Welcome to Retirement Scan, our daily roundup of retirement news your clients may be talking about.

Seniors should prepare for hefty, unforeseen expenses in retirement, such as healthcare, housing and transportation costs, writes an expert on MarketWatch. To do this, retirees should live a frugal, flexible lifestyle and consider buying insurance to cover big ticket items, but they should avoid working longer, the expert says. "If you use the fear of unexpected retirement costs to rationalize an unsatisfying job, and if you keep it up for too long, then you risk the biggest expense of all: throwing away precious years of your life, while never having truly lived."

Seniors who want to minimize their tax burden in retirement should take a proactive strategy throughout the year, according to this article on Kiplinger. They should also understand the rules for taxing Social Security benefits, minimizing their taxable income and strategizing their charitable donations for tax purposes. Seniors should also consider a Roth conversion to boost their after-tax income in retirement and handle their investments according to their tax classification.

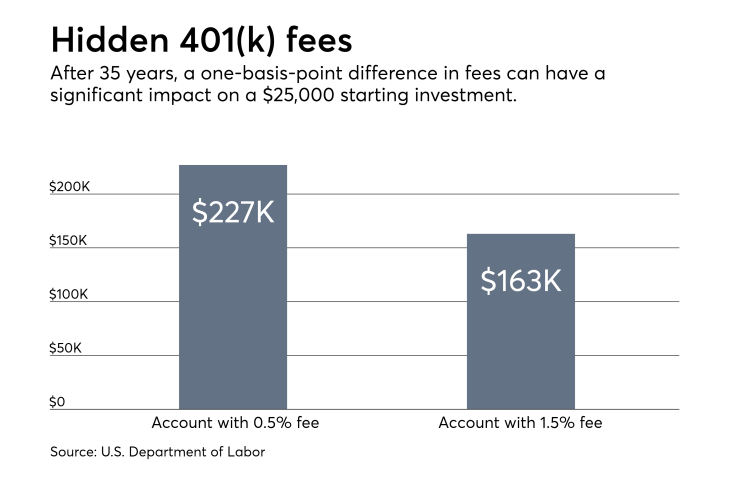

An expert advises 401(k) participants to consider boosting their contribution rates if they are planning for an early retirement, according to this article on Yahoo Finance. They should also check if there are hidden fees in the plan and find ways to avoid them, as well as remove poor-performing funds from their portfolio if possible, says the expert. “If you start saving $500 per month when you’re in your 20s and you have an accumulated average in return rate of say 7%, and you've really minimized your fees, when you wake up in your early 60s, you're going to have well more than a million dollars put away.”

Seniors who consider filing for Social Security at age 62 and continue working can expect their benefit payouts to be permanently reduced and the program will have to withhold $1 of their benefits for every $2 they earn over a certain threshold, according to this article on NerdWallet. Retirees on Social Security who decide to work again have the option of suspending the benefits to boost their future benefit payouts. A portion of their retirement benefits will also be subject to taxation if their combined income, or their adjusted gross income plus their tax-exempt bond interest and 50% of their benefits exceed a certain threshold.