Amanda Schiavo is an associate editor of Employee Benefit News. Follow her on Twitter at @SchiavoAmanda.

-

The legislation includes a provision that would raise the age limit for making contributions and taking required minimum distributions.

June 6 -

Retirees should live a frugal, flexible lifestyle and consider buying insurance to cover big ticket items.

June 5 -

They can do research by visiting funeral homes to get a better understanding of cost and burial details.

June 3 -

Be sure to check if the original owner has started taking minimum distributions to ensure clients make the right decisions.

May 31 -

"Part of the conversation should be exploring how your client uses the health-care system," says a CFP.

May 30 -

Many older workers don’t know they are allowed to take penalty-free withdrawals from their 401(k), 403(b) and 457 plans.

May 29 -

An average couple aged 65 who are about to retire this year will need $285,000 to cover healthcare expenses.

May 28 -

Ensure their contributions don't exceed the limits to avoid a penalty tax.

May 24 -

Seniors who hold retirement savings in various assets should develop a tax-efficient withdrawal strategy.

May 22 -

Lawmakers are poised to merge two bills that would make it easier for workers to save for retirement.

May 21 -

The startup plans to double its team and expand its services to more clients.

March 13 -

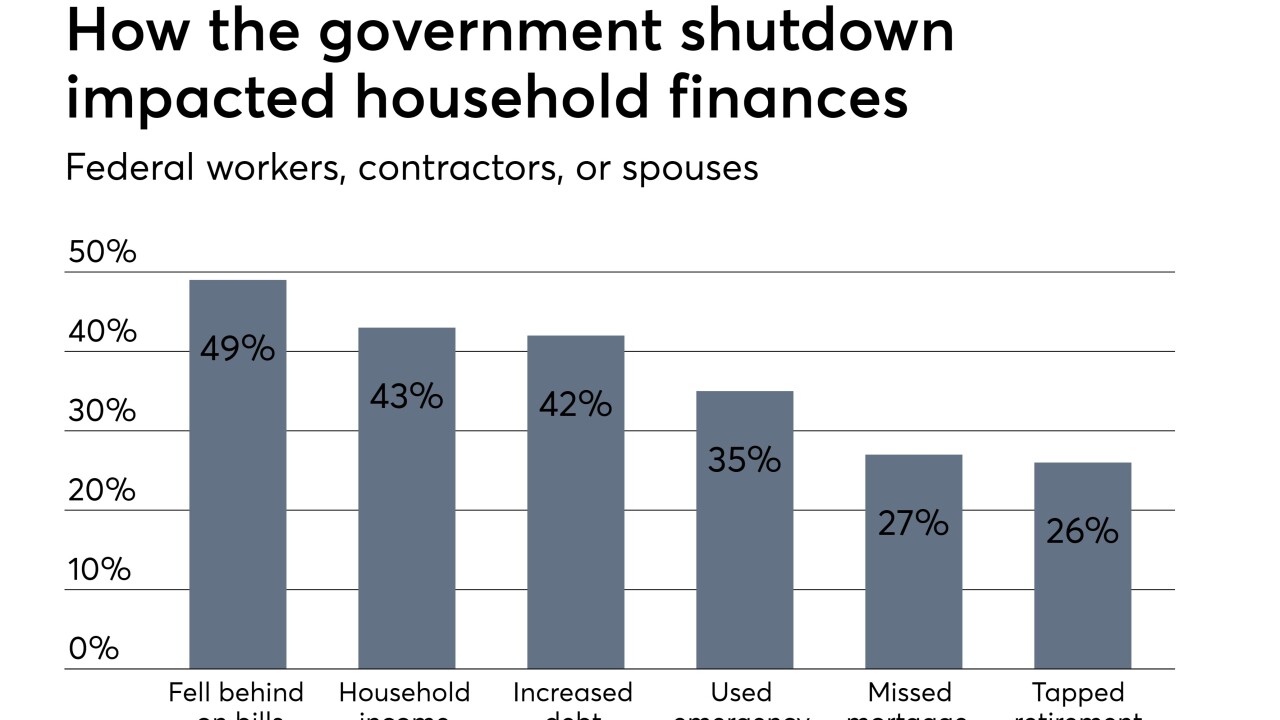

The last government shutdown highlighted how many Americans ignore basic planning lessons.

