7 trillion of the world’s wealth crosses borders. Over the past five years, that pool of money has been expanding by 5% a year.

Over the next five years, China will account for roughly one-third of the flows into offshore financial centers, with most of it likely to end up in Hong Kong and Singapore, Zakrzewski says.

-

Jamie Price and incoming majority owner Reverence promise more of the same for the 6,500-advisor IBD network.

May 13 -

Despite ongoing consolidation among investment management platforms, the fintech's chief executive says there's plenty of space to serve advisors who have clients with complex needs.

April 24 -

These insiders are well placed to propel their firms forward and encourage colleagues to address the industry’s shortcomings.

December 19

The two cities, and perhaps the U.S. and United Arab Emirates, “have the strongest exposure to growth markets as offshore financial centers,” and should expand at annual compound rates of 7% to 8%, she says. Asia’s total personal wealth is expected to reach $58 trillion by 2023, which would leapfrog it over Western Europe’s projected $53 trillion.