February 19 -

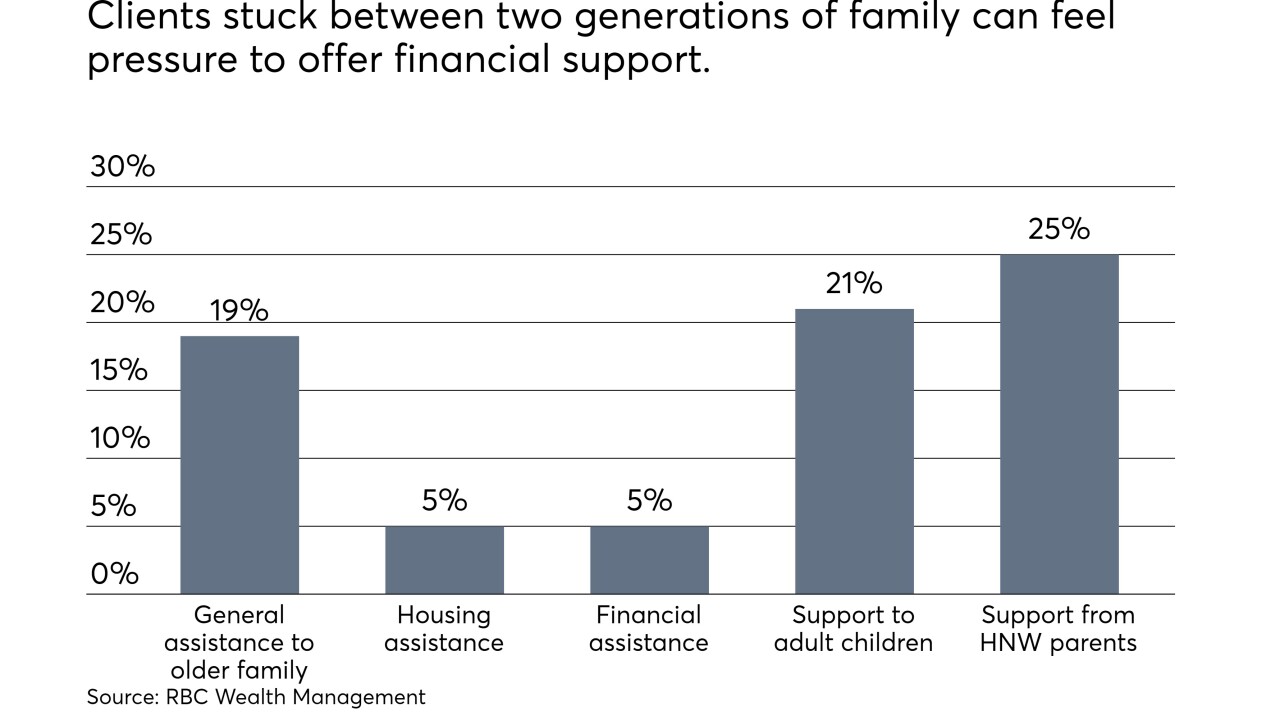

About 19% of adults support elderly family members in some way.

February 13 -

He’s the latest broker to leave a wirehouse for a regional BD.

February 6 -

The firm has been on a recruiting tear, with a particular emphasis on wirehouses.

February 6 -

Planners share their favorite out-of-left-field appeals for advice.

February 4 -

A psychologist or therapist on staff can help advisors connect with clients who are going through a major life event.

January 31 -

The firm has been aggressively recruiting wirehouse talent.

January 29 -

“We are looking to grow a firm of high quality financial advisors who are looking to make a real difference in people’s lives,” the firm cofounder says.

January 25 -

The teams are led by brokers who’ve been featured on Barron’s and Forbes’ advisor rankings.

January 